By: Brent Weiss, Co-Founder and Chief Evangelist

Higher education is always marketed as invaluable, but there’s a very real price tag. Every year the price of higher education goes up, and it’s easy to feel like you’re always a step behind with saving. We know. But there are ways to make it just a little less painful and not go into debt, and I’m here to lay them out for you. There’s a lot to cover here, so I’ve broken this down into a two-part series. In this first part, I’ll lay out some tips and advice you can use to set up the college savings plan that’s right for you.

First things first. There is no one-size-fits-all plan, which is a bummer. The good news is that there are a few easy steps you can take today to make progress immediately, and your planner can help you find the plan that best fits your life right now and in the future.

The average sticker price of a college education is a whopping $26,226 per year, so it’s no wonder that many families feel overwhelmed when they think about how to pay for college. Couple that with the annual cost increasing by an average of 5% over the last decade, and many aren’t sure where to even begin. However, starting to save now, whether early or late in the game, is an important first step and will have a lasting positive impact.

Now that we find ourselves in November (National Scholarship Month) I wanted to share a few insights and offer a few tips to help you plan for—and ultimately pay for—college without breaking the bank or taking on too much student loan debt.

The good news is that you’ve already taken the most important step in working with one of our CFP® Professionals to craft a financial plan that will improve your chances of achieving your goals. The other good news is that college is a finite period, typically lasting four years (unless your child is on the Van Wilder plan), so this won’t last forever.

The Balancing Act

Before getting into the specifics of planning for college, I want to offer a quick money mantra that has helped me plan for my own finances:

“Keep it simple, make it balanced, give it purpose.”

I want to focus on the “make it balanced” part today. Your plan for college should not be made in a vacuum. The strategy should take into account your other goals such as retirement savings, budgeting, and home purchases, and should provide balance, allowing you to enjoy your life today.

5 steps to your ideal savings plan

Now, let’s talk about the steps to take to create your ideal college savings plan.

Tip: Make sure to include your child(ren) in the planning process as soon as they are old enough to understand financial concepts. Including them in the planning will help them better understand the costs and help set expectations when it comes to choosing a school.

