The information provided is based on the published date.

Key takeaways

- ESG (Environmental, Social, and Governance) investing has seen strong demand despite some controversy

- Investors grappled with difficult decisions when Russia invaded Ukraine in 2022, as rising energy prices most impact low-income households

- ESG investing excludes companies that engage in activities deemed harmful to society or the environment and those with poor records on labor rights, diversity and inclusion, and corporate governance

- A new rule from the Department of Labor allows advisors to consider ESG factors when advising pension funds

The world of ESG (Environmental, Social, and Governance) investing has been through some controversy lately. However, overall demand for ESG funds remains strong. According to Morningstar, U.S. ESG funds netted $3 billion in new assets in 2022, vs. an outflow of $370 billion for conventional funds. For individuals interested in expressing certain values in their investment portfolio, ESG investing can be a good solution, but the space is definitely getting harder to navigate. Here are our thoughts on the new challenges and how we approach ESG investing.

What is ESG investing?

ESG investing is a type of investment strategy that evaluates a company's environmental, social, and governance practices in addition to its financial performance. An ESG score is used to assess the sustainability of an investment across these categories, providing insight into its overall impact on society and the planet.

Learn more about ESG investing

Russia, Ukraine, and controversial industries

One of the basic tenets of ESG is to avoid investing in controversial industries. Often this would include weapons production and fossil fuel-related companies. However, when Russia invaded Ukraine in February 2022, ESG investors grappled with this stance. One might not like war in general, yet still support Western democracies supplying arms to defend Ukraine. Even within the ESG community, this caused a major rethink of how investment managers treated defense stocks.

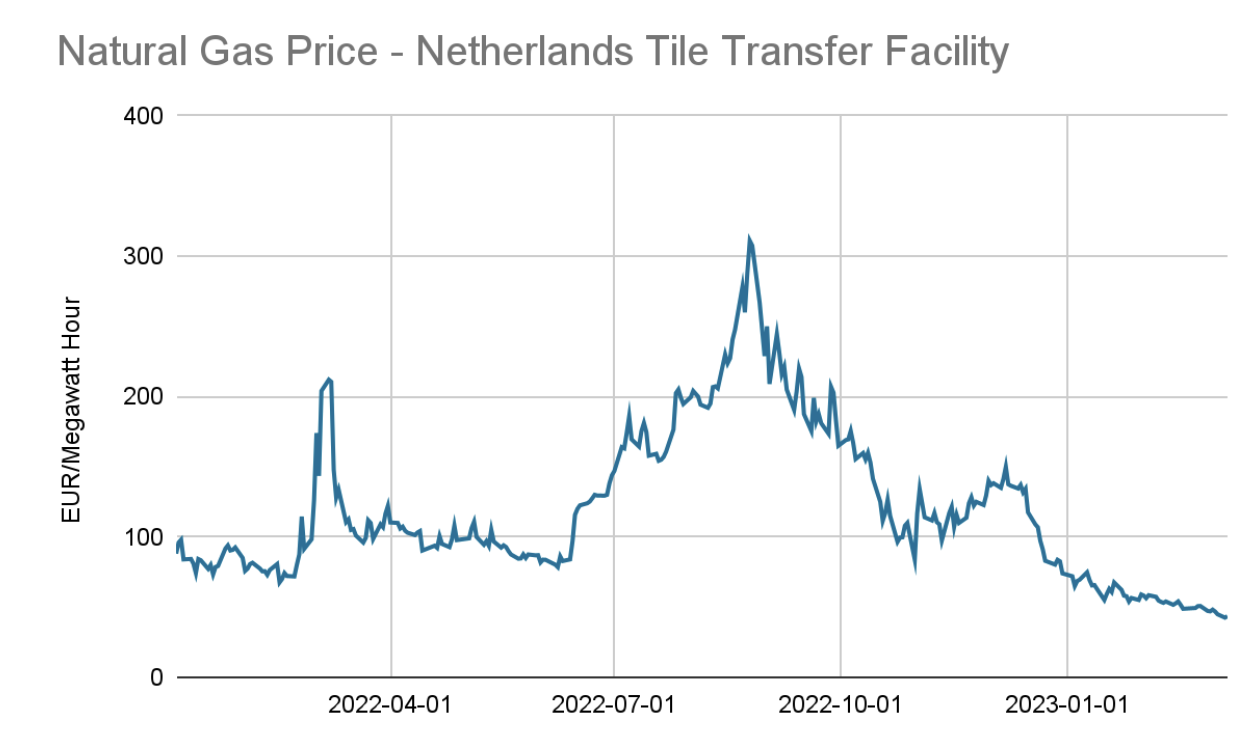

Another challenge brought on by the Ukraine invasion relates to fossil fuels. About 19% of electricity generation in Europe comes from Russian natural gas. Russia is also a major oil exporter globally. This made applying sanctions against Russia much more difficult. Electricity prices were already surging all over Europe. A complete ban on importing Russian natural gas would have made this problem all the worse.

