The information provided is based on the published date.

Key takeaways

- In recent weeks, smaller company stocks have enjoyed a historically strong rebound vs. their larger company peers.

- This can come at the expense of some of 2024’s big winners, especially AI-related stocks, which have declined in value recently.

- This episode illustrates the importance of diversification. Owning a little of everything ensures that you own the asset that winds up driving returns.

- Whether the smaller company outperformance trend continues probably depends on how strong the next couple quarters of earnings reports for smaller companies, especially relative to larger tech stocks.

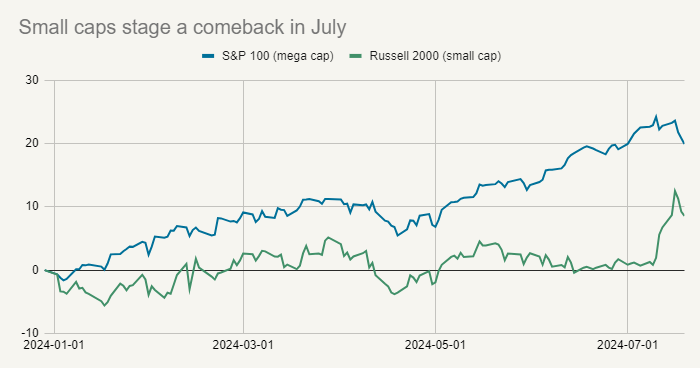

For the first half of 2024, large company stocks had dominated returns. As of July 10, the year-to-date return of the S&P 100 (an index of mega cap companies) had a return of 24.2% vs. just 2.0% for the Russell 2000 index of smaller companies.

Then, seemingly out of nowhere, small company stocks started surging. Between July 10 and July 19, the Russell 2000 jumped 6.5% while large cap stocks fell 3.5. This stretch marks the largest two week return differential between the Russell 2000 and the S&P 100 since the small cap index was created in the 1970’s.

Source: S&P Dow Jones Indices, Russell Indexes

While large caps generally struggled in general since July 10, tech stocks have performed especially poorly. The so-called “Magnificent 7” of Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla declined 8.4% over this same period.

At Facet, we’re long-term investors, so normally we wouldn’t be inclined to react to a trend that’s only a couple weeks in the making. However this historic move for small caps highlights some key questions for markets going forward as well as some key tenets of how we approach investing.

Why did small caps struggle in the first half?

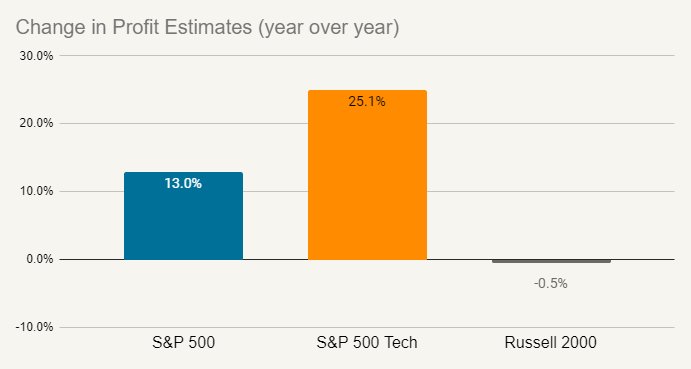

We have talked a lot about the extremely strong profit reports from some notable tech companies in recent quarters. That earnings boom is nowhere to be found in smaller companies. Profit estimates for the S&P 500 have increased by 13% since this time last year, with tech stocks doing even better. Small caps on the other hand have seen almost no growth in profit estimates.

Source: Bloomberg

Given this, it isn’t a mystery why small caps lagged their larger peers. The companies with profit growth tend to outperform those without, and we’ve seen this very much on display in 2024.

Why the sudden reversal?

So what changed the last couple weeks to cause small caps to surge and large caps to struggle? There are a lot of guesses but not a lot of clear answers. If I asked five friends of mine in the industry, I’d probably get five different answers. Here are at least a few common theories:

- Many hedge funds were betting on tech stocks rising and small caps falling. When a lot of investors make the same bet, it can cause larger reversals that would occur naturally.

