The information provided is based on the published date.

Key takeaways

- Global stocks fell slightly, weighed down by currency movements, the threat of tariffs, and rising interest rates.

- Bonds struggled as persistent inflation damped hopes for further rate cuts.

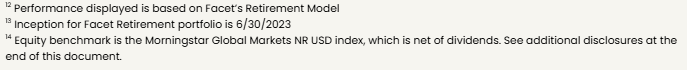

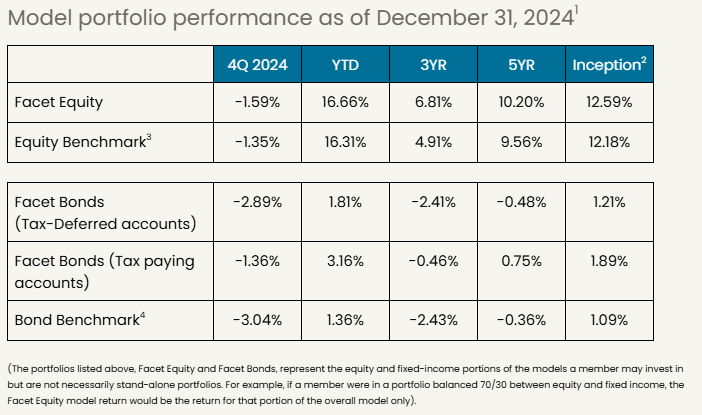

- Facet’s equity ETF mix was slightly behind benchmark, with some underperformance from tech and healthcare the main culprits.

- Facets bond ETF mix was ahead of benchmark, as our more defensive interest rate position allowed our allocation helped avoid some of the losses in fixed income this quarter.

Global stocks fell slightly in 4Q, with the Morningstar Global Markets index falling 1.35%. It was a period of shifting narratives: the U.S. election, a surging dollar, stubborn U.S. inflation, and rising interest rates all contributing to market volatility this quarter. However, this middling quarter capped off a strong year for global stocks. The Morningstar index was up over 16% for the year.

Bonds had a tougher quarter. The Morningstar Core Bond index fell more than 3%, amidst signs that the Federal Reserve could be done with rate cuts for a while.

Facet’s primary equity ETF mix was slightly behind benchmark for 4Q, while the bond allocation was slightly ahead. Both finished slightly ahead for 2024 as well as longer time frames.

Here is a recap of what happened this quarter, and our analysis of what it might mean going forward.

If you're a current Facet member and are interested in learning more about investing with Facet, please reach out to your planner and start the conversation. The investments team is available to meet with you, answer questions, and talk through your options.

U.S., AI stocks dominate

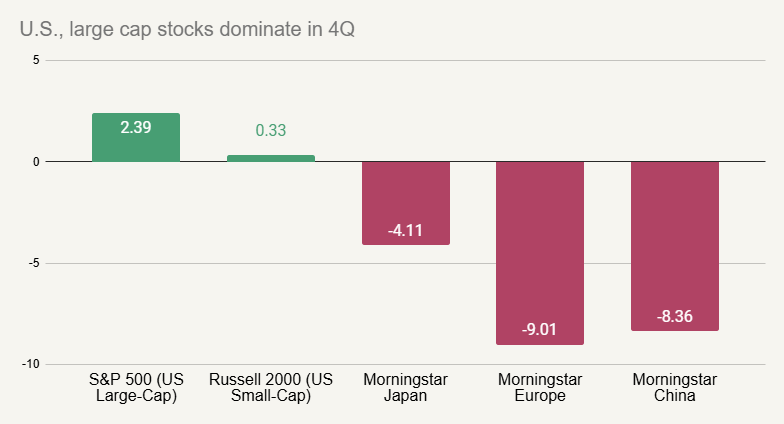

While global stocks were down in 4Q, U.S. stocks fared better. The S&P 500 rose just over 2%, while small-cap U.S. stocks were barely positive, and most other regions were negative.

Source: Morningstar, Dow Jones S&P Indices, FTSE Russell

Even within the U.S., returns were narrow in 4Q. The so-called Magnificent 7 stocks (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla) accounted for more than 100% of the entire S&P 500 return in 4Q. In other words, on net, the other 493 stocks were slightly negative.

This continues a trend that has been evident most of this year: a relatively few stocks, namely those involved in the artificial intelligence boom, have been the main drivers of global stock performance.

