The information provided is based on the published date.

Key takeaways

- Stocks rose modestly this quarter, with AI-related companies leading the way.

- Bonds were only slightly higher, as strong economic data and only modest improvements in inflation lead to modestly higher interest rates.

- Facet’s ETF mix performed very similarly to benchmark in 2Q. Our overweight of high profitability companies and corporate bonds was a benefit, but this was offset by our underweight of emerging markets.

- Looking forward, market returns probably depend on continued strength of AI spending, the extent that non-tech companies can keep growing profits, and whether inflation can keep subsiding.

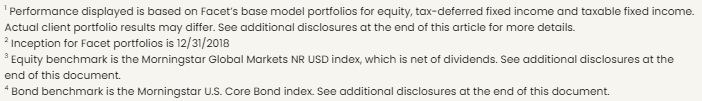

Stocks rose again in 2Q, marking the third straight quarter of positive returns. The Morningstar Global Markets index adding 2.4% this quarter, ending near an all-time high. Extremely strong profit reports from AI-related companies as well as lower inflation data helped push stock prices higher.

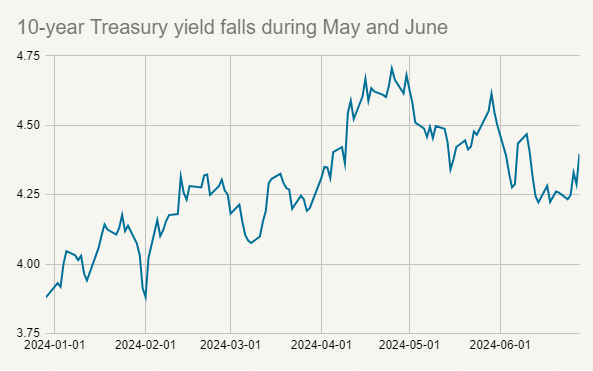

Bond yields were marginally higher, but with substantial volatility. Yields rose substantially in April, with the 10-year Treasury hitting 4.71%, but signs of lower inflation helped bonds recover in May and June, ending at 4.40%. This resulted in the Morningstar Core Bond index ending the quarter slightly higher.

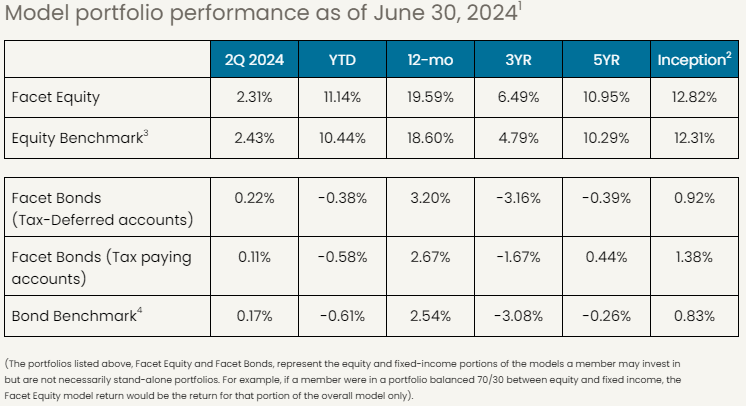

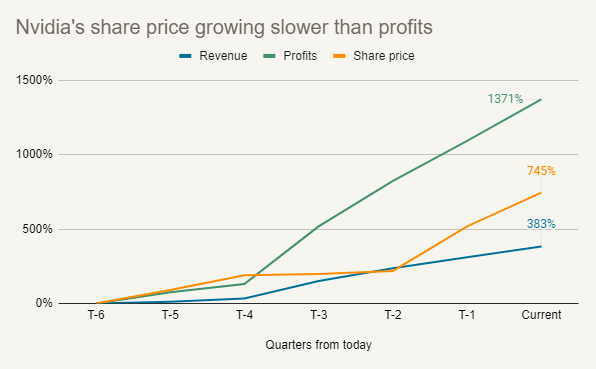

Facet’s ETF mix performed very similarly to the indexes in 2Q, but remains solidly ahead of benchmark for the year as well as longer time periods.

Here is our analysis of what happened and what it might mean looking forward.

If you're a current Facet member and are interested in learning more about investing with Facet, please reach out to your planner and start the conversation. The investments team is available to meet with you, answer questions, and talk through your options.

