Financial Wellness Overview For Jimmy Ellis

Your Details

Name: Jimmy Ellis

Email: [email protected]

Income: $900,000

Investments: $2,000,000

Married

Age: 62

W2 Income: $100,000

Children under 22: 3

More Info 2

More Info 3

More Info 4

More Info 5

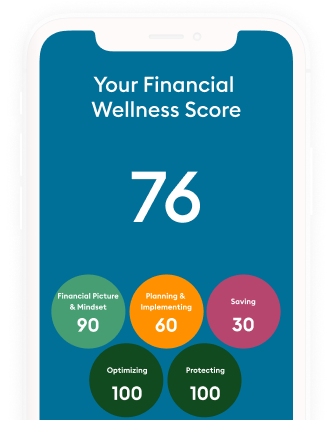

Financial Planning Focus Areas

Your top priorities

- More travelling for family vacations.

- College planning plus retirement

- Estate Planning

Your Personalized Investment Strategy

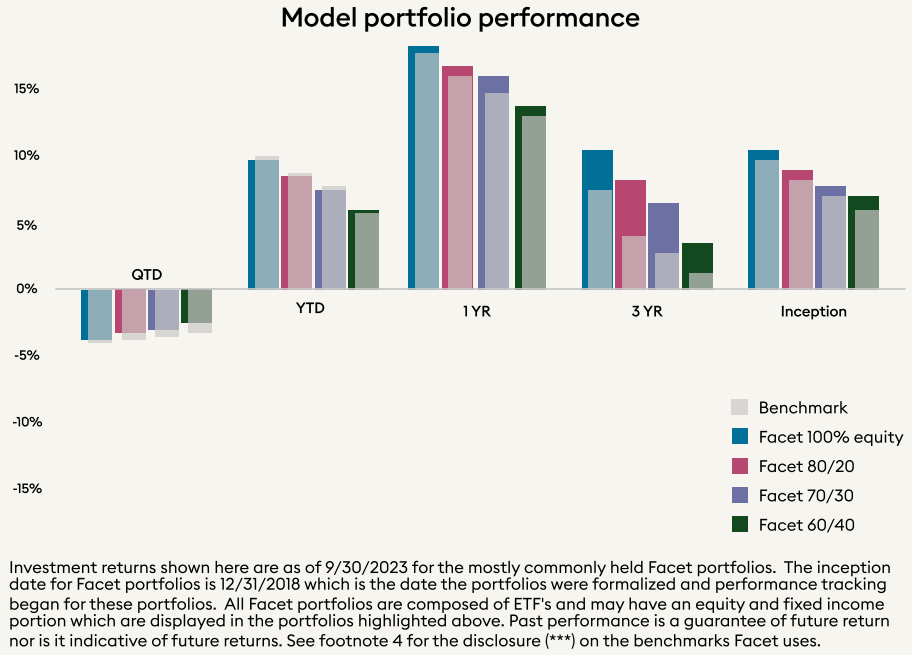

Proven Investment Strategy

Our investment Strategy is based on Nobel Prize-winning research

No Additional Cost

Investment management at no additional cost (it’s already included in your fee!)

Tailored To You

A tailored portfolio that aligns with your planning strategy

Facet Portfolio Performance

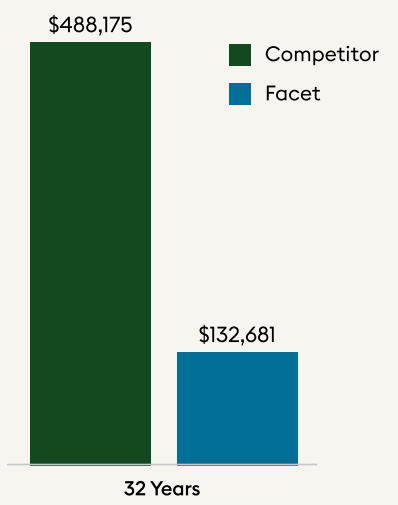

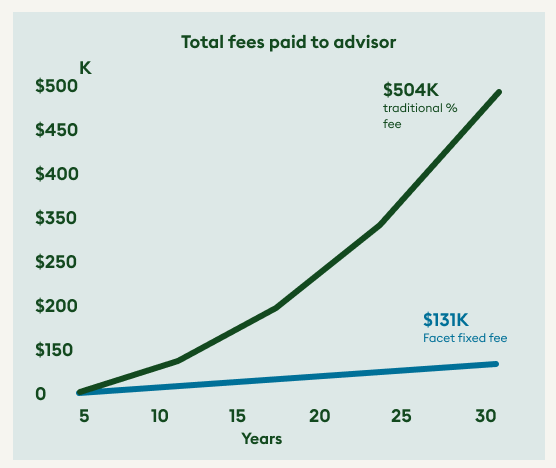

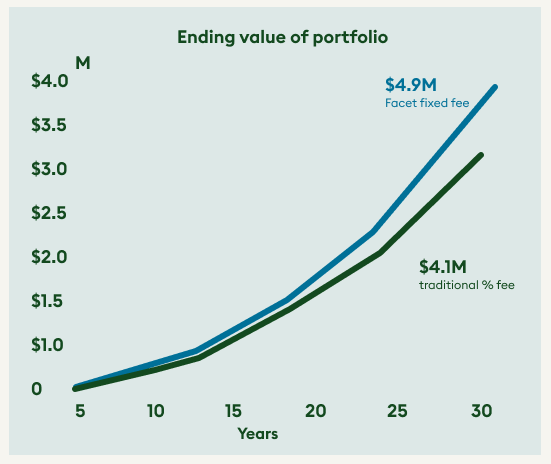

You keep more

When you keep more, you make more

Keeping it simple.