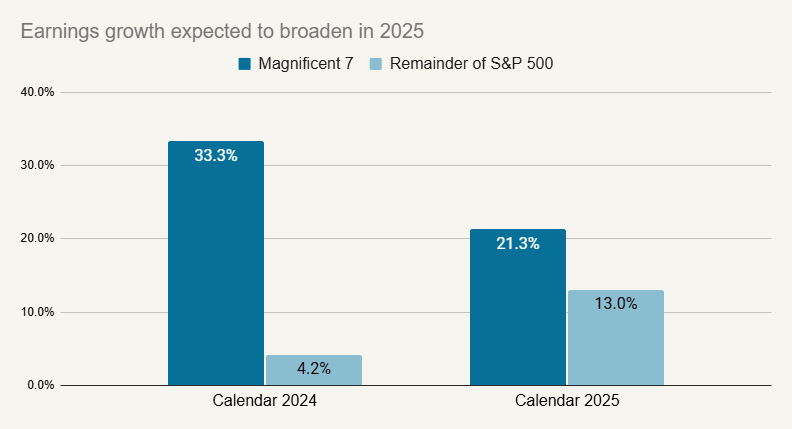

This has sparked some talk of an AI bubble forming in these stocks. However the dominance of these stocks in 2024 makes sense when we look at earnings growth. According to data from Factset, the Magnificent 7 stocks will finish 2024 having grown earnings by 33% vs. just 4% for the rest of the S&P 500. However, that is expected to change in 2025.

Source: Factset

Factset calculates this data by averaging the various earnings expectations from Wall Street analysts. These analysts expect earnings growth to slow among the Magnificent 7 and accelerate for the rest of the S&P 500.

If this comes to fruition, it should mean that stock returns are also broader in 2025. In other words, it makes sense that only a few stocks would dominate returns if those same stocks are the only ones growing profits. However if profit growth is healthy among a broader set of companies, then there should be greater gains to diversification.

The narrow returns this quarter were a bit of a drag on Facet’s relative return for equity portfolios. We are underweight more speculative growth companies in favor of those with higher profits and more stable revenues. This was not a benefit in 4Q.

Election result shifts interest rates, dollar

The U.S. election had a number of short-term impacts on the market this quarter, although what the lasting impacts are remains to be seen.

The biggest single impact is related to taxes. The tax cut passed in 2017 is set to expire in 2025. With Donald Trump winning the White House and Republicans holding narrow majorities in the House and Senate, markets gained confidence that those tax cuts will be extended.

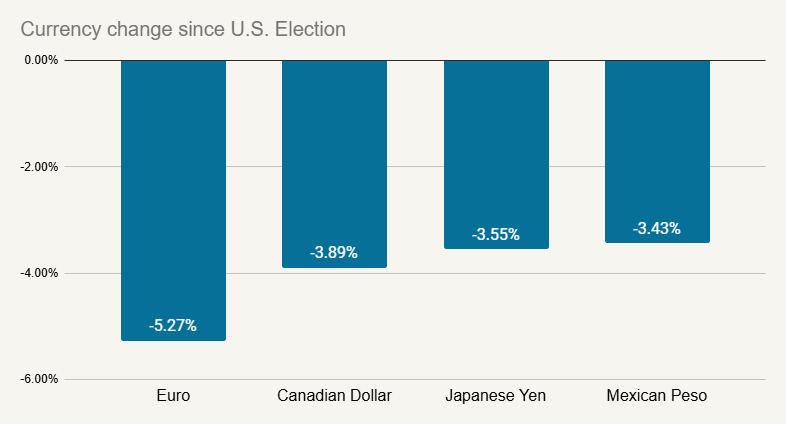

The next biggest effect will probably be from tariffs. We wrote about how this might impact the economy and markets in another piece. In terms of immediate impacts, the threat of tariffs has pushed the dollar higher against other currencies.

Source: Bloomberg

The dollar is gaining strength as currency traders bet that companies will either move production to the U.S. or make other maneuvers to avoid tariffs. This will involve moving currency from overseas to the U.S.

This has weighed on non-U.S. stocks. When U.S. investors buy overseas stocks, even through an ETF, they functionally transform their dollars into the foreign currency. Therefore the return on that stock is partly a function of currency movements.

The other factor weighing on non-U.S. stocks is fears that tariffs could harm the economy of exporting countries. This quarter markets in export-led economies like China, Mexico, Vietnam, Korea, etc., all fell more than 7% during the quarter, in large part due to this concern.