The AI boom powers the market higher

Equity market returns in 2Q were truly dominated by companies participating in the artificial intelligence boom. Almost the entirety of the global stock market’s return can be explained by just 5 companies:

- Nvidia, which designs the semiconductors widely used to create AI models

- Taiwan Semiconductor, which manufactures most of the cutting edge semiconductors worldwide, including Nvidia’s AI chips.

- Microsoft, Amazon and Alphabet, which provide cloud computing power vital to AI development

- Apple, which announced a big AI initiative to overhaul their Siri product

Source: Morningstar Global Markets Index

While there was certainly some sense of euphoria surrounding AI this quarter, these outsized returns were rooted in surging profits, not mere speculation.

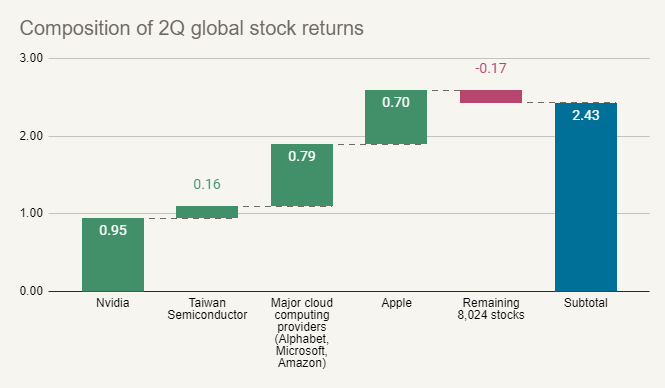

Take Nvidia, which has seen its stock rise nearly 750% over the last 18 months and briefly became the world’s most valuable company. Clearly there is a lot of optimism around the company’s future prospects. However it is worth noting that the stock is actually rising slower than the company’s profit growth.

Source: Nvidia company reports

I.e., investor’s aren’t speculating that Nvidia will be able to turn the AI boom into profits. The profits are already here. In fact, with the share price rising slower than profits, it suggests investors expect Nvidia’s profit growth to slow significantly in the coming quarters.

Could this be a bubble?

Investors old enough to remember the 1990’s tech bubble, which includes yours truly, may be feeling a sense of déjà vu. Then it was the internet that was sure to change the world and create immense business opportunities for the companies that could capitalize on this new economy. Now some people are talking about AI in the same terms.

The irony is that the internet did change the world, and there were immense business opportunities. All the optimistic projections came true, and yet it was still stock valuations that became disconnected from reality. Even the “winners” of the internet era took a long time to recover from the bubble bursting. After the market peaked in March of 2000, Amazon didn’t make a new high until 2007. For Microsoft it took until 2016. Companies like Intel and Cisco Systems have never revisited their 2000 highs.

Could the same thing happen to Nvidia and other stocks that have surged lately on AI optimism?

We still don’t think there’s many signs of a bubble in AI. It's tempting to look at a stock like Nvidia that has risen so quickly and assume it must be overvalued. But as we said above, the company’s profits have grown almost 14 times in just 18-months. It would be strange if the stock were not up huge! Again, this isn’t speculation, this is the stock reacting to what has actually occurred.

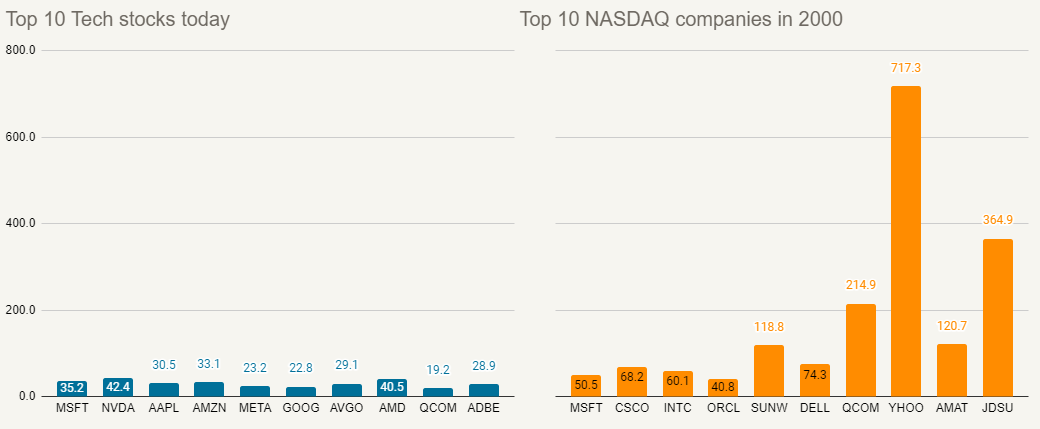

Here’s another way to illustrate the point. The chart below shows the price-to-earnings (P/E) ratio of the 10 biggest tech stocks today compared to the 10 biggest Nasdaq stocks at the market peak in 2000. The P/E ratio is a good measure of how much future speculation is built into a stock’s price. The higher the P/E, the more the company has to grow profits to justify today’s price.

