The information provided is based on the published date.

Key takeaways

- An FSA is a tax-advantaged savings account for healthcare expenses

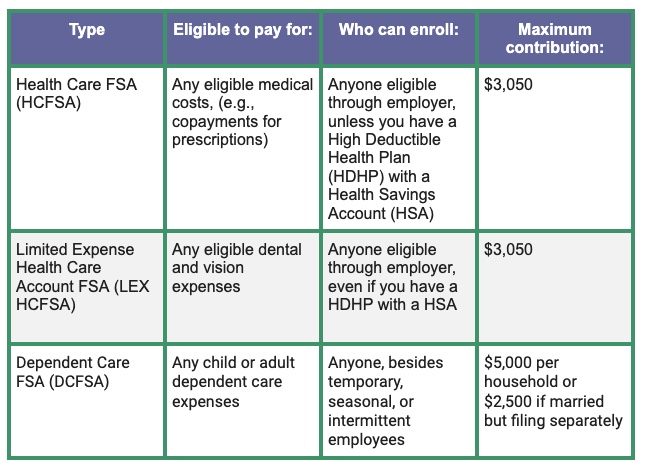

- There are different types of FSAs, such as health care, dependent care, and limited expense health care

- Contributions to FSAs are always pre-tax, meaning the IRS won't tax the money you put into your FSA

- FSA contributions have annual maximum limits

- Health care FSAs can be used to pay for medical expenses that are not typically covered by insurance

FSA meaning

A flexible spending account (FSA) is a tax-advantaged savings account that allows you to put away money for healthcare and dependent care. Each year, there's a maximum limit you can contribute to an FSA.

FSA contributions are always pre-tax. This means that the IRS won't tax the money you put into your FSA.

For example, if you contribute $2,500 to your FSA, you won't have to pay taxes on that portion of your salary. It's a practical way to reduce your taxable income while still getting the health care services you need.

Types of FSAs

Health Care FSA (HCFSA)

A health care FSA (HCFSA) is an account that is earmarked for health care expenses and used to pay for various medical expenses. HCFSAs are an option for those who need to cover medical costs that aren't typically covered by insurance. Some eligible healthcare expenses that can be paid through an FSA include:

- Copays: doctor visits, prescriptions

- Certain OTC meds

- Vision expenses

- Dental expenses

Check out the IRS site here for the full list of FSA-qualified medical expenses.

By enrolling in an FSA, you designate a specific amount of funds for healthcare expenses up to a predetermined annual threshold (established by the Affordable Care Act in 2013). The cap for 2023 is $3,050.

Flexible spending accounts (FSAs) come with different payment options for medical expenses. For example, some plans offer debit cards for immediate payment, while others require out-of-pocket payment and reimbursement from submitted claims.

If you need to submit claims, most providers offer direct deposit reimbursement. The type of FSA plan you have depends on what your employer offers. Check with your HR department if you have any questions about your FSA.

Dependent Care FSA (DCFSA)

If you're paying for childcare and employed or actively seeking work, you may be eligible to contribute to a dependent care FSA. DCFSAs allow you to use pre-tax dollars to pay for expenses like child care, summer day camps, and more. It's a practical solution that can help ease the financial burden of caring for your loved ones.

Like a health FSA, dependent care expenses may need to be paid upfront with reimbursement through the plan. In 2023, the maximum annual contribution limit for dependent care FSAs is $5,000 per family or $2,500 if married, filing separately.

Limited Expense Health Care Account (LEX HCFSA)

A Limited Expense Health Care FSA, also known as a limited purpose FSA, is an alternative to the general purpose Health Care FSA. The limited purpose FSA is applicable when a participant is enrolled in a high deductible health Plan (HDHP) with a health savings account (HSA). It allows participants to submit eligible dental and vision expenses only.

What's an HSA, and how does it work?

Like an FSA, a LEX HCFSA is only offered through your employer; you can't open one independently. Federal law also stipulates an annual contribution limit of $3,050 in 2023. This amount is generally raised annually to adjust for inflation.

Comparison: Types of FSAs

Advantages and disadvantages of flexible spending accounts (FSAs)

Advantages of FSAs

- Medical expense reimbursements: Funds contributed to an FSA before taxes can be used for various medical expenses. These expenses include but are not limited to, the cost of the diagnosis, cure, mitigation, treatment, or prevention of ailments affecting any structure of the body.

- Spouse and dependent coverage: FSA owners can use their health reimbursement account to pay for their medical expenses along with spouses' and dependents' qualified medical expenses.

- Medical equipment coverage: FSAs cover diagnostic devices, bandages, and crutches. Moreover, you can use FSA funds to reimburse expenses incurred for prescription medications, insulin, and over-the-counter (OTC) drugs for which you have a prescription.

- Deductible reimbursements: FSAs can be used to reimburse account holders for medical service deductibles and copayments.

Disadvantages of FSAs

- Not complete coverage: Surgery expenses for cosmetic purposes and items/services that promote general health, like gym memberships, are not eligible for reimbursement.

- Spending time limits: Typically, FSA funds must be spent within the plan year. However, there are two options that your employer may offer if you have money left in your account :

- A maximum of 2 1/2 additional months of "grace period" to spend the money in your FSA, or

- The option to carry over up to $610 per year (as of 2023) to use the following year

- Does not pay for premiums: FSAs can cover copays and deductibles but not insurance premiums.

Final word

An FSA can be a great way to save money on healthcare costs if you're eligible. However, it's important to understand the pros and cons of these accounts before committing to one.

To learn how your FSA money fits into your overall financial plan, click the button below to get started.

Facet

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.