Worried about working until the day you die?

By submitting this form, you acknowledge that you have directly provided the email and phone number contact information listed, you also acknowledge that Facet has the option to use either method to contact you, and agree to the terms set forth in our Company Privacy Notice. Message frequency varies, and message and data rates may apply. Reply STOP to opt-out of messages, and email [email protected] for help.

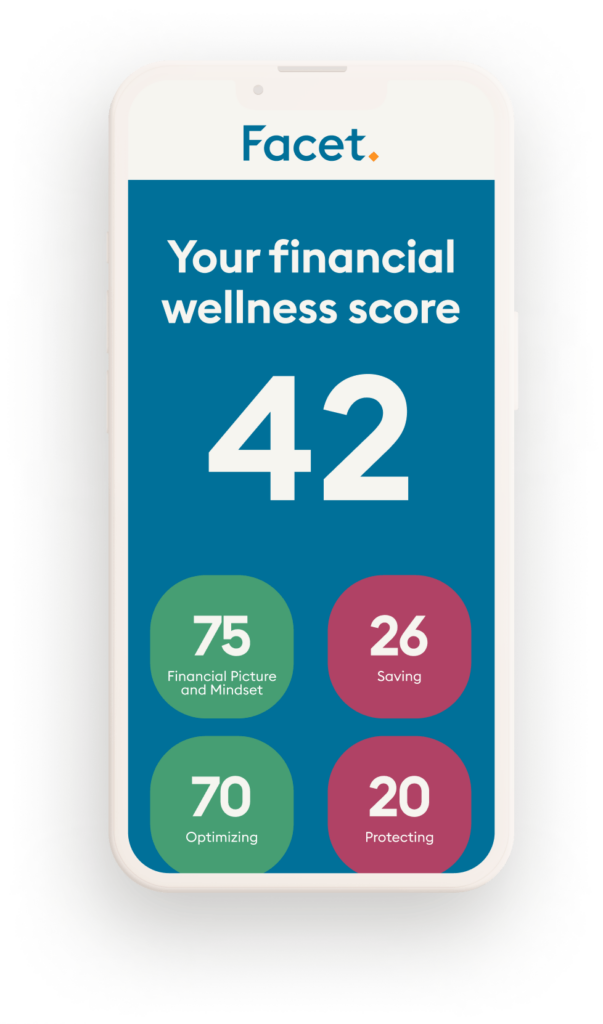

Honestly, how are you doing with your money?

You can find out in under 4 minutes. Your Financial Wellness Score will unlock insights into what you’re doing right and what could still be better.

** Nerdwallet review conducted in October of 2023 based on the time frame of August – October 2023. Nerdwallet’s independent assessment includes data collection, interviews and testing which results in star ratings from poor (one star) to excellent (five stars). Nerdwallet was not paid for this review however does receive compensation based on referrals.

How a Facet memberships work.

Our flat-fee model means no commissions.

Support from a team of CFP® professionals and experts.

Secure, industry-leading technology to manage and organize your entire financial life in one place.

Exclusive partner offers that complement your financial outcomes.

Antonio & Gimez T

New York

“After taking the time to get to know my goals and personality, Facet matched me with an advisor… Not only is [my CFP®] willing to discuss my own finances, she takes the time to answer any questions I have about the world of finance more generally, and I come out of each meeting having learned something new. I highly recommend Facet Wealth to anyone looking for financial advice.”

Isabella Z

Massachusetts

“Facet has completely changed my outlook on how I handle my finances and my confidence in my financial stability and strength in the future. My planner and the team are incredible, and just as excited as I am about building a strong financial future for me.”

Steve E

Massachusetts

“The fee structure is probably the other biggest thing that sent me to Facet and it’s made me very happy with Facet. It puts us at an equal footing with anybody else. It’s not about how much money I have managed by Facet. It’s about us as a client…and as we grow our finances, the attention we get is not gonna change. We’re still a client paying for our Facet services with a fee structure that supports us as just a couple, not as a set of assets.”

Sarah & Michael D

North Carolina

Nerdwallet review conducted in October of 2023 based on the time frame of August – October 2023. Nerdwallet’s independent assessment includes data collection, interviews and testing which results in star ratings from poor (one star) to excellent (five stars). Nerdwallet was not paid for this review however does receive compensation based on referrals.

“Facet’s pricing model helps you pay for what you need, when you need it. Clients who need more basic help can get assistance with benefit elections, budgeting, or debt planning. Clients with more complex financial situations may need advice on starting a family, saving for an education, planning for stock compensation or starting a business.”