Source: Bloomberg

Here we see that today’s top tech stocks have much lower P/E ratios than just about all the big tech companies in 2000. To put this into context, Nvidia’s stock price would have to rise about 50% to have the same P/E ratio as Cisco Systems in 2000.

We see three very basic scenarios for AI stocks going forward. The first is that AI really does present a big business opportunity and the current players maintain their edge on the competition. If this occurs, the big tech stocks above will probably perform very well. If that’s the case, you’ll be glad you own these stocks with your mix of ETFs, as these companies are among the largest holdings.

The second is that AI is a big opportunity, but something happens to Nvidia or other current players. Maybe they fall behind on innovation, like Intel did in the 2000’s, and some other companies rise to become the big winners of the AI boom. If that’s the case, investors in highly diversified portfolios like Facet’s will own those eventual winners.

The third is that AI just isn’t all it is cracked up to be. Maybe AI spending doesn’t totally dry up, but it doesn’t grow anywhere near as quickly as investors are currently assuming. If that occurs, these big tech companies probably decline in value. In this scenario, highly diversified investors will be glad they own other things.

Beyond tech, stocks struggle

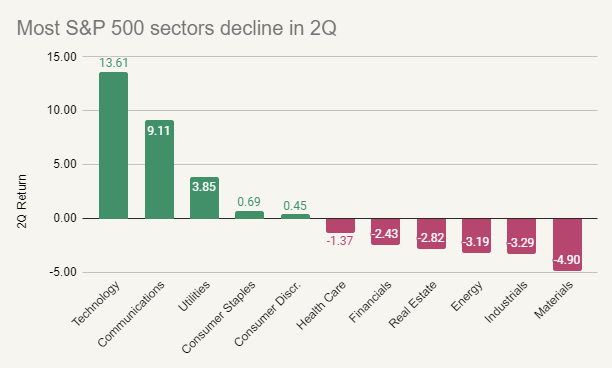

While it was a good quarter for AI-related stocks, most other types of stocks struggled. Only 201 members of the S&P 500 produced positive returns for the quarter, with most major sectors declining.

Source: S&P Dow Jones indices

Even the move higher for utilities was AI related, as the sector is seeing increased electricity demand from data centers.

It isn’t likely that the market will remain this narrow. In a sense, this chart makes it look worse than it really is. Year-to-date all sectors have positive returns except for real estate after most stocks had a strong 1Q.

However part of this might just be where we are in the economic cycle. Certain sectors tend to perform best when broad economic growth is accelerating, such as energy, materials and some industrials. These companies are often referred to as “cyclical” since they are more sensitive to the macro cycle. Right now economic growth is steady or perhaps even softening a bit. That could reverse, but for now these aren’t the ideal conditions for these companies.

Others, like financials and real estate, are very sensitive to interest rates. The view that the Fed is going to keep rates higher for longer is weighing on these sectors. Again, that could easily change in the future, but at the moment that makes for a tougher environment for stocks in these sectors.

This is partly why Facet reduced our position in the Vanguard Value ETF at the end of last quarter and added the Vanguard Mega Cap Growth ETF. This lowered exposure to these cyclical and interest-rate sensitive stocks while increasing exposure to companies naturally growing at a faster rate. This change was definitely a benefit this quarter.

Inflation may finally be subsiding, Fed poised to cut rates

Inflation seemed to be on the rebound in the first quarter, which had some traders questioning whether the Federal Reserve might keep interest rates high for longer than previously expected. However this reversed course in 2Q. We now believe the Fed is highly likely to cut rates this year, probably with the first one coming in September.

This was certainly a relief to the bond market. The 10-year Treasury had risen to above 4.70% in April before retreating in May and June, ending the quarter at 4.40%.