Facet’s primary equity ETF mix is overweight U.S. and underweight emerging markets stocks. Both of these positions benefitted our returns relative to our benchmark.

Other impacts of Trump’s policy agenda are a bit less clear. We know what he’s said on the campaign trail, but we know that campaign promises don’t always come to fruition for a variety of reasons.

That hasn’t stopped the market from speculating. For example, the healthcare sector has underperformed materially, falling almost 7% since election day. Traders are concerned that the Trump administration may be more hostile toward new drug approvals and/or pharmaceutical pricing. This has been a mild detractor for Facet’s ETF mix, as we are slightly overweight healthcare.

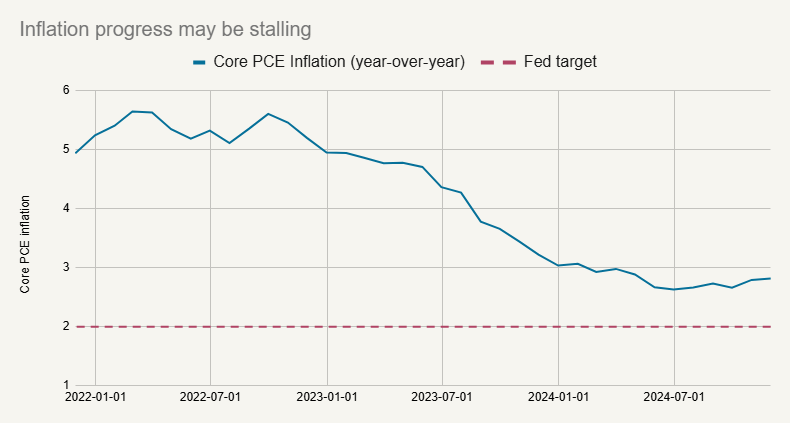

Stubborn inflation may mean fewer rate cuts

The Fed cut interest rates twice this quarter, but the December cut could be the last for a while. While inflation has fallen considerably since 2022, progress has stalled in recent months. The Fed’s favored inflation metric, Core PCE inflation, has been stuck between 2.6 and 2.8% since May. That’s well above the Fed’s 2% target.

Source: Bureau of Economic Analysis

For the Fed to resume cutting rates, inflation is going to have to start falling again. If it doesn’t fall, or falls too slow, the Fed could be done cutting rates entirely.

Trump’s policies could also have some inflationary impact. Tariffs are likely to push consumer prices higher. Any curb on immigration could result in a tighter labor market, which tends to be inflationary. Tax cuts tend to boost consumer spending, which also tends to push up prices.

Concerns over inflation and the Fed definitely weighed on bonds this quarter. The 10-year Treasury yield rose from 3.78% to 4.57% during the period despite the two Fed rate cuts. Rising rates cause bond prices to fall, resulting in the Morningstar bond index’s 3% decline this quarter.

Facet’s bond mix outperformed this quarter. We had positioned portfolios to be a bit underweight interest rate risk, especially in longer-term bonds, which helped our portfolios somewhat as rates rose this quarter.

Looking forward, we remain cautious on longer-term interest rates. We think it entirely possible that inflation does indeed start subsiding again at some point during 2025. However the longer inflation remains above the Fed’s target, the more hesitant they will be to cut rates again. We think this leaves the risk/reward balance leaning more toward higher yields.

Economy appeared to gain momentum in 4Q

One reason why inflation has stayed high is that the economy continues to perform very well. If anything, the economy accelerated a bit this quarter.

- Job gains accelerated in September-November compared with the prior three months.

- Consumer spending also accelerated over that same time frame.

- Unemployment held steady in 4Q after rising for most of 2023 and 1H of 2024.

- New orders from the ISM Manufacturing Survey suggested manufacturing growth for the first time in 8 months.

This continued economic strength has a lot of important implications. First it means the Fed isn’t going to be in a hurry to cut rates. When they cut by an outsized 0.5% in September, there had been a lull in hiring that concerned the Fed. But if the jobs market stays this strong, the Fed can focus solely on inflation. As we said above, this makes future rate cuts less likely.

This also means that the economy can handle higher interest rates. In 2022, the Fed aggressive rate hiking campaign had many economists projecting a recession in 2023. This was in large part because those economists assumed that the economy simply couldn’t handle interest rates being as high as they were.

