Don't leave your finances up to chance...

You work too hard to have an uncertainty when it comes to your finances.

Facet tackles the uncertainty you are feeling and replaces it with unwavering confidence. And the best part… a Facet membership not only gives you access to objective, personalized, and affordable financial advice for everything your money touches, but it could ALSO pay for itself.**

Book an intro call with Facet today to learn more.

Book an introductory call with Facet

**Based on a study conducted by Facet in May of 2024. A complete data set was reviewed for core recommendations made for each of Facet’s service levels. That data showed that the majority of Members achieved value greater than their planning fee. This value was shown to reoccur on an annual basis. Assumptions included average expenses and fees, using retirement tax savings, portfolio expenses, debt refinance, tax loss harvesting, and potential insurance premium savings as value drivers using Facet’s investment services, and discounting value to align with the acceptance of Facet recommendations. Facet has tiered pricing packages based on the individual service needs of the member. Investment management is included at no additional fee for Core, Plus and Complete Memberships. Investment management is not included as a service in any other financial planning only membership level Facet may offer. This is not a guarantee or prediction of actual results for any member and results may vary by member. Some value like tax loss harvesting may vary year to year.

By submitting this form, you acknowledge that you have directly provided the email and phone number contact information listed, you also acknowledge that Facet has the option to use either method to contact you, and agree to the terms set forth in our Company Privacy Notice. Message frequency varies, and message and data rates may apply. Reply STOP to opt-out of messages, press 9 to opt out of voice reminders, and email [email protected] for help. See Terms and Conditions.

We’re one of the fastest-growing financial services companies*, as seen in:

**

**

*In 2024, Facet was ranked 961 on Inc. 5000 list of America’s fastest-growing private companies based on a three year revenue growth rate. An entry fee was collected by Inc. 5000 for their vetting of the submitted information.

**Nerdwallet review conducted in October of 2024 based on the time frame of August – October 2024. Nerdwallet’s independent assessment includes data collection, interviews and testing which results in star ratings from poor (one star) to excellent (five stars). Nerdwallet was not paid for this review however does receive compensation based on referrals.

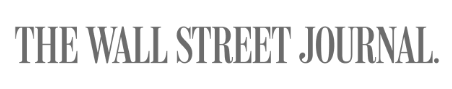

Honestly, how are you doing with your money?

You can find out in under 4 minutes. Your Financial Wellness Score will unlock insights into what you’re doing right and what could still be better.

Why choose Facet?

For your entire life (not just your investments)

Because every life decision has financial impacts, we advise on everything your money touches, like major purchases, benefit selections, your investments and more—plus, we go even further to help you execute your plan.

The highest level of financial planning

Our virtual service is accessible from anywhere and around your schedule. You’ll meet with a CFP® professional (the highest certification possible) and they’ll never sell you products or earn commissions.

Flat-fee planning memberships

With Facet, all of our memberships are a flat fee. This keeps you and your goals at the center of every decision we make.

