The information provided is based on the published date.

Key takeaways

- Facet takes a proactive approach to investing by allocating ETFs tailored to the current market environment and member circumstances

- We don't attempt to predict the future, but rather aim to capture long-term trends in stocks and bonds while adjusting portfolios when risk-reward imbalances are favorable

- An example of this is when US Treasury yield curves are inverted and we adjust the bond expenditure in tax-deferred accounts accordingly

- A static portfolio is vulnerable to shifts in markets, as seen historically with utility stocks and REITs, as well as unforeseen changes in personal circumstances

- We believe Facet's approach of dynamic planning and flexible investment strategy "hits the ball back" over the net by making small portfolio adjustments that accumulate value over time

At Facet, we take a proactive approach to investing. This means that while we use portfolios of ETFs, those allocations do not remain static.

There are a number of reasons why your investments might change, ranging from goal realignments to new tax situations to evolving market conditions. We believe portfolios tailored to your circumstances and the current market environment give you the best chance of meeting your financial goals.

That being said, sometimes we are asked how Facet’s approach differs from a basic buy-and-hold of a simple set of ETFs or even something like a target date fund.

While these approaches might seem similar to Facet’s strategy, we believe the differences lie in a combination of Facet’s dynamic planning approach as well as our flexible investment strategy.

Optimizing risk and reward

We don’t pretend to be able to predict the future. The economy and the markets sometimes move in ways that confound even the most experienced professionals. That’s why, for the most part, we aim only to capture the general upward trend in stocks and bonds over time.

However, there are times when the risk-reward of certain market segments is out of balance. An example is when the upside potential is much greater than the downside risk. Or it could be the other way around, where the downside risk is significant, but the upside potential is relatively small.

When we see this, we want to adjust our portfolios to either take advantage of positive imbalances or avoid negative imbalances. These opportunities don’t come around every day, but they happen often enough that we believe the benefits can add up over time.

A good recent example was in the bond allocation for tax-deferred accounts, such as IRAs. In April 2023, the US Treasury yield curve was inverted, meaning that short-term bond yields were higher than long-term bond yields.

At the time, we believed that if the economy remained strong, longer-term bond yields could rise quicker than short-term bond yields, resulting in a less inverted curve. Conversely, if the economy weakened, we believed markets would start pricing in Federal Reserve rate cuts, which would cause short-term bond yields to fall more quickly than long-term yields. Again, that would result in the yield curve becoming less inverted.

Was it possible for the curve to become more inverted? Yes, but the scope for this was limited.

At the time, the Fed had already signaled that it would be slowing the pace of rate hikes, and historically, the curve inverts more in response to faster rate hikes. So, any further inversion would be slight, whereas the curve could uninvert largely.

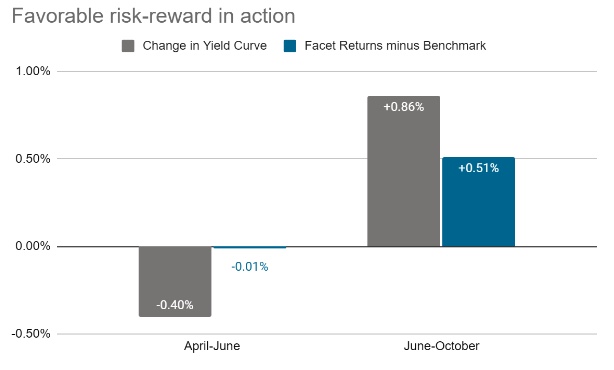

So what actually happened? From April 19, when Facet executed this trade, until June 30, the curve became more inverted. I.e., the opposite of what we were positioned to have happened. However, because the degrees were small, Facet’s bond mix only underperformed its benchmark by 0.01% during that period.

From June 30 until October 26, the yield curve uninverted by a large degree, exactly as we thought was likely. During that period, Facet’s bond ETF mix outperformed by 0.51%.

As we said before, we do not find these kinds of favorable risk-reward imbalances all the time. In addition, there is no guarantee that past success will translate into future results. However, we believe that over time, these opportunities are likely to add value to portfolios.

A buy-and-hold approach misses out on these opportunities.

Risk and reward changes over time

A static portfolio also suffers from the fact that the nature of different assets changes over time.

In the 1980s, it was common for retirees to buy portfolios of utility stocks for the high dividends and low volatility. But today, the S&P Utilities index only has a 3.7% dividend yield, and its value has declined by over 13% this year. So today, it neither has a high dividend nor especially low volatility. When markets change, you need to change with them.

Another prime example of this is Real Estate Investment Trusts (REITs).

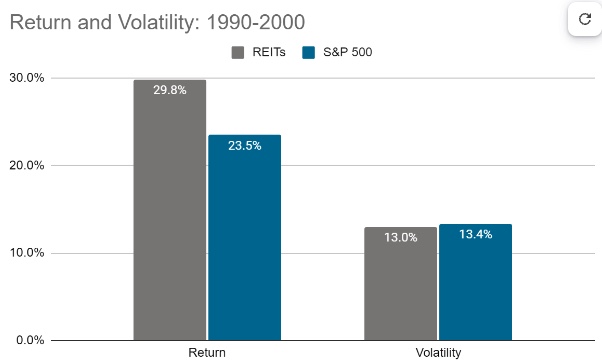

When I studied for my Chartered Financial Analyst (CFA) designation in the early 2000s, the curriculum described REITs as a lower volatility, higher return sector than traditional stocks. This had been true at the time.

The chart below shows the return and monthly volatility for both the S&P 500 and REITs from 1990-2000.

