The information provided is based on the published date.

Key takeaways

- Expect near-term price hikes on consumer goods due to tariffs in 2025, as retailers like Walmart pass on increased costs, directly impacting your wallet.

- The full inflation impact from tariffs is uncertain, depending on evolving trade policies and business reactions, but an initial price spike of around 1.4% is a reasonable estimate.

- Tariffs could lead to an economic slowdown and potentially rising unemployment; however, sustained high inflation is less likely without corresponding strong wage growth.

- For investors, while tariffs create economic uncertainty, potential Federal Reserve rate cuts in response to a weakening economy could offer support to the stock market.

Recent warnings from major retailers, like Walmart, suggest that price increases related to newly implemented or proposed tariffs are on the horizon. Walmart specifically cautioned that if consumers "have not already seen" prices rising, "it will happen in May and then it will become more pronounced." This raises critical questions for consumers and investors alike: How high could inflation go? How long might these effects last? And what does this all mean for your money?

A lot of variables at play

Predicting the precise inflationary impact of tariffs is challenging due to numerous shifting variables. Most notably, the exact tariff rates and their scope remain fluid. As of this time we are publishing this in May 2025, the landscape has already seen changes. Most recently, proposed tariffs on certain goods from China that were set at 145% were “paused.” This results in the tariff rate dropping to 30%. Such changes significantly alter any inflation forecast.

Furthermore, future trade negotiations could lead to new agreements, or existing tariff "pauses" could be reversed, effectively re-imposing or increasing tariffs. These are major unknowns. Additionally, the precise reactions of businesses (in terms of absorbing costs versus passing them on) and consumers (in terms of spending habits) to these tariff effects are yet to be fully seen.

Let's delve into these factors and how they might influence interest rates, the stock market, and the Federal Reserve's policy decisions.

Understanding the initial price shock

It's probable that the most direct inflationary impact of tariffs will manifest as a relatively short burst, likely over the next two to three months. This is because the increased costs to companies due to tariffs are immediate. If businesses decide to pass these costs on to consumers, they are likely to do so quickly to protect their margins.

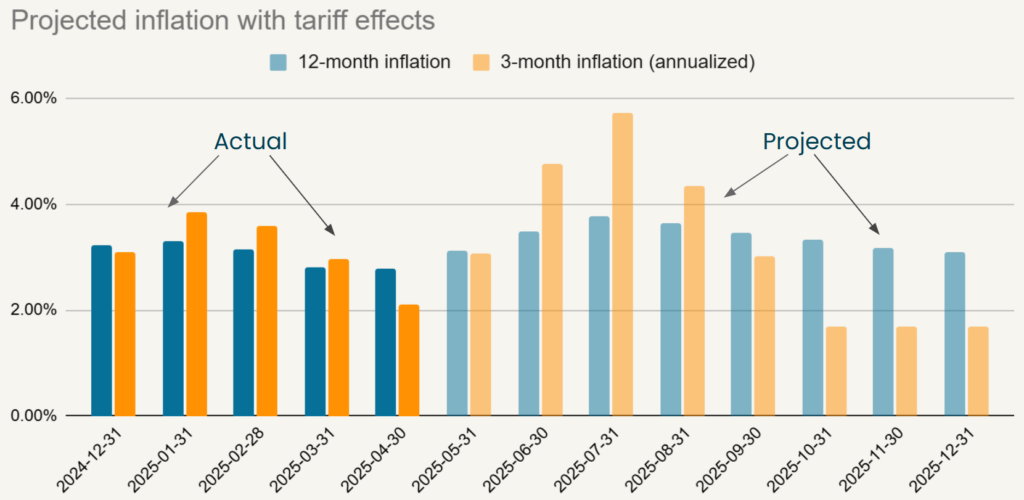

The Yale Budget Lab, which has been closely tracking the evolving tariff plans, estimated as of May 12, 2025, that the proposed tariffs could lead to an approximate 1.4% increase in overall prices over a relatively short period.

If we take this 1.4% estimate as a working baseline and assume this price spike occurs primarily over a two to three-month timeframe, it would imply that Core CPI (Consumer Price Index) could peak at around a 4% year-over-year rate sometime in June or July 2025.