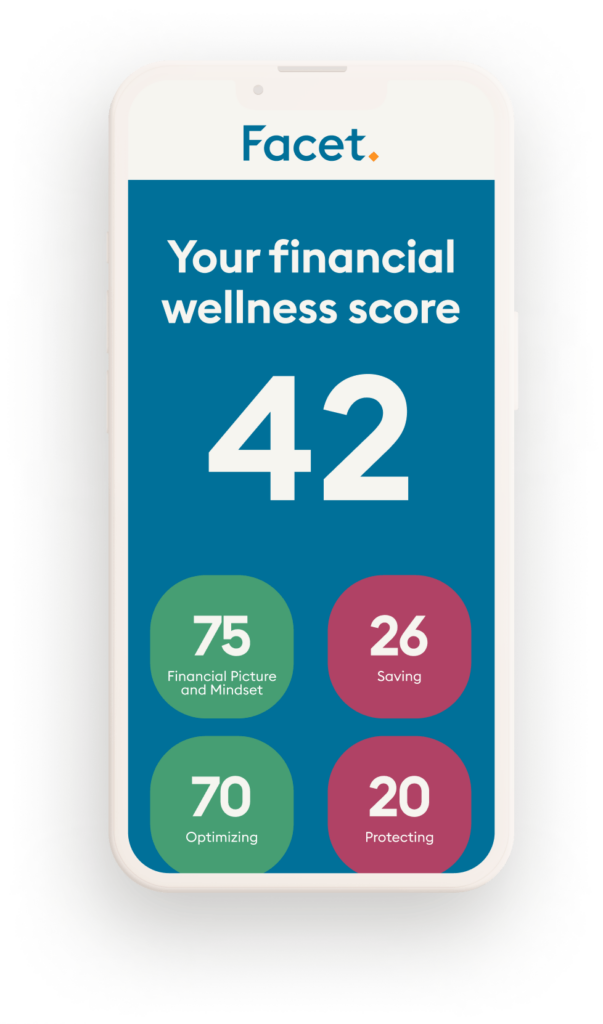

How we work with you.

Take a look at what it’s like to work with Facet.

Meet with a CFP® professional.

You’ll work virtually with a CERTIFIED FINANCIAL PLANNER™ professional to establish a strong foundation, reveal choices you didn’t know you had, and ensure you’re making the right ones. We’ll also work with you to execute your plan.

Build a plan and put it into action.

Nurture your plan.

*Meeting frequency varies based on your membership tier.

How we can help.

Your financial life is impacted by much more than the market. Unplanned and planned changes are a part of life, so our team of CFP® professionals will work with you on an ongoing basis to create the best possible outcomes.

Life milestones

- Getting married or having children

- Separation or divorce

- Healthcare or medical expenses

- Inheritance or a death in the family

- Buying or renting a home

- Elder care planning

Career changes

- A new job, raise or career change

- Employee stock plan questions*

- Benefit selection

Investments & Taxes

- Investment management and optimization

- Retirement account management

- Market and tax law changes

- Tax planning questions*

Retirement planning

- Distribution strategies

- Generational transfers and charitable giving

- Navigating Social Security

- Healthcare planning

We’re one of the fastest-growing financial services companies.*

Members in all 50 states

*In 2024, Facet was ranked 961 on Inc. 5000 list of America’s fastest-growing private companies based on a three year revenue growth rate. An entry fee was collected by Inc. 5000 for their vetting of the submitted information.

How we’re different.

What Facet members are saying.

Colby is a current Facet member and received a free membership for providing this testimonial. Zach, Maggie, and Alyssa are current Facet members and did not receive compensation for providing this endorsement. All opinions are their own and not a guarantee of a similar outcome. Facet is an SEC RIA. Facet’s specific investment management services vary depending upon the chosen service level. This is not an offer to sell securities.

Grow your knowledge.

We think financial planning information should answer more of the questions we all have and be less complicated. Learn about how we approach personal finance through our library of free articles that will help you deepen your financial literacy.

Are AI stocks in a bubble? A 2026 market update.

As artificial intelligence continues to dominate headlines, many investors are left wondering if we are witnessing a sustainable technological revolution or a repeat of the late-90s dot-com bubble. While AI infrastructure spending has powered stocks higher over the last couple years, concerns are mounting regarding the sustainability of these capital expenditures and the actual pace ... Read more

Should you hedge against a weak dollar? A guide to 2026 currency risk

The U.S. dollar has struggled lately. According to the ICE U.S. Dollar Index, the American currency was down 9.4% in 2025, which was the worst year for the dollar since 2017. The trend has continued so far in 2026, with the dollar down another 1.5% through February 11. So why is the dollar dropping? How ... Read more

Who is Kevin Warsh? Trump’s Fed Chair nominee and what he means for your money

President Donald Trump will nominate Kevin Warsh as the next Chair of the Federal Reserve. If confirmed by the Senate, Warsh would take over for Jerome Powell, whose 8-year tenure at the helm of the Fed saw the stock market nearly triple in value. Warsh has long been a critic of the Fed, and may ... Read more