Retire sooner than you think

Wondering if you can retire early? Whether you’re aiming for retirement at 40, 50, 55, or even 60, it’s never too early or too late to start planning. The information below is designed to quickly help you understand your options and help you make the right choices for a financially secure future. If you’d like to learn more, get started by scheduling a call for a free consultation with a Facet expert.

Plan your early retirement with Facet's expert financial guidance.

Can I Retire Early?

Retiring early isn’t just a dream—it can be achievable with the right planning. If you’re eyeing an early exit from your career, whether at 40 or later, a clear understanding of your financial situation is key. Expert advice in tax, investment, and retirement planning can help you evaluate your finances, identify retirement income sources, and help optimize your savings strategies. This approach helps ensure you’re prepared for a financially secure early retirement.

10 Possible Reasons People Might Choose to Retire Early

- More time for hobbies and travel.

- Opportunities for second careers or volunteer work.

- Health benefits of less stress.

- Greater involvement in your children’s or grandchildren’s lives.

- Flexibility to manage health issues.

- Potential for reduced living expenses.

- Freedom from the daily grind.

- More time for personal development.

- Financial independence.

- Early investment in your personal well-being.

How to Retire Early on Different Ages

Retiring at different ages such as 40, 50, 55, or 60 calls for customized strategies. For example, retiring at 40 often requires a more aggressive approach to savings and investments compared to planning for retirement at 60. Understanding these nuances is crucial. Financial planning experts can provide valuable insights and guidance to navigate these unique challenges, helping you to devise a plan that aligns with your retirement goals at any age.

Social Security and Early Retirement

If you’re considering early retirement, it’s important to understand its impact on your Social Security benefits. For those thinking about retiring at 62, be aware that full benefits are not available until your full retirement age, and claiming early can result in a reduction due to early retirement penalties. You can find more details, including a retirement calculator*, on the official Social Security Administration website** to help you make an informed decision about when to start receiving benefits.

What If I Don’t Have A Lot of Savings?

Wondering how to retire early without substantial savings? The key is to utilize smart financial strategies and realistic goal setting.

- Prioritize learning about budget management, investment basics, and diversification strategies.

- Understanding how to leverage tax-advantaged retirement accounts, such as IRAs and 401(k)s, and exploring passive income opportunities can significantly boost your financial resources.

- It’s also beneficial to familiarize yourself with debt management techniques*** to minimize liabilities and help free up more funds for savings.

Each of these areas can be crucial for building a secure financial foundation that supports early retirement, even when starting with limited funds.

What are Some Steps to Early Retirement?

The journey to early retirement involves careful planning and strategic financial management. Here are some steps to consider:

- Assess your current financial health.

- Define your retirement lifestyle and necessary income.

- Create a robust savings plan.

- Invest wisely to grow your retirement funds.

- Consider healthcare and other long-term costs.

- Plan for contingencies with expert advice.

Expert Financial Guidance

Seeking personalized financial guidance is necessary when plotting a course to early retirement. No matter your age or financial status, working with experienced financial planners can help tailor wealth management strategies to your unique situation. This team of experts can assist in navigating the complexities of retirement planning, and help to ensure you have a comprehensive and realistic plan to guide you to achieving your retirement goals.

Ready to start your journey to early retirement? Facet is here to help with our affordable, fixed fee financial services. Let us help make your dream of retiring early a reality with the right planning and support.

Get started below, or call us today to schedule a free consultation. Your future-self will thank you!

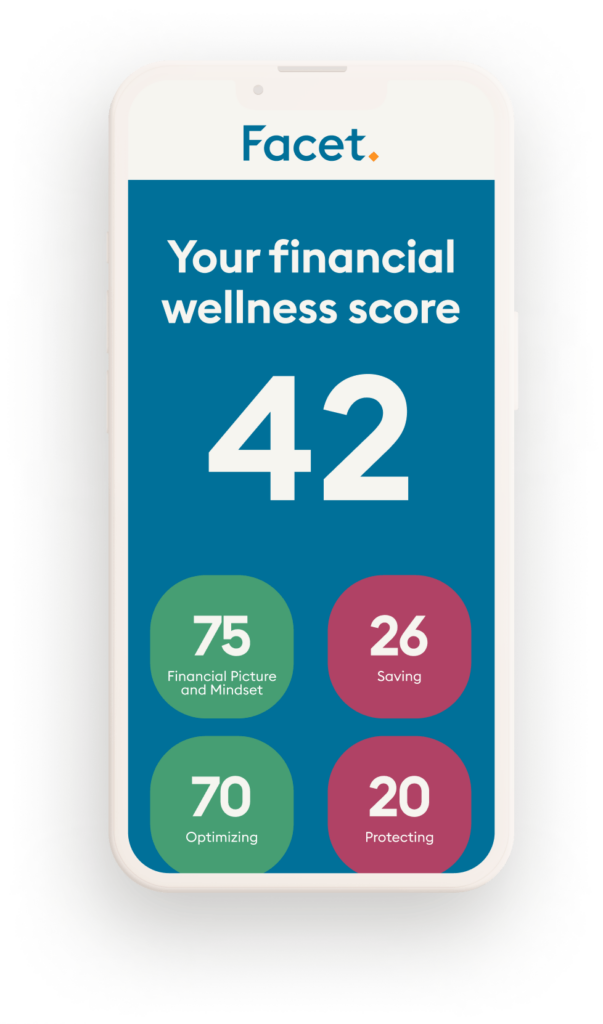

Honestly, how are you doing with your money?

You can find out in under 4 minutes. Your Financial Wellness Score will unlock insights into what you’re doing right and what could still be better.

** Nerdwallet review conducted in October of 2023 based on the time frame of August – October 2023. Nerdwallet’s independent assessment includes data collection, interviews and testing which results in star ratings from poor (one star) to excellent (five stars). Nerdwallet was not paid for this review however does receive compensation based on referrals.

How we’re different.

What Facet members are saying.

Testimonials were provided by current members of Facet ("Facet Wealth, Inc."). Members have not been paid for their testimonial and there are no material conflicts of interest that would affect the given testimonials. These testimonials may not be representative of the experiences of other members, and do not provide a guarantee of future performance success or similar services.