The information provided is based on the published date.

Key takeaways

- Fed Chair Jerome Powell signaled that the Fed is prepared to start cutting their target interest rates at their next meeting in September.

- This is mostly due to inflation slowing, giving Powell more confidence that inflation will eventually get back to the 2% target.

- The Fed is also concerned about some nascent signs of softness in the jobs market.

- The market will now focus on how many cuts the Fed will eventually make, which will be influenced by a number of key factors.

After months of speculation, it seems we finally know when the Federal Reserve’s first rate cut will be. During Fed Chair Jerome Powell’s press conference, he said that a “reduction of the policy rate could be on the table as soon as September.” This language gives a strong indication that the Fed plans to cut rates at their next meeting.

So what finally has them convinced that now is the time? Will there be additional cuts after September? And what does this mean for your portfolio? Here are our thoughts on what happened at this Fed meeting and what comes next.

Fed finally ready to cut

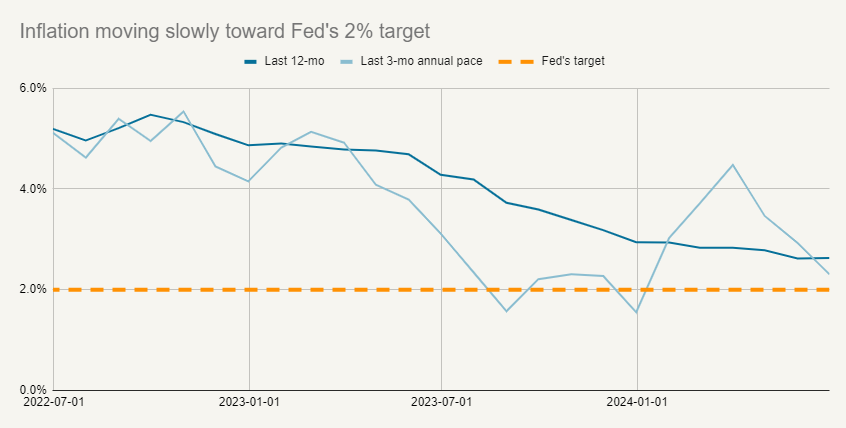

For several months, the Fed said that it would not consider cutting rates until it “gained greater confidence that inflation is moving sustainably toward 2%,” with 2% being their official inflation target. During Fed Chair Jerome Powell’s press conference, he said that “the second quarter’s inflation readings have added to our confidence.” We can assume he chose these words carefully in part to signal that a rate cut is near.

In June, when Committee members last published formal forecasts, the median estimate was that core inflation would end 2024 at 2.8%. However, through June, inflation has only been 2.6% over the last year. In other words, new data in July has indicated that inflation is slowing more quickly than previously assumed.

Source: Bureau of Economic Analysis

It was our view for a long time that the slow improvement in inflation would continue, based on our analysis of the underlying details of inflation data. There was a bit of an inflation rebound during the first quarter, which you can see in the graph above.

While subsiding inflation is the overwhelming reason why the Fed is ready to cut rates, it isn’t the only reason.