Given today’s economic strength, we know interest rates at this level aren’t a problem. This suggests we are in an era of structurally higher interest rates.

Market is expensive, but conditions are good

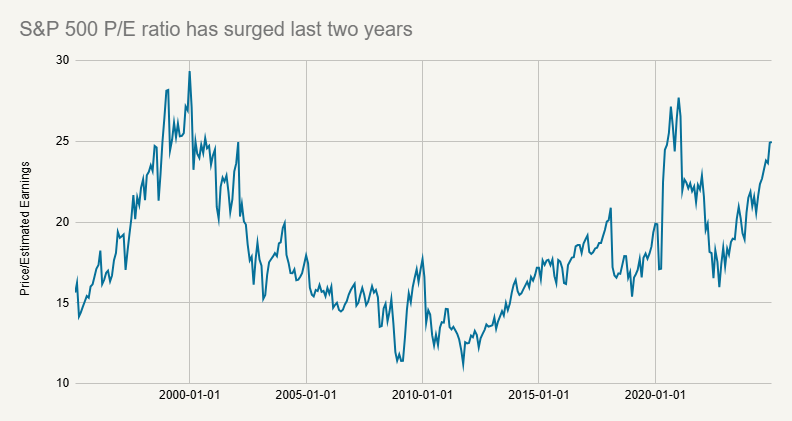

No matter how you slice it, the stock market is expensive right now. Here is a chart of the price-to-earnings (P/E) ratio of the S&P 500.

Source: Bloomberg

Think of the P/E ratio as how much you have to spend to buy a company with $1 of earnings. Today that’s about $25. The long-term average is about $18. You can see from the chart above, there aren’t a lot of other periods where the P/E climbed above 25. Notably one such period was during the 1990’s internet bubble.

While we certainly acknowledge the market is expensive, here’s the reality: the market always gets expensive when times are especially good. As we said above, the economy is humming. In addition, according to Factset, U.S. companies are expected to grow profits by 15% next year. That’s far above the 10-year average of 8%. The more you look, the more strength you find. Profit margins are expected to be 13% next year, again well above the 10.8% average over the prior decade.

Saying the market is expensive when conditions are this good is kind of like saying that a brand new Lexus is more expensive than a used Toyota. While literally true, it doesn’t provide any insight about value.

If stocks sell-off, it will be for a reason

This isn’t to say stocks will definitely rise next year. There are always risks. But we stress that stocks don’t decline just because they get expensive. You need some catalyst to cause stocks to decline. Historically, that catalyst has almost always been a recession, or at least the fear of one.

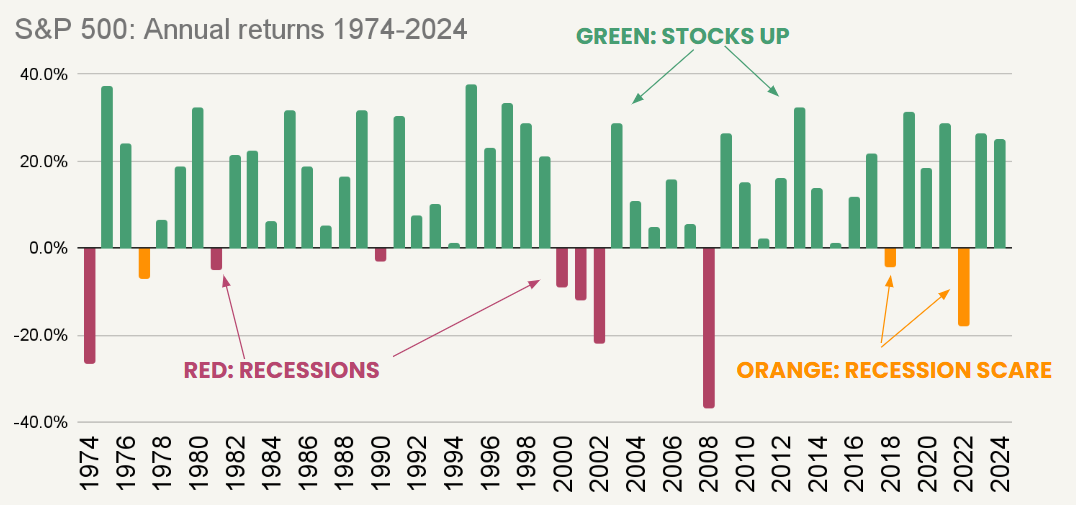

The chart below illustrates this point. It shows the annual returns of the S&P 500 for the last 50 years. In green are all the up years. In red are down years that surrounded a recession. Orange are years where a recession was widely feared but never came to fruition.

