The information provided is based on the published date.

Key takeaways

- When it comes to investing, there are two primary strategies – trying to beat the market (an active approach) or trying to mirror it (a passive approach)

- Passive investors believe investing broadly, diversifying, controlling risk, and keeping fees and taxes as low as possible will lead to the best returns

- Active investors believe their research, forecasting, stock selection, and market timing can give them an edge and help them outperform the markets

- When it comes to returns, active management simply doesn’t add up – underperformance, high fees, and high taxes aren’t a winning combination

- A passive investment strategy combined with a proactive and evolving financial plan is the key to achieving better investment outcomes

The investment strategy you choose today is critical to your long-term success.

Some believe stock selection and market timing – known as active investing – is the right approach.

Others believe investing broadly, managing risk, and keeping fees and taxes as low as possible – a passive approach – is better.

The only thing that really matters is which strategy works for you.

Here’s what you need to know about both strategies and why passive investing may be your key to better investment outcomes.

What is passive investing?

Passive investing is a strategy that focuses on having a long-term investment outlook and remaining invested through the ups and downs of the markets and the economy.

It’s often referred to as a buy-and-hold approach because it’s a strategy that aims to minimize the buying and selling of investments in response to market conditions.

The goal of passive investing is to participate in, or mirror, the returns of the markets, not try to beat them. It’s the idea that stock selection and market timing don’t work and that investors should invest broadly to reduce risk, keep fees as low as possible, minimize taxes, and make changes only when it makes sense for their financial plans.

Focusing on what you can control and ignoring what you can’t—like the markets, the economy, interest rates, or inflation—will lead to better returns and outcomes.

Types of passive investments

There are two principal ways to be a passive investor, and both approaches involve investing in an index fund designed to track an index’s returns.

An index is a way to categorize and track a group of stocks or bonds with similar characteristics.

For example, the largest 500 companies in the United States are tracked via the S&P 500 index. This is why you may hear passive investing referred to as index investing.

Here are the two passive investments (index funds) you should know:

1. An index mutual fund

Individual investors put their money into a fund – a large pool of money - and that fund invests in the stocks or bonds that track a particular index either in the US or overseas.

2. An exchange-traded fund (ETF)

Exchange-traded funds (ETFs) are similar to a mutual fund in that they invest broadly across stocks and bonds based on a selected index. The main difference is that ETFs, like stocks, can be bought or sold throughout the day (intraday), whereas mutual funds can only be bought or sold once daily (after markets close).

Is passive investing a popular strategy?

Based on the 2021 Gallup Investor Optimism Index, a survey among US investors showed that 71% believe passive investing is a superior strategy for investors seeking solid long-term returns.

Only 11% of those surveyed expressed that timing the market is more important to achieve high returns. On the other hand, 89% stated that having “time in the market” is more crucial to achieving better returns.

As the popularity of passive investing rises, so too does the number of index funds across various stock market indexes. According to Statista, the total number of US index mutual funds in 2000 was 271. In 2022, that number increased to 517.

Interestingly, S&P index funds dropped to just 77 at the end of this span, down from 118 twenty-two years prior. However, “other domestic equity” funds climbed from 101 to 265, signaling a rise in other indexes, like the Dow Jones Industrial Average (DJIA).

Pros and cons of passive investing

No investment strategy is perfect, and passive investing is no exception. It all depends on what type of investor you are.

The pros:

Diversification

Passive investments practice diversification—allocating money broadly to several stocks or bonds—as measured by the index they track, instead of one or a few companies.

Lower risk

Diversification comes with lower risk. Investing across many companies means you aren’t subject to the risk of any one company failing.

Lower costs

Because passive investments don’t rely on market forecasts, company research, or active trading, their costs are incredibly low and often a fraction of the cost of active investments.

Lower taxes

Since passive investments employ a buy-and-hold approach and don’t actively buy and sell stocks, they don’t generate a lot of taxes (e.g., capital gains), which means you pay less over time.

The cons:

Less flexibility

Because passive investments own a wide array of stocks or bonds, you have to hold every company in the index and can’t hand-select or drop any particular company.