- Earnings season is coming up, and some investors might worry that expectations are too high for some tech stocks.

- Recent inflation reports have been softer, increasing the odds of Fed rate cuts. Some believe lower interest rates could benefit companies with low profit margins and higher debt loads. This describes a lot of small cap companies and not many large tech companies.

- Should Donald Trump win the Presidency in November, his plans for higher tariffs would hurt more global larger cap companies more so than smaller, more domestic companies.

Regardless of exactly why this reversal got started, it illustrates a key broader point about investing. Things can change very quickly and without warning. In fact, I would argue that over the last decade or so, the rise of algorithmic trading has meant that reversals happen more quickly and in larger amounts than ever before. Given this, being prepared for a variety of possible market outcomes ahead of time is crucially important.

Diversification as an offensive weapon

Usually when you hear about diversification, risk management is the main benefit cited. However we argue that diversification isn’t just about playing defense, it is also about playing offense.

At Facet, we are focused on maximizing the chance you will meet your financial goals, whether that’s funding education, retirement, buying a house, etc. That’s not exactly the same thing as trying to maximize return.

By this we mean that in order to pursue maximum returns, you have to guess at what segment of the market will perform the best. Either you need to trade in and out of market segments or you need to bet on some portion of the market outperforming the others over your personal time horizon.

Both are really tough bets to make. Sometimes members ask us about only owning the S&P 500 since large cap U.S. stocks have been the best performer the last decade. But what happens if we go through a decade like 1999-2009, where the S&P was down 9% while small caps were up 41% and emerging markets were up 156%?

In that case, holding only large cap U.S. stocks would be disastrous to your financial plan.

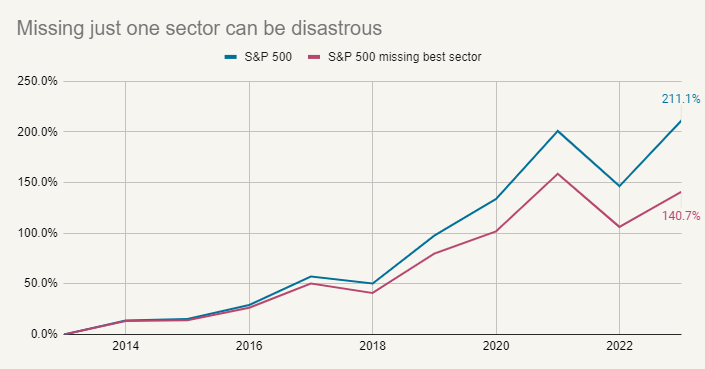

We can also illustrate the point by looking at sectors within the U.S. market. The chart below shows the S&P 500 over the last 10 calendar years, producing a cumulative return of 211%. However what would have happened had you missed out on the best performing sector each year, e.g., tech or financials or utilities? The answer is you only would have made 141%.

Source: S&P Dow Jones Indices

Diversification isn’t just about spreading around your investments to avoid downside risks. It is also about making sure you capture whatever part of the market is the big return driver.

Can the small cap rally persist?

The point above is to say that there’s a scenario where the last couple weeks was the beginning of a larger trend. Smaller companies tend to outperform during a cyclical acceleration, i.e., a period where the economy gains new momentum. It is certainly possible that falling inflation and Fed rate cuts could cause this kind of acceleration. Meanwhile it is also possible that large cap stocks struggle. Maybe company investments in AI slow down, causing profits at big tech companies to fall short of today’s lofty expectations.

Or it could turn out that the last few weeks were a minor fluctuation, and that the AI boom continues.

It is a common approach for investors to decide which of these outcomes they think are more likely, and then bet their portfolio on that outcome. If they make the right bet, it can certainly result in strong performance. But if they make the wrong bet, it can hobble your whole financial plan. To us that’s more like gambling than it is investing.

This isn’t to say you keep a static portfolio. Facet does adjust allocations based on current market opportunities, and we aim for these adjustments to generate competitive returns vs. a benchmark. However our focus is on building portfolios that can produce reasonable returns across a variety of possible market outcomes. We think this nuanced approach means less guessing and more consistency.