A Guide to Unlocking the Potential of Your Extra Cash

Investing your extra money can often feel like navigating a labyrinth, especially if you’re not starting with a massive fortune. If you’re wondering what to do with extra cash, sitting funds, or how to invest wisely, you’ve come to the right place. If you’d like more assistance than what’s provided on this page, schedule a call for a free consultation with a Facet expert.

Every dollar of your extra cash can be invested smartly to ensure optimal growth and security.

Challenges to Investing Your Extra Cash

Investing extra cash isn’t without its hurdles:

- Lack of large funds: Many believe substantial initial capital is required to start investing effectively, and this is true if you’re using traditional investing firms. (Most traditional firms require minimums between $100k to $500k before they’ll even talk to you.)

- Complexity: The vast array of investment options can be daunting, making it hard to choose the right path.

- Risk concerns: Fear of losing money can deter many from investing.

Benefits of Investing Your Extra Cash

Investing your surplus funds through flat-fee planning offers numerous advantages:

- Potential for higher returns: Let your money work for you, potentially outpacing inflation and savings accounts.

- Financial security: Build wealth for long-term goals, like retirement or educational expenses.

- Passive income: Potentially generate income through investments that provide returns on a regular basis.

Tax Implications of Investing Your Extra Cash

Investing can also have tax implications, which Facet can help you navigate:

- Capital Gains: Managed effectively to minimize tax bills.

- Tax-efficient investing: Strategies that can reduce the amount of taxes you pay on investment returns.

Flat-Fee Investing: Your Gateway to Wise Investments

Flat-fee investing is the solution to many of these challenges. Here’s how Facet makes it possible:

- Transparency: Know exactly what you’re paying for with a simple, flat fee.

- Accessibility: Get started without needing a large upfront investment.

- Personalization: Receive advice tailored to your financial situation and goals.

Why Choose Flat-Fee Over Traditional Financial Planning?

Traditional financial planning often involves percentages of assets under management (AUM), which can become costly as your portfolio grows.

Facet’s flat-fee model means:

- Cost-effectiveness: Pay for the service, not a percentage of your asset growth. Many traditional firms charge a 1% assets under management (AUM) fee* and so compared to a flat fee, you may potentially be paying more in fees over time. Facet’s fee is flat and our unbiased services start as low as $2,000 a year– and that’s it.

- Predictability: Better financial planning with predictable costs.

Who Qualifies?

Everyone with a financial dream qualifies to invest their extra cash. Whether you’re planning for a big purchase, securing your family’s future, or building a nest egg, our flat-fee service is designed to scale according to your needs.

Let Facet Guide You

Ready to take control of your finances? Facet is here to show you how every dollar of your extra cash can be invested smartly to bring about optimal growth and security. With us, you invest not just in the market, but in your peace of mind.

Get started by scheduling a free consultation. Your present and future-self will thank you!

Sources:

*AUM Fees

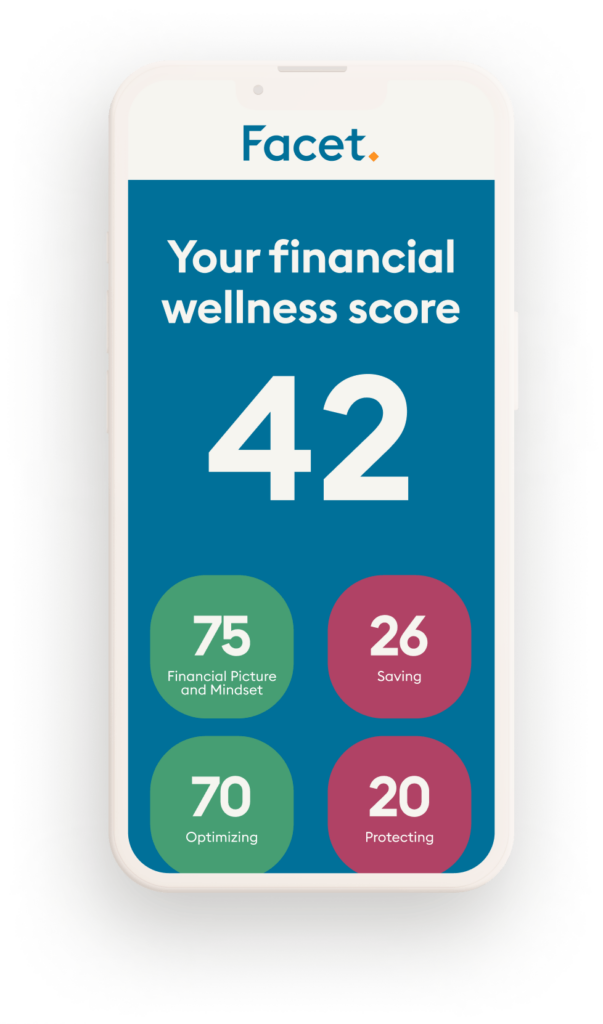

Honestly, how are you doing with your money?

You can find out in under 4 minutes. Your Financial Wellness Score will unlock insights into what you’re doing right and what could still be better.

Schedule a call with Facet

Get help with catch up contributions and every important financial decision with a flat fee membership.

How we’re different.

What Facet members are saying.

Testimonials were provided by current members of Facet ("Facet Wealth, Inc."). Members have not been paid for their testimonial and there are no material conflicts of interest that would affect the given testimonials. These testimonials may not be representative of the experiences of other members, and do not provide a guarantee of future performance success or similar services.