Market returns

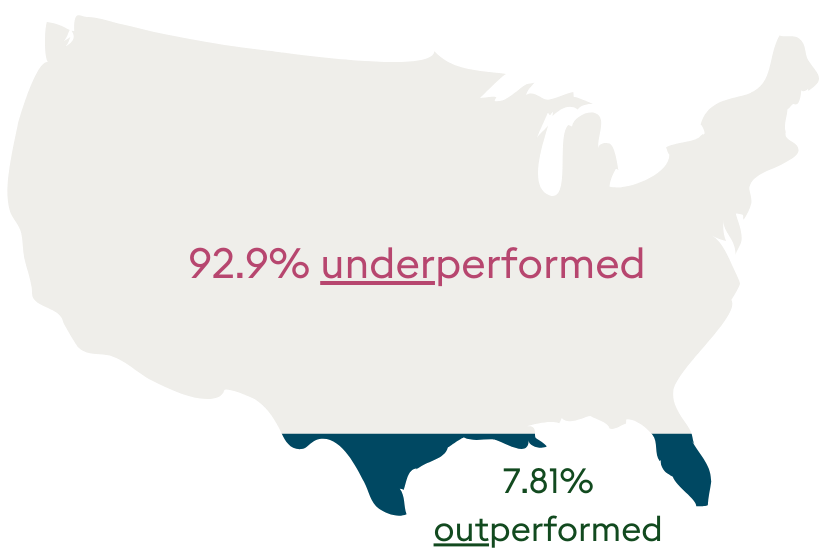

For investors who believe in active management, passive investments will only generate returns that mirror the market. They will never beat market returns. This isn’t necessarily a bad thing, as less than 10% of US actively managed funds have beaten the market in the last twenty years.

Active vs. passive investing: Differences and performance

An active investment approach is the counterpart to a passive investment approach. Active investors are individuals or larger institutions, like investment companies and Wall Street firms, that believe stock selection and market timing can produce returns greater than those of the broader market, such as the S&P 500.

Active investors take a hands-on approach, researching individual companies and trying to forecast economic changes, interest rates, inflation, and other indicators to gain an edge. In short, they actively buy and sell investments based on their forecasts.

Which method performs better, active or passive investing?

To some, active management can sound like a winning strategy. Who wouldn’t want to buy the winners and avoid the losers?

Unfortunately, market timing and stock selection strategies fail to provide the investment returns that many seek. The majority of professional money managers that actively trade stocks or bonds fail to generate returns that are better than the index they are trying to beat.

Source: SPIVA® index versus active scorecard as of 01/24/2024

Source: SPIVA® index versus active scorecard as of 01/24/2024

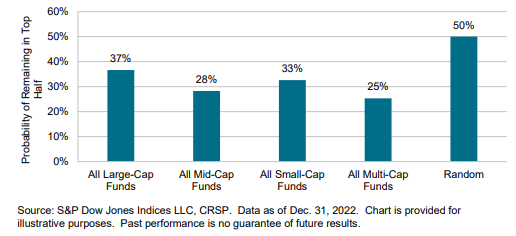

Even when active managers do outperform, those periods of excess returns are short-lived, making it very difficult to not only pick the best managers but also find the ones that consistently outperform over time. If you’re wrong, it can be a very costly mistake.

Best performing funds in years 1-5 years fell off in years 6-10

The bottom line is that active investments fail to outperform, charge high fees – often 0.50% to 1% or higher – and create higher taxes. It’s a bad combination that leads to your returns being lower than you think.

On the other hand, passive investments mirror market returns, help you create a well-diversified portfolio, better manage risk, come with very low fees, and minimize taxes. This is why passive investing can be a great solution for most people looking to participate in market returns, grow their money, and keep more of it working for them over time. Remember, it’s not just how much you make; it’s how much you keep.

Final word

What most people (and maybe even your financial advisor) get wrong about investing is that they believe their investment strategy alone is the key to better returns and outcomes. The truth is that any investment strategy, passive or active, developed without a financial plan to guide it will fail.

Having a plan to guide your strategy will help you make critical decisions over time, including optimizing your cash flow, how much to invest, what account types to use, what investments to own, how much risk to take, and how to minimize fees and manage taxes. Passive investing is simply a tool, albeit a powerful one, to help you execute that strategy.

Get in touch today to learn how Facet’s team of experts can help you create a personalized financial plan and investment strategy.

Facet

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.