Shifting Into Retirement: Your Ultimate Pre-Retirement Guide

Welcome to Your Retirement Planning Hub

As you approach the golden years of 60-65, it’s time to start thinking seriously about your retirement. The decisions you make now could have a significant impact on your future financial security and lifestyle. Here, we’ll address some of the most pressing questions and strategies for those planning for this significant life transition. If you’d like more assistance than what’s provided on this page, schedule a call for a free consultation with Facet.

Discover essential strategies and answers to key questions for planning a secure and comfortable retirement.

When Should I Take Social Security?

Deciding when to start taking Social Security is one of the most important decisions you’ll make. Should you claim early at 62, or wait until 70 to maximize your benefits? Understanding the implications of your choice can significantly impact your retirement income.

Key Points to Consider:

- Early Claiming: Starting benefits at 62 can reduce your monthly benefit by up to 30%.

- Full Retirement Age: Depending on your birth year, this ranges from 66 to 67.

- Maximizing Benefits: Waiting until 70 increases your benefits by 8% per year after full retirement age.¹

How Many Months in Advance Should You Apply for Social Security Benefits?

To ensure your benefits start on time, apply for Social Security at least four months before you want them to begin. This allows ample time for processing and any unforeseen delays.²

At What Age Do You Get 100% of Your Social Security?

You receive 100% of your Social Security benefits at your Full Retirement Age (FRA). For most, this is between 66 and 67 years old, depending on your birth year.¹

What Retirement Withdrawal Strategy Should I Be Using?

Choosing the right withdrawal strategy is essential to make your savings last. Consider the 4% rule, which suggests withdrawing 4% of your retirement savings annually. However, adjusting for your specific needs and market conditions is crucial.³

How Should My Investments Change Approaching Retirement?

As retirement nears, it’s wise to shift your investment strategy to reduce risk:

- Increase Bonds: More stable than stocks, bonds can provide steady income.

- Diversify: Spread investments to mitigate risk.

- Lower Risk: Focus on preserving capital rather than aggressive growth.⁴

What Are IRA Catch-Up Contributions?

Catch-up contributions are extra funds you can add to your IRA or 401(k) retirement accounts once you reach 50. This can help boost your retirement savings.

Key Points:

- IRA Limit: $1,000 extra annually.

- 401(k) Limit: $7,500 extra annually (as of 2024).⁵

Should I Use a Backdoor Roth IRA?

A Backdoor Roth IRA is a strategy for high-income earners who exceed Roth IRA income limits to contribute to a Roth IRA, by passing these income limits.

Key Points:

- Income Limits: No income limit for the conversion process.

- Tax Implications: Pay taxes on converted amounts.

- Withdrawal Rules: Tax-free withdrawals if rules are followed.⁶

What About a Mega Backdoor Roth IRA?

A Mega Backdoor Roth IRA can allow even larger contributions through after-tax 401(k) contributions.

Key Points:

- Limit 2024: Up to $66,000 combined employee and employer contributions.

- Tax Implications: Pay taxes on converted earnings.

- Withdrawal Rules: Tax-free if held for at least five years and after age 59½.*

Ready to Shift Into Retirement?

Facet has helped over 2,100 individuals plan their transition into retirement since 2022. Let us help you navigate this important phase of your life. Contact Facet to learn more about personalized, flat-fee financial plannings services. Start by scheduling a free consultation and start carefully planning your secure and comfortable retirement today!

Sources:

1. https://www.ssa.gov/pubs/EN-05-10035.pdf

2. https://faq.ssa.gov/en-us/Topic/article/KA-01891

3. https://www.investopedia.com/terms/s/safe-withdrawal-rate-swr-method.asp

4. https://www.investopedia.com/terms/a/assetallocation.asp

5. https://www.irs.gov/retirement-plans/plan-participant-employee/retirement-topics-catch-up-contributions

6. https://www.investopedia.com/terms/b/backdoor-roth-ira.asp

* https://www.forbes.com/advisor/retirement/mega-backdoor-roth/

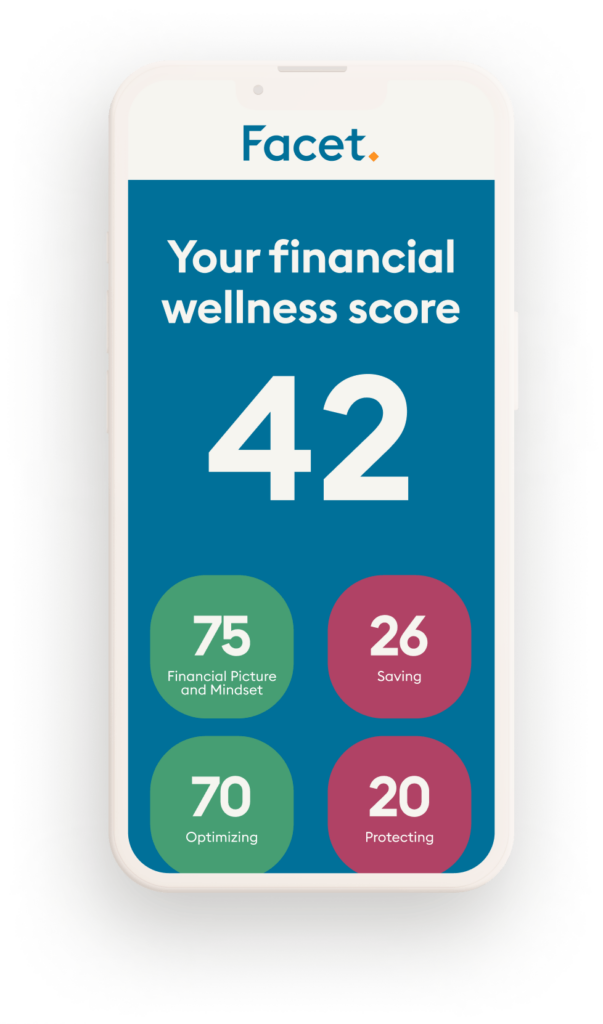

Honestly, how are you doing with your money?

You can find out in under 4 minutes. Your Financial Wellness Score will unlock insights into what you’re doing right and what could still be better.

Schedule a call with a Facet expert

Get help with catch up contributions and every important financial decision with an affordable flat fee membership.

How we’re different.

What Facet members are saying.

Testimonials were provided by current members of Facet ("Facet Wealth, Inc."). Members have not been paid for their testimonial and there are no material conflicts of interest that would affect the given testimonials. These testimonials may not be representative of the experiences of other members, and do not provide a guarantee of future performance success or similar services.