In the U.S., gasoline prices were also surging, with the national average price at the pump hitting $5 in June. In both the case of European electricity and U.S. gasoline, the price surges hit lower-income households harder. On average, these households spend more of their income on energy-related goods and services.

Moreover, it highlighted the advantage of having energy produced domestically. For example, the U.S. was able to produce enough natural gas to replace Russian gas. In 2022, about half of Europe's natural gas came from the U.S., which is expected to grow in 2023. U.S. oil production also surged in 2022 after declining the two years prior, which helped to bring gas prices down. All of this production requires investment and maintenance spending on things like drilling, processing, transportation, etc.

Rising energy prices affect lower-income households the most, while high prices for fossil fuels inadvertently support Russia's war efforts. This has created a struggle between two crucial issues: the environmental concerns of ESG and the social interests of humanity. However, addressing climate change necessitates transitioning away from fossil fuels. Consequently, ESG investors face a challenging task in balancing these competing priorities, with no clear-cut solution available.

New ESG rule

On February 1st of this year, a new Department of Labor (DOL) rule went into effect, allowing anyone advising pension funds or 401(k) plans to consider ESG factors in their analysis. This rule sparked controversy in the Senate and House of Representatives, who voted to revoke this rule, but President Biden said he plans to veto the resolution.

Setting aside the political angle of this rule, it is worth considering why it was necessary anyway. In many cases, investment advisors have a legal obligation to their clients, called fiduciary duty. This includes Facet – we are legally bound to do what is in the best interest of our members, no matter what.

Is ESG investing in a client's best interest?

The law says that advisors of employer-sponsored plans "may not sacrifice investment returns or assume greater investment risks as a means of promoting collateral social policy goals." So the answer to this question comes down to whether you believe ESG helps or harms investment performance. Unfortunately, the answer isn't so simple.

Different academic and industry studies have come to opposite conclusions. It depends on how the parameters are set, how ESG is defined, what time periods are used, etc. For example, the FTSE USA All Cap Choice Index, an ESG index, has outperformed its traditional counterpart, the FTSE USA index, in the five years ending February 28th, 10.0% vs. 9.5%, but has underperformed over the last three years, 11.4% vs. 11.8%.

The DOL rule only applies narrowly to employer-sponsored retirement plans. Different rules apply to firms like Facet that primarily advise individual investors. However, the challenge of fitting ESG within the concept of being a fiduciary applies to a wide variety of situations.

Facet's approach to ESG investing

Facet believes our fiduciary duty to our clients is similar to what is described above: we believe we must endeavor to provide the best mix of risk and return to all our clients, whether they choose to express their values through ESG or not. We believe that if we apply our same investment process to all client portfolios, we can produce very similar long-term results for both ESG and non-ESG clients.

Part of this means following an exclusionary strategy instead of an inclusionary one. Here’s the difference between the two strategies.

- An exclusionary strategy has an objective set of rules and removes any company that violates those rules.

- An inclusionary strategy attempts to invest only in companies with robust ESG attributes and make outsized investments in them.

An inclusionary strategy is necessarily subjective – someone needs to decide how to weigh the various ESG factors that might be relevant to a company.

For example, a company might have low carbon emissions but a poor diversity record. This requires some subjective judgment. Typically this judgment would either come from the investment manager themselves or be outsourced to a third-party ESG scoring system.

The subjectivity of inclusionary funds introduces similar problems as active stock picking. Extensive evidence shows that subjective opinions about a stock's future do not lead to better financial performance. In an ESG fund, subjectively adding stocks based on the manager's opinion of a company's ESG characteristics isn't likely to do any better.

Inclusive funds also tend to be less diverse. For example, the inclusionary Vanguard Global ESG Select Stock Fund has only 39 holdings, while the exclusionary Vanguard ESG US Stock ETF holds 1,495.

Exclusionary strategies make it easier to achieve your financial goals while also expressing your values. Finding funds that fit Facet’s key criteria: low cost, wide diversification, and strong tax efficiency, is much easier.

The broad diversification also makes it easier to have confidence that the fund will perform as expected. We’re comfortable saying we don’t know if stocks will rise or fall. Our focus is on whether our funds will generally rise with the market.

We believe exclusionary funds are much more predictable in this way.

You wind up with a portfolio with significantly better ESG factors than the general market by eliminating companies with controversial practices. What’s more, you also know what you are getting. The exclusionary rules are easy to understand. You can decide for yourself if those rules are a reasonable fit for your values. With subjective inclusionary funds, it can be hard for an outsider to know what companies may or may not be included.

ESG investing can be challenging. Controversies like the ones we mentioned previously will likely continue to crop up. Despite these challenges, we believe we can create portfolios that put equal weight on your ESG values and financial goals.

Tom Graff, Chief Investment Officer

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.