Step 1: Set a realistic goal

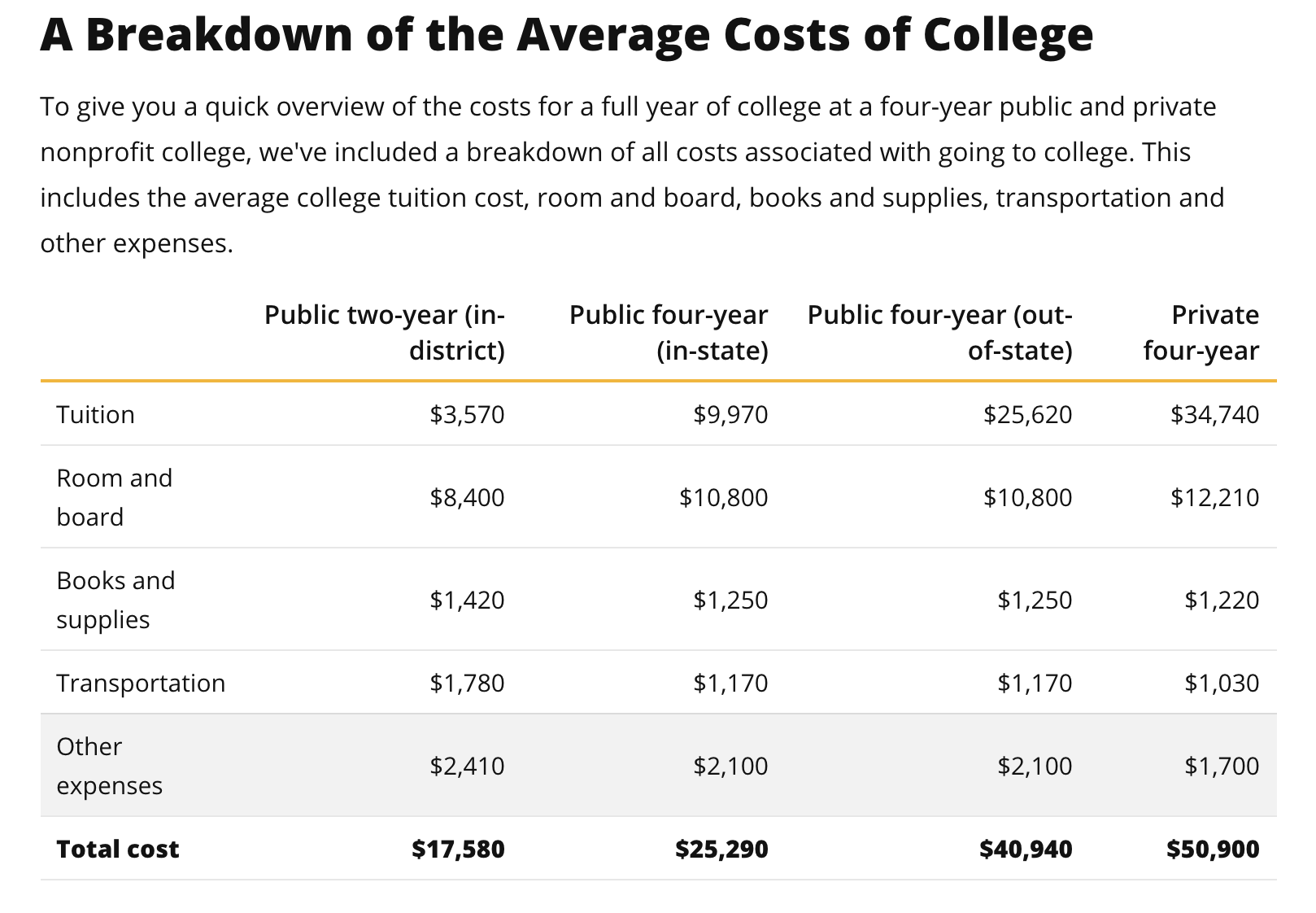

(via ValuePenguin)

The goal will be how much you want to have saved by the time you have to start actually paying for college. Talk to your planner about your desired outcomes. College costs can vary wildly depending on the type of school and the location so it is important to narrow the scope. It can be hard to know what your children will be doing in 10+ years, but we have to start somewhere. Your goal does not have to be to fully fund four years of college via savings. Talk to your planner about what is realistic. There is no right or wrong answer. There is only your answer.

Step 2: Decide how much to save

Once you set your realistic goal, you can work with your planner to determine how much to start saving today. Don’t worry if what you’re saving right now doesn’t seem like enough. Most families start small and then build up to the monthly or annual goal that they set. Life happens and there are other goals to take into account. Starting small is still starting!

Step 3: Choose the right vehicles

This is where things can get a little tricky as there are many ways to save for college. The options include:

- 529 college savings plans

- Coverdell Education Savings Accounts

- Prepaid college trusts

- Retirement accounts – typically Roth IRAs

- Bank accounts – savings, CDs, money markets

- Taxable investment accounts

- Custodial accounts (UTMAs)

- US Savings Bonds

My favorite college savings vehicle is the 529 college savings plan. Due to the potential for state tax advantages, tax-deferred growth, and tax-favored distributions (if used for qualified expenses), the 529 plan can help maximize your savings. Just like other types of accounts, there are advantages and disadvantages to 529 plans and each state’s plan varies so make sure you discuss them with your planner. As you can see, there are other options available to you, and there is no one size fits all solution. It may make sense for you to diversify the types of accounts you use. Your planner can help you navigate the landscape.

I generally do not recommend commingling (sounds scandalous) savings for college and other financial life goals, like retirement. Some families choose to use a Roth IRA or another form of investment account, and I am a fan of compartmentalizing in most cases. This form of mental accounting can help us stay committed to the goals that we set. There are certainly situations where this can make sense so make sure you discuss it with your planner.

Step 4: Get started

With a strategy in place, put the plan in motion. Simple, right? Regardless of how much you are saving, getting started is essential to creating success. In addition to gradually building savings over time, getting started helps to create healthier habits. One tip is to set up an automated contribution plan to the account of choice. This will help you stick to the strategy as it becomes part of your everyday life (like buying your daily coffee…or is that just me?). And once you do start, take a minute to celebrate. Every step you take, no matter how big or small, is a step towards a healthier financial future. Be proud of that.

Step 5: Evaluate and evolve

The one thing we do know is that life will change and the plan will need to change with it. Even with a plan in place, it’s important to review the strategy every year and make adjustments as life evolves, another child comes along, or you gain greater clarity around the college/school of choice. Your Facet planner will take the time to review the plan each year to make sure you stay on track.

Whew, that was a lot! Next, in Part 2, we will dive into choosing the right school and how to get the most out of the money you’ve saved.