The information provided is based on the published date.

Key takeaways

- Long-term investing: Since I still have time before retirement, I’d invest primarily in stocks to max out growth over a long horizon.

- Lump-sum investing: Investing a windfall immediately typically outperforms waiting, as "time in the market" is more beneficial than trying to "time the market."

- Diversification: Use broad ETFs (exchange-traded funds) to create a highly diversified portfolio, minimizing risk and capturing consistent market growth.

- Risk management: Balance high-risk investments with a diversified core portfolio, ensuring long-term financial goals remain secure.

One technique professional investors use to analyze their portfolio is to ask themselves: what would I invest in if I started from scratch? This sets aside all biases around what you currently own, and forces you to think fresh.

In this piece, we’ll do a version of this exercise. I will walk through how I would invest a sudden windfall of $100,000 today.

Investing for growth

To set the parameters, we’ll assume this money is for a long-term goal, like retirement. If we were saving for some shorter-term goal, this could all change. This is how I’d invest $100,000 for long-term gains.

I’m also speaking strictly for myself here. Everyone’s personal situation is different, so my advice to you could be quite different than what I’d do myself. I’m 47 years old, and I have a great job. I plan on working a long time to come.

Given all that, I’d put the $100,000 entirely in stocks. Not only do I have a fairly long time horizon before retirement, I also assume that even after I retire I’ll be living off that money for a long time. I need this money to grow, and stocks are the easiest way to achieve that.

Timing matters less than you think

Second, I would invest the money all at once. I know this might seem extreme to some. In my years in the investment business, I’ve known many people who had sudden windfalls. Overwhelmingly, they were very hesitant to put this new money into the market in one fell swoop.

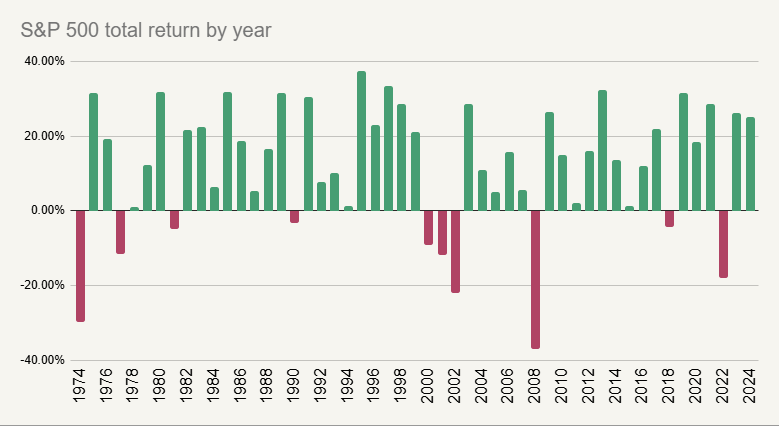

However, the data says that waiting to invest tends to cost you. Historically, stocks have risen about 8 out of every 10 years. Of course, history may not repeat itself. But if that history is correct, it suggests that you have about an 80% chance that waiting to invest costs you.

Source: Dow Jones S&P Indices

Admittedly, it's certainly possible that this coming year will be one of the 2 out of 10 where stocks fall. However, this actually matters less than most people think.

If you’re going to be a long-term investor, you’re going to go through some bad markets. It actually doesn’t matter what the timing of the bad markets are, assuming you aren’t adding or withdrawing from your account.

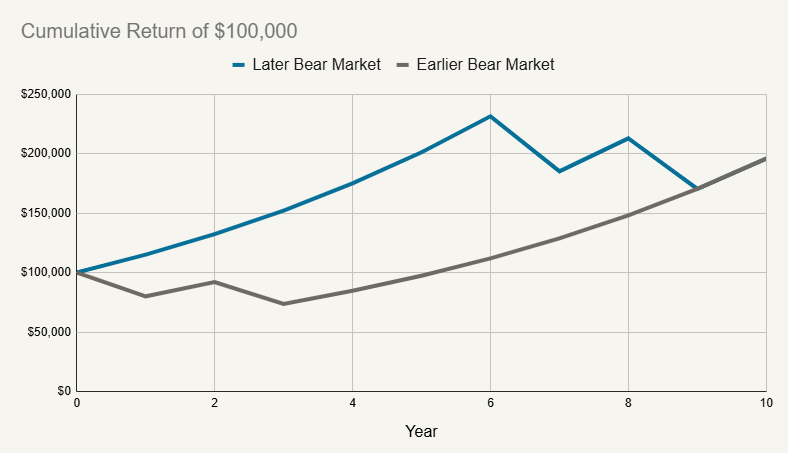

Here is the math behind this. Say that we invest for ten years, and in eight of those years, the market returns 15%. In two of those years, the market declines by 20%. The chart below shows the value of $100,000 invested in two scenarios. The blue line assumes the negative periods happen in years 7 and 9. The grey line assumes the down markets happen in years 1 and 3. You can see that both scenarios wind up in the same place.

Source: Facet calculations

Bear in mind that if you're actually adding or withdrawing from your portfolio, this math changes quite a bit. If you're continuing to add, it actually is better if the negative markets happen sooner. Future buys will occur at a lower level. If you're withdrawing, that’s a more complicated situation, and requires careful planning. This isn’t something we are going to cover in this article, but it definitely something that Facet can help you navigate.

Making the easy bet

I would invest my $100,000 in a highly diversified portfolio using broad ETFs. I believe the more diversified you are, the more likely your portfolio will capture the general upward movement in stocks over time. The most important thing to me is that when I do retire, I can afford to live the life I want to live. If I invest in a more narrow portfolio, even something like an S&P 500 fund, I’m taking more risk.

I would be the first to admit: this might sound pretty boring. It's true that if I buy a set of globally diversified ETFs, there’s no chance I turn my $100,000 into $1 million in a short period.

However, one thing I’ve learned over my 25 years in the investment business is that success comes from finding the easiest bet you can make. Then make that bet over and over. When it comes to investing in stocks, the bet I’m most confident in is that stocks will generally rise over time. To me, that’s the “easy bet” and the one I want to make over and over.

What if you want to take a bit more risk?

All of that summarizes what I’d do if I had a sudden influx of $100,000. However, this isn’t the only way to do it. In fact, I’m sure a lot of people would take at least some of that money and invest it in something with more risk but maybe more upside. Could be an individual stock, some set of stocks or even crypto.

If you're considering such an investment, be sure you size that bet right. One approach is to separate your portfolio into two buckets: a higher risk bucket that you can afford to lose, and a more diversified bucket that is meant to make sure you meet your goals.

Make the “meet my goals” bucket large enough that you’re going to be able to retire on time, even if the other bucket doesn’t contribute at all. Or put another way, make the high risk bucket small enough that even if it loses half its value and never recovers, your financial goals aren’t totally ruined.

Sometimes boring is best

As I said, I realize my $100,000 investment plan isn’t very exciting. But for me and my situation, I feel most confident that a boring plan is actually best. I could chase big gains, but I’d rather give myself a pretty high probability of hitting my long-term goals, and someday, a very long time from now, enjoying my retirement.