That's kind of our thing.

- Personalized, dynamic planning that aligns with your values and supports every financial decision

- Always a CFP® professional, always a fiduciary with your best interest in mind

- Tech-powered solutions and expert guidance for a data-driven, human-led experience

- Investing included with no additional AUM fees (assets under management) or commissions

- Access to a CFP® professional anytime via messages

- No confusing industry jargon

Choose the membership that’s right for you.

- Served by any Facet CFP®

- Unlimited messaging access

- Up to 4 virtual sessions (year 1)

-

1 virtual session

(year 2+) - Cashflow and debt management

- Investing included with no additional AUM fees or commissions

- Retirement & life planning

- Insurance planning

- Estate planning (guidance only)

-

Business hours

(9am - 5pm)

- Small dedicated CFP® team

-

Up to 2 virtual sessions

(year 2+) - Equity and comp planning

- Extra hours upon request (up to 8pm)

- Your own dedicated CFP®

-

Up to 4 virtual sessions

(year 2+) - Estate planning (full plan and documents)

- Advanced tax strategy

- Extra hours upon request (7am-8pm)

Your membership pays for itself

The majority of our members see that the service pays for itself year after year when they take advantage of everything that our membership offers, including investment management at no additional cost.*

This brave claim requires a disclosure

Disclosure: Based on a study conducted by Facet in April 2023. A statistically valid sample of members following Facet’s current planning process demonstrated that more than half of these members, defined here as a majority, achieved value greater than their planning fee. This value was shown to reoccur on an annual basis. Assumptions included average expenses and fees, using retirement tax savings, portfolio expenses and tax loss harvesting as value drivers using Facet’s investment services, and discounting value to align with the acceptance of Facet recommendations. Facet assesses clients an annual flat fee for service based on the complexity of planning needs. There is no separate or additional fee for investment management. This is not a guarantee or prediction of actual results for any member and results may vary by member. Some value like tax loss harvesting may vary year to year.

Frequently asked questions.

Why should I choose Facet?

In an industry saturated with fees, confusing jargon, and cookie-cutter solutions, Facet exists to make financial planning affordable, accessible, and personalized.

Affordable: With our flat-fee membership options and commission-free approach to investing, we’re helping you keep money in your pocket so you can spend it on the things that matter most to you.

Accessible: Financial planning can be complicated enough as it is, without all the fancy jargon and hard-to-understand processes. With knowledgeable, unbiased CFP® professionals, intuitive technology and ongoing support, we’re making financial planning simple. (As it should be.)

Personalized: There is no one-size-fits-all approach to planning because there is no such thing as a “standard client.” We take the time to understand our members’ individual needs, dreams and priorities to develop plans that help them achieve success by their unique definition of the word.

How does Facet work?

Once you choose and purchase a Facet membership, the financial planning process begins with a virtual meeting with a CFP® professional. They will get to know you, your situation and your goals to create a personalized plan and set you up for success (whatever that looks like to you.)

What is financial planning?

Financial planning is about setting goals, analyzing your current finances and creating strategies to achieve those goals. When you work with a financial planner, these strategies can include cash flow, debt, and investment management, as well as retirement, insurance, education, equity, and estate planning (and the list goes on.) Most importantly, financial planning with Facet is personal, making sure every goal and strategy is aligned with our members’ unique values and priorities.

Can I purchase services a la carte?

The only service available a la carte is estate planning. The price of this service is $2000 for the first year and $300 annually every year after.

I can do this myself, why do I need a financial planner?

What’s a fiduciary?

What happens if I want to cancel my membership?

All of Facet’s memberships are annual and non-refundable. If you choose to cancel your membership, you will be responsible for any outstanding balance, and will retain access to your planner and services for the remainder of the term.

Can my spouse or partner join under my membership or do they need one of their own?

You and your spouse or partner can use the same membership.

Do you charge a percentage of my assets under management (AUM) in addition to my membership fee?

There’s no additional cost for investment management, it’s included as part of your membership. While we don’t charge additional fees for managing your accounts, our custodians may charge fees that will be deducted from your account. You can view a full list of potential custodial costs here.

How can Facet manage my investments as part of my membership when others charge a fee?

1 Kitces.com | Source: Tharp, Financial Advisor Fee Trends And The Fee Compression Mirage.

“[The Facet service] was like tenfold my expectations in terms of what I got. I’ve just been so overjoyed with having what I would describe as a partnership with Facet to run the business of life. I’m never looking back.”

Tyler A | Cupertino, CA

*Learn more about our community supporters.