Job market slightly concerning

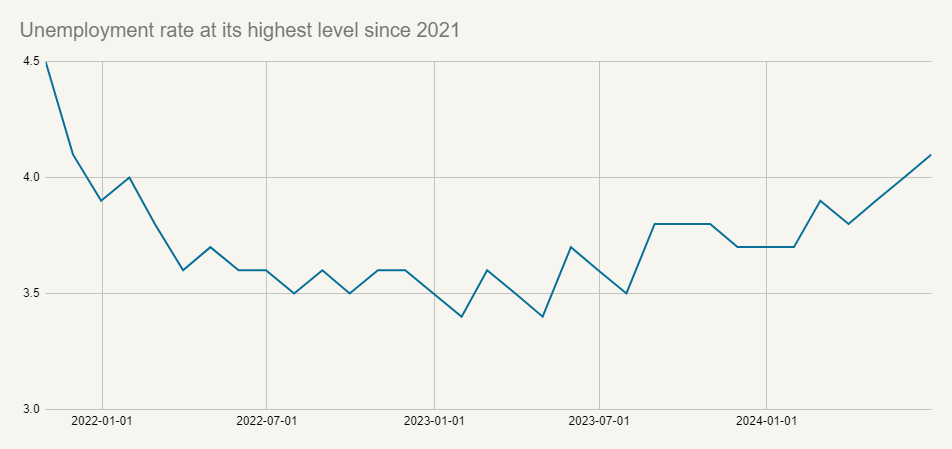

The jobs market has been a bit of a conundrum lately, and this is probably causing some concern within the Fed. Monthly payroll gains have remained reasonably strong. Job gains for June were 206,000 according to the Department of Labor, and have averaged 222,000 per month so far in 2024. Job gains of that level are about average for non-recessionary periods.

However the unemployment rate has been climbing lately. The June unemployment rate hit 4.1%, the highest since late 2021.

Source: Bureau of Labor Statistics

This leaves unemployment 0.7% above its most recent trough. It is unusual for unemployment to rise this much during an economic expansion. Since 1950, every other instance of unemployment rising by at least 0.7% was during a recession.

Historically, when unemployment has increased by this degree, it has generally been because companies were laying off workers. Today, the layoff rate has been steady at a very low level. Today’s layoff rate is lower than anytime from 2010-2019.

Rather than layoffs driving unemployment higher, today’s issue is that the labor force is growing faster than people are getting hired. In other words, more people are looking for work who were previously not employed. Meanwhile company hiring has slowed substantially. Today’s hiring rate of 3.6% is down from over 4.5% at the end of 2021. It is also below the 2019 average of 3.9%.

As we said above, this is an unusual situation. Jobs are increasing but unemployment is rising. Hiring is weak, but layoff levels are historically low.

I’d say overall this has the Fed slightly nervous. Inflation declining remains the main reason why they will be cutting in September, but they are definitely paying attention to the employment situation.

Election won’t stand in the way of a cut

The Fed’s September meeting will come just 48 days before the November election. The Fed has become a bit more intertwined with politics in recent years. Recently Republican Presidential candidate Donald Trump warned Powell not to cut rates ahead of the election, saying that doing so could boost Democrats.

The Fed fiercely guards their political independence. This independence is something that economists broadly agree is important for any central bank to effectively manage monetary policy. However Trump is hardly the first President to pressure the Fed.

Hence the Fed has a long history of carefully navigating the politics of their decisions. In this case, the most apolitical thing the Fed can do is pretend like the election isn’t happening and make decisions based solely on economic data. Cutting might be seen by some as a political act, but not cutting when the data suggests they should would be equally political.

Whatever happens, the Fed will have to ensure charges of politicization. Acting according to the data gives them their only chance at a reasonable defense.

How many times will the Fed cut in 2025?

The market has been obsessed with when the Fed would make their first cut for nearly a year. However now the focus must shift from when will they cut to how many times will they cut.

We can get some clues from the Fed’s own projections. In June, the median Fed Committee member projected that at the end of 2025, Core inflation would be 2.3% and the Fed will have cut interest rates by 1.25%. If each cut is the typical 0.25%, implies 1-2 cuts in 2024 and 3-4 more in 2025.

Of course, a lot can happen between now and the end of 2025, but this does provide some helpful context. If inflation keeps subsiding slowly, the Fed is probably inclined to also keep cutting slowly.

To get even more cuts, economy probably needs to weaken

I would note that this could result in only a minor decline in mortgage rates. To see longer-term interest rates decline more significantly, the Fed will have to cut more than 5-6 times.

In order for that to happen, the economy probably needs to weaken more significantly. If inflation settles in around the Fed’s target of 2%, the Fed will be content to keep interest rates steady. For example, if by the end of 2025, inflation is steady at 2% after the Fed cuts rates by 1.25%. There won’t be an impetus for more rate cuts.

So to see a larger decline in rates, we probably need a recession, or at least, a clear threat of one. Alternatively, the Fed could decide to cut more aggressively if inflation levels fell materially below 2%, as this would be a sign that interest rates were too high.

Either of these scenarios could happen, but given current circumstances, the best assumption is that all interest rates settle in at higher levels than we experienced during most of the 2010-2020 period.