The information provided is based on the published date.

Key takeaways

- A fiduciary has the legal requirement to put the client’s interests ahead of their own

- Fiduciary relationships are most commonly present in the financial industry

- Not all financial advisors are held to the fiduciary standard

- A fiduciary has a duty of care and loyalty to a client

The financial industry is full of jargon, and a lot of it is more confusing than helpful. One word that pops up fairly often is “fiduciary.”

While that may sound very technical, it is a critically important term when choosing a financial advisor.

Here’s what a fiduciary is and why you should always look for one to handle your financial planning needs.

What is a fiduciary?

Simply put, a fiduciary is an individual or entity with the power to act on behalf of another person or organization.

That means they must act with integrity and in good faith when making decisions on behalf of their beneficiaries (or clients).

Fiduciary relationships are most commonly present in the financial world. Individuals who assume fiduciary roles can include:

- Money managers, including financial advisors and planners

- Accountants

- Attorneys

- Executors

- Board members and corporate officers

Origins of fiduciary standards for financial advisors

The fiduciary duty came about as a way for regulatory organizations like the Securities and Exchange Commission (SEC) to regulate or oversee financial advisors’ actions in their client relationships. It all started with the Investment Advisers Act of 1940.

Note: The SEC released a clarification of fiduciary duty in 2019.

The “40 Act” established the guidelines naming activities that qualify as “investment advice” and which financial advisors are subject to a fiduciary duty.

When determining whether or not a financial advisor is subject to the fiduciary duty, the ’40 Act applies three criteria:

- The type of advice offered

- How the advisor is compensated

- Whether or not providing investment advice is their primary job

For people seeking financial advice, it can be difficult to determine who is and isn’t required to act as a fiduciary.

The good news is that you can still find a fiduciary if you know where to look and ask the right questions.

What does a fiduciary do?

Here is where things start to get a little confusing. Under the ’40 Act, a financial advisor must act as a fiduciary when providing advice or recommending securities (such as buying or selling stocks, mutual funds, or exchange-traded funds).

In addition, the Act also covers how advisors are compensated for the advice they give (e.g., do they charge a commission or an asset-based fee). That’s it—only investment-related advice.

What the Act doesn’t address is any advice related to other essential financial planning topics like insurance, taxes, and estate planning, among others.

Investment advisors who work exclusively with retirement plans such as 401(k)s and 403(b)s are also held to the fiduciary standard. These individuals may advise on the overall plan’s design and investment selection and always act in their client’s best interests.

However, the fiduciary standard does not specify the types of fee models that advisors can use. Therefore, an advisor can still be a fiduciary and receive a commission for investment advice.

In fact, all an advisor has to do to stay compliant under the Act is to:

- Act in your best interest, and

- Disclose how they are paid and any conflicts of interest

Also, because the fiduciary standard only applies to investment advice, there are no standards for what services (if any) are offered outside of general investment recommendations. As a result, two advisors can claim to be fiduciaries yet offer different services and charge different fees.

Are all financial advisors “fiduciary financial advisors”?