Source: Bloomberg

For bonds, the decline in yields allowed the Morningstar Core Bond index to recover some of its 1Q losses, although it is still down about 0.6% for the year. Whether interest rates will keep falling is a much more difficult question. We covered this in more depth in our article about real estate, but it is important to note that longer-term bonds are priced assuming the Fed cuts 4-5 times over the next year or so. Rates won’t fall just because the Fed follows through with these cuts.

Dominant U.S. dollar, political uncertainty pressures international stocks

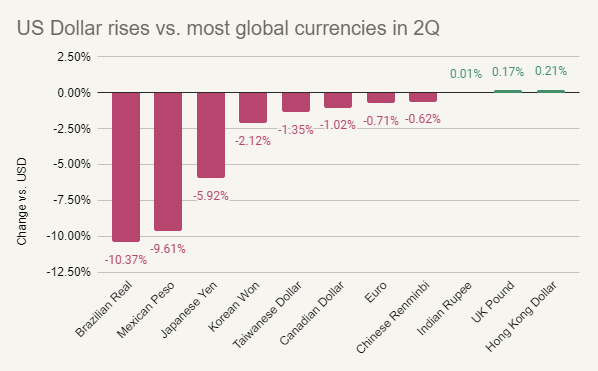

The U.S. dollar continues to power higher vs. most other currencies, due to a combination of relatively high interest rates and strong economic growth.

Source: Bloomberg

The strong dollar has weighed on non-US equity returns. When you buy a non-US stock, even if it is inside of an ETF, you effectively convert your dollars into the other currency, then buy the stock. Therefore part of your return will be based on that other currency’s value vs. the dollar. This can make a large difference. So far in 2024, the Morningstar Japan index is up 19.9% in yen terms, but when translated back into the dollar, that winds up only being 5.0%.

Politics was another factor in non-US returns this quarter. Surprise election results in India, Mexico and France injected some uncertainty into markets. American investors are likely focused on the effect of our own election on markets, but so far it has been overseas politics that have actually had an impact.

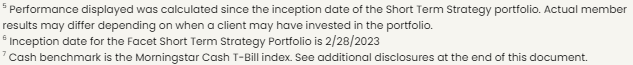

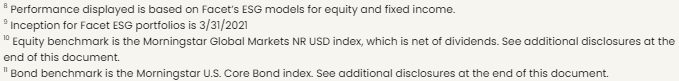

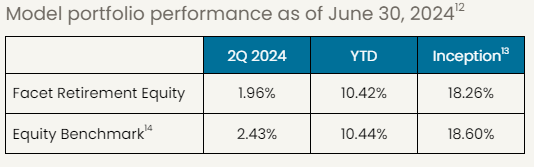

Facet’s equity and bond ETFs perform in-line with benchmark in 2Q, both ahead for YTD

Facet’s main equity ETF portfolio finished the quarter about equal to the Morningstar Global benchmark. On the positive side, Facet’s ETF mix has us slightly overweight tech stocks in general and semiconductor stocks specifically. This is partly due to our recent addition of the Vanguard Mega Cap Growth ETF. It is also partly due to much of the semiconductor industry fitting the “quality” overweight Facet has had for the last two years. In finance jargon, quality means companies with higher profit margins, lower debt burdens and less profit volatility compared to peers.

The main detractor was Facet’s underweight to Emerging Markets (EM) stocks. After underperforming substantially the prior two quarters, EM staged something of a rebound this quarter, outperforming Developed Markets stocks by 3%. Facet is about 5% underweight EM and has been since early 2023. Over that whole period, this underweight has been very positive, but it was a negative this quarter.

In bonds, our ETF mix for retirement accounts also performed very similarly to the Morningstar US Core Bond index. Facet is currently underweight duration, which means our portfolios should outperform when interest rates rise. This was a big benefit last quarter, but this quarter with interest rates being about unchanged, there was little impact.

The ETF mix for non-retirement accounts for members in higher tax brackets was mildly behind benchmark, as tax-free municipal bonds lagged the broader bond market. For members in these higher brackets however, ultimately the tax-exempt income is in your best interest over the long-term.

All of these strategies remain solidly ahead year-to-date due to a strong 1Q.

What might be coming next?

I think there are three basic questions that will dictate performance of stocks for the remainder of the year. First, do businesses keep investing in AI-related infrastructure? Right now all evidence points to robust AI spending continuing. Nvidia has long lead times on their orders, so we have good visibility into demand for at least a couple quarters. If demand for Nvidia’s chips remains strong, it should be good news for other players in the AI ecosystem, including cloud computing, data centers, power providers, other semiconductor companies, etc. To be sure, this could all change, but there’s no sign of a shift at the moment.