Source: Bureau of Labor Statistics, Yale Budget Lab

It's important to note this doesn't mean every item will increase by 1.4%. Consumer spending is roughly two-thirds services, which are likely less directly impacted by tariffs on goods. Realistically, we'll probably see significant price increases for certain imported goods, lesser increases for others, with the overall average impact potentially landing around that 1.4% figure.

Any estimate is just a guess

This 1.4% estimate, while based on available data, rests on significant assumptions. If any of these assumptions prove incorrect, actual inflation could be notably higher or lower. One key assumption is that the tariff landscape doesn't undergo further major alterations – for example, that any new trade deals negotiated with countries other than China effectively align with a universal tariff rate similar to the current 10% benchmark (an assumption based on recent agreements like the one with the U.K.). It also presumes that a longer-term arrangement with China will approximate the roughly 30% tariff levels currently in effect for many goods.

Another major variable is how much of the tariff cost companies will actually pass on. Some businesses might absorb a portion of the cost to avoid losing sales volume. Conversely, some companies not directly impacted by tariffs on their inputs might still raise prices if their tariff-affected competitors do, creating an "umbrella effect."

These numerous variables make precise forecasting exceptionally difficult. While the 1.4% initial spike estimate seems reasonable and likely in the correct ballpark, the actual outcome could certainly deviate.

What happens after the initial spike?

Once this initial period of price adjustment passes, the subsequent path of inflation will largely depend on the underlying strength of the U.S. economy.

To experience sustained high inflation – where prices continue to rise rapidly month after month – consumer spending typically needs to be robust and growing. This generally requires strong wage growth to fuel that spending. This dynamic was evident in 2021 and 2022 when high inflation coincided with rapid wage increases.

There's little reason to believe that tariffs themselves will directly cause rapid wage growth. In fact, the opposite could occur. There is a broad consensus among economists that widespread tariffs are likely to cause some degree of economic weakness and potentially an increase in unemployment. When unemployment is rising, consumers typically spend less, not more, which would usually lead to a slowdown in inflation.

Therefore, our expectation is that after a short period of tariff-induced price increases, the rate of inflation will likely subside. To be clear, this doesn't mean prices will fall back to pre-tariff levels; rather, the pace at which prices increase should slow down.

The extent of this slowdown will depend on the economy's condition at that point. If economic growth remains similar to pre-tariff levels, inflation might revert to the mid-to-low 2% range. However, if the U.S. economy were to fall into a recession, inflation could decrease much more significantly.

What does this mean for investors?

For the stock market, the key determinant of performance is typically the outlook for corporate profit growth. This, in turn, largely depends on the overall health of the economy. If tariffs are severe enough to push the U.S. into a full-blown recession, stocks would likely suffer. Conversely, if the economy absorbs the tariff impact and continues to grow at a pace similar to 2024, stocks could continue to perform well.

A likely scenario falls somewhere in between: the economy weakens somewhat but avoids a major recession. In this situation, the Federal Reserve's actions become particularly crucial.

The Fed could find itself in a challenging position, potentially facing rising inflation and rising unemployment simultaneously – a scenario often referred to as "stagflation." However, if the economy does soften in the latter half of the year and the Fed observes the inflation rate is subsiding, it's plausible they would be comfortable cutting interest rates. Fed Chair Jerome Powell recently addressed such a scenario where the Fed's dual mandates (price stability and maximum employment) might conflict. He indicated the Fed would assess whether either variable was likely to self-correct and how quickly.

Reading between the lines of such communications, inflation driven by a one-time supply shock like tariffs is more likely to self-correct (as the price level adjusts and then stabilizes) than a sustained rise in unemployment. The impact of tariffs on economic growth and employment could be more enduring than the initial price shock. Therefore, if the economy shows clear signs of weakness, it seems reasonable to expect that rate cuts could follow.

Conclusion: Navigating the uncertainty

Putting all these pieces together, it's highly probable that tariffs will cause consumer prices to rise in the near term, meaning many goods are likely to become more expensive. For investors, however, the outlook is more nuanced and potentially more hopeful. It's possible that while economic growth might weaken somewhat in response to tariffs, it may not be enough to trigger a deep recession. Furthermore, potential interest rate cuts from the Federal Reserve, which appear likely if economic weakness materializes, could provide a boost to the economy and/or the stock market. Either of these outcomes could be relatively favorable for stock investors in the medium term, despite the initial inflationary pressures.