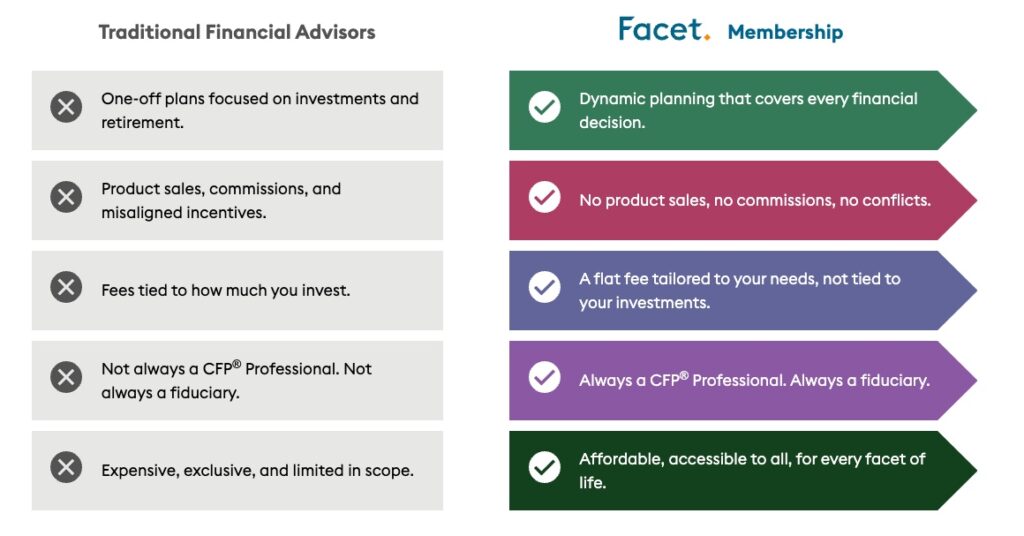

By definition, financial advisors are fiduciaries. However, this description falls short of providing a comprehensive understanding of the advisor’s role and expertise. In short, not all financial advisors are the same.

The challenge lies in the fact that a “financial advisor” is someone who offers financial services tailored to your individual circumstances. While they may act as a fiduciary advisor, the range of services they provide can differ significantly.

Being a fiduciary doesn’t inform you about:

- How the investment advisor charges for their advice

- Their level of education or experience

- The type of advice they provide (e.g., investments vs. planning)

- The level of service (one-time or ongoing and evolving)

Make sure to ask the right questions

A fiduciary advisor must act with a duty of loyalty (putting your interests ahead of their own) and care (acting with the respect, skill, prudence, and diligence of a professional). If you aren’t working with a fiduciary, you may be putting yourself at risk.

A fiduciary must disclose all conflicts of interest. For example, if they recommend an investment with a high fee, they have to tell you about the fees before you decide on the investment.

However, it’s important to note that fiduciaries do not necessarily have to eliminate all conflicts of interest. They simply have to manage and disclose them to you.

Ensuring your financial advisor is a fiduciary is a good start, but it’s not everything. Remember that just because someone is a fiduciary financial advisor does not guarantee they are the right one for you.

When talking to a potential advisor, always ask if they are bound to always act as a fiduciary.

This is important because some advisors are held to a “best interest” standard, which is different from a fiduciary relationship. These advisors are governed by a separate SEC rule called Regulation BI, or Best Interest.

While this may sound similar to being a fiduciary, it’s actually a much lower standard. Regulation BI states an advisor must act in the client’s best interests—which is different from putting you first—and it only applies at the time of the transaction or sale.

This is not an ongoing requirement and does not require the advisor to put your interests ahead of their own.

How to find a fiduciary who is right for you

The financial services landscape can be flat-out confusing, but we have some good news: There’s an easy way to find a financial advisor who is a fiduciary who will provide the advice and guidance you need and want.

First, always look for an advisor who is a Certified Financial Planner™ Professional. A CFP® professional is not only held to a fiduciary standard, but that standard applies to all financial planning advice—not just guidance on your investments.

In addition, CFP® professionals are held to rigorous education and experience requirements that make the certification the gold standard in the industry.

They not only have to meet the high ethical standard of being a fiduciary but also must demonstrate industry-leading knowledge, including retirement planning, college planning, investment management, taxes, insurance, estate planning, and the psychology of money.

It’s important to note that not all CFP® professionals offer the same services or advice or charge the same fees, so you must do your homework.

To make things easier for you, check out these 10 questions you should ask before working with a financial advisor to ensure they have the knowledge you need.

Final word

It’s best not to assume—you have a right to know. Ask the right questions and be an informed decision-maker. Finding a financial advisor you trust is critical to enjoying the life you want to live.

Experience the difference of working with a CFP® Professional at Facet today.

Facet

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.