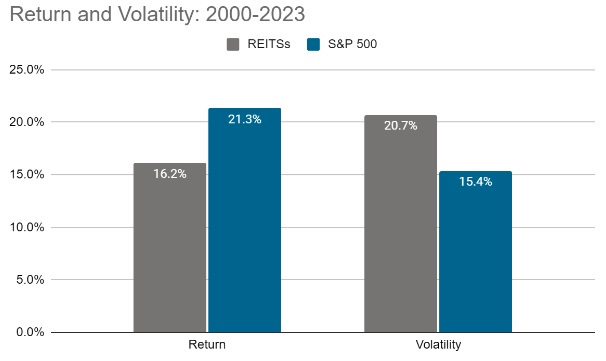

Various reasons were given for why REITs might be inherently different from other kinds of stocks that would lead to this pattern persisting—consistent dividends, real estate as an inflation hedge, etc. But since 2000, REITs have actually had worse returns and more volatility than traditional stocks.

When people create portfolios they intend to hold forever, they are inevitably built on assumptions about the future, colored by the recent past. But neither the economy nor markets are static.

The one thing we can be sure of is change. Whatever assumptions you make today, they are very likely to be wrong in the future. Think about the assumptions baked into your investments now, and then consider what could change.

Could global stocks outperform the US going forward? Will bond yields keep rising? Can you rely on dividends for income?

Often, investors are making massive assumptions within their portfolios without realizing it. Unfortunately, those assumptions could come back to bite you when markets inevitably evolve.

What happens if your circumstances change?

Above, we discussed that market conditions are very likely to change over time, and that’s an important reason to have a dynamic portfolio. In addition, though, your own circumstances are also very likely to change, and your portfolio should adapt as well.

Perhaps the best example of this problem is with target date funds. Generally, these are funds you can buy that are pegged to the year you intend to retire.

For example, the Vanguard Target Retirement 2035 fund might be your selection if you intend to retire by 2035. Today, that fund allocates about 70% to stocks and 30% to bonds, but as it gets closer to 2035, the allocation will flip its exposure to more bonds and fewer stocks. I.e., the allocation shifts slowly to be more conservative as you age.

The concept isn’t wrong. It is generally good advice to get more conservative as you approach retirement. But what happens if something changes between now and 2035? What if you decide to keep working longer? Or retire sooner? What if you get an inheritance? Or experience a medical issue?

All of this might influence how your portfolio should be allocated, but the target date fund isn’t going to adjust to any of that. Equally important is the fact that the target date fund’s allocation makes sense for the average person retiring at that time, but you aren’t the average person.

For example, Facet’s asset allocation advice might be very different depending on the size of your portfolio, how much you expect to spend in retirement, your dependents, other income you might be receiving, tax circumstances, and any number of other factors.

If you had no other choice, a target date fund would probably be good enough. But we don’t think you should aim for good enough. We think a more thoughtful approach increases your likelihood of success.

Hitting the ball back over the net

In 1970, businessman Simon Ramo wrote a book titled, “Extraordinary Tennis for the Ordinary Player.” In it, he argues that most amateur tennis matches are lost, not won. I.e., it isn’t about hitting great winners but avoiding mistakes. Just keep hitting the ball back over the net, and it will work out.

We think this is a good analogy for investing. Like tennis, you can’t just sit still. You have to hit the ball back. But also, if you are always trying to hit big winners, you will probably hit more balls out of bounds than anything else.

Facet’s investment approach is about making small portfolio adjustments that we believe will have a high likelihood of success. In other words, we’re consistently hitting the ball back over the net.

Here’s an example of what we mean.

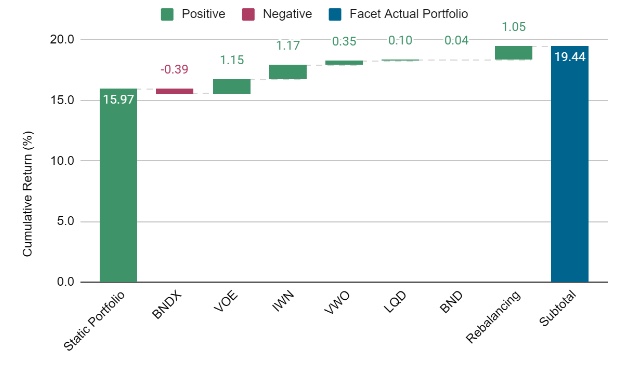

Over the last three years, Facet has either sold or reduced the weighting of six ETFs within a typical IRA portfolio with a 70% stock allocation. The chart below compares how the original portfolio would have performed vs. Facet’s actual performance with each of these six portfolio changes.

This shows that if we kept the portfolio static, it would have produced a 15.97% cumulative return over the three years ending September 30. Each box represents one of the ETFs Facet either sold or reduced, with the ticker symbols listed along the horizontal axis.

The boxes show how much each portfolio changed, either added or subtracted value in percent return terms. Negative numbers (red boxes) are where what Facet bought performed worse than what we sold, and the green boxes are where what we bought outperformed.

Here, you see that in five of the six sales, Facet’s change was a net positive. Lastly, we include the value-add from simple rebalancing over this period, which was 1.05%.

You see that no one change was a huge winner. Rather, we have made many small decisions that have added up to significant benefits. Of course, there can be no guarantee that Facet will continue this success, but this is how we intend our strategy to work—small but consistent wins.

This is what we mean by hitting the ball back over the net: utilizing a dynamic portfolio construction that adjusts to your personal circumstances and market conditions. We believe that is the best way to maximize the changes to meet your financial objectives.

Tom Graff, Chief Investment Officer

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.