Source: Dow Jones S&P Indices, National Bureau of Economic Research

What we see on this chart is that the vast majority of time that there isn’t a recession, stocks go up. The vast majority of the time stocks go down, it is because there was a recession. Everything else is just noise.

This is why when Facet is building defense into our portfolios, we are focused on recession risk. Recessions are hard to predict, and they come on suddenly, so there is value to having some level of protection. Within equity portfolios, we are underweight emerging markets, which tend to underperform in any kind of U.S. slowdown. We are also overweight companies with high profit margins and low debt levels. These kinds of companies tend to be more resilient in a slowdown. It is also likely that in a recession the U.S. dollar could decline, which is typical when the Fed is cutting rates. This would probably boost performance of stocks in Europe and Japan.

All that being said, if earnings growth is indeed 15% as Wall Street analysts are currently projecting, it is very likely stocks will keep going up. There’s a lot going for the U.S. economy, and we see no obvious signs of that changing in 2025.

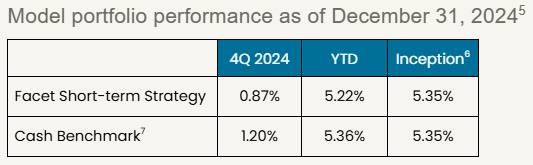

Facet’s Short-Term Strategy

Facet’s Short-Term Strategy (STS) is designed to produce stable returns commensurate with the yields available in shorter-term bonds. The strategy is designed for members with money goals that are only a few years away.

STS’s performance was a bit behind the Morningstar Cash T-Bill index this quarter. The strategy holds a mix of very short-term bonds, floating rate bonds, and 1-3 year Treasury bonds. As general interest rates surged higher this quarter, it resulted in those 1-3 year bonds lagging the return of T-Bills that make up the index.

This follows the pattern we would generally expect from this strategy. Over short periods, like a month or a quarter, there will usually be mild underperformance when rates rise, mild outperformance when rates are steady or falling.

However the strategy now has a significantly higher yield than other short-term options. The T-Bill index’s yield is 4.3%, while most high-yield cash accounts have fallen below 4%. STS has a yield of 4.6%. If this yield advantage persists, it will compound over time, and this will likely benefit STS over longer periods.

Facet’s Environmental Social Governance (ESG) Strategy

Facet’s ESG equity strategy was a bit ahead of the Morningstar Global index for the quarter. The strategy utilizes a set of ETFs that screen out stocks based on certain ESG criteria. As a result, it tends to significantly underweight energy, utilities, and heavy industrial companies.

2024 has been a tough year for energy, metals and mining companies, and 4Q continued that trend. Although crude oil prices rose slightly this quarter, it remains down significantly for the year. Metals prices also mostly fell this quarter, weighing on mining and metals companies. The underperformance of these companies was a material benefit to the Facet ESG equity strategy vs. the benchmark.

On the bond side, performance was about in-line with the benchmark. Facet’s overweight of corporate bonds vs. Treasury bonds had little impact this quarter, but has been a minor positive for the year.

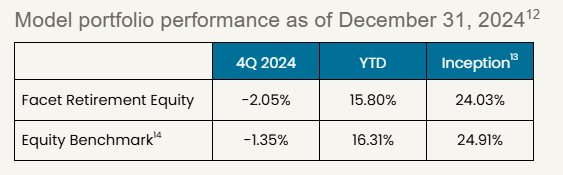

Facet’s Retirement Strategy

Facet’s Retirement Strategy is meant for members who are either already in retirement or close to it. The strategy utilizes ETFs that we expect will have relatively less volatility than our traditional growth model. Generally speaking, Facet expects this strategy to lag the equity benchmark a bit during big up quarters. Adding lower-volatility funds to this ETF mix should protect against the downside while giving up some upside.

This quarter the strategy slightly underperformed the Global benchmark. As discussed above, returns this quarter were dominated by a relatively small number of high-volatility stocks. This strategy is underweight those stocks in favor of ones with less volatility.

While this weighed a bit on relative performance this quarter, we are pleased with the strategy’s performance for the calendar year. Given the large overweight to defensive stocks in the strategy, and given the powerful up move in stocks, we’re pleased that the strategy finished the year close to benchmark.