The second big question is about earnings strength outside of AI. There are some headwinds. Consumer spending on goods has been soft recently, which has weighed on both consumer companies as well as goods manufacturers. High interest rates are weighing on industries that use a lot of debt, especially real estate. However, unlike the tech space, expectations are not high for these industries. It might only take a minor improvement in conditions for the non-tech sectors to perform quite well.

Another potential positive for non-tech stocks could be a revival of mergers and acquisitions (M&A). Activity in this area has been very light, especially given how strong the economy has been the last two years. This has hurt financial stocks directly, as income from investment banking activity has been very weak. But more generally, the potential for a company to get bought at a premium is a common source of upside in most cycles. The spike in borrowing costs has made M&A more expensive, which has held back activity. However many of the big banks have reported that deal activity could be starting to recover. If so, that could be another positive for non-tech stocks.

Lastly, does the Fed wind up cutting rates? Right now the market is expecting 1-2 cuts this year and another 3-4 next year. If it plays out exactly like this, longer-term interest rates (such as Treasury bonds or mortgage rates) will remain relatively high. Moreover, the yield curve will probably remain very flat, meaning shorter-term bond yields will be about the same or higher than long-term bond yields. That would not be especially good for financials and real estate.

More broadly though, all else being equal, lower interest rates are better than higher interest rates for both stocks and bonds. However “all else being equal” is a critical caveat. I think the last 4-5 years have taught some investors the wrong lessons. The Fed is always an important player in the market, but it has seemed to be the dominant player the last few years, with stocks seeming to rise anytime the Fed is cutting and fall anytime they are hiking.

This has not been the normal pattern over longer horizons. Usually when the Fed is cutting it is because the economy is weak, possibly going into a recession. If the Fed winds up cutting rates more aggressively in 2024 and 2025 because the economy is slipping into a recession, that will almost certainly be bad for stocks. It may have felt like rate cuts rescued stocks from the 2020 recession, but that was a unique situation.

It is possible that the Fed cuts more aggressively simply because inflation falls more quickly than currently projected, but the economy otherwise is strong. That is a potentially very good outcome for investors. Both stocks and bonds could produce strong results in this case. If the Fed winds up cutting less than 4-5 times over the next year, stocks could still do quite well as long as the economy remains strong.

All of this is a long way of emphasizing a point we have been making for almost two years now: company earnings are more important for stocks going forward than interest rates. The Fed will matter, but it will be a secondary factor.

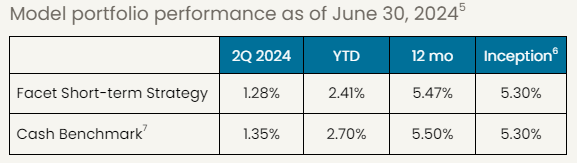

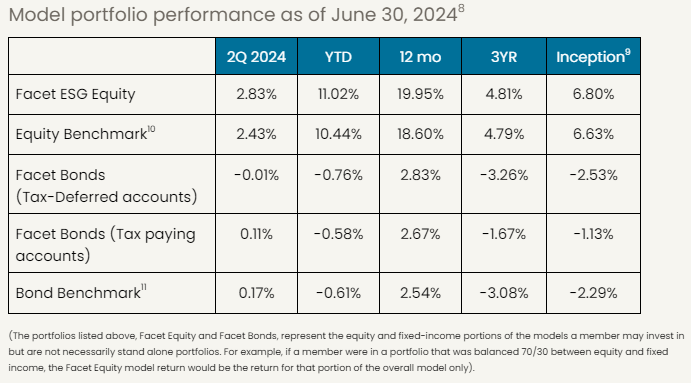

Facet's Short-Term Strategy

Facet’s Short-Term Strategy (STS) is designed to produce stable returns commensurate with the yields available in shorter-term bonds. The strategy is designed for members with money goals that are only a few years away.

The STS’s performance was about the same as the Morningstar Cash T-Bill index. With interest rates generally unchanged for the quarter, there was little to differentiate STS from the index. For the year, slightly higher interest rates have weighed down STS relative to the benchmark slightly, but the strategy continues to produce consistently positive returns with low volatility compared to other bond options.

Facet's Environmental Social Governance (ESG) Strategy

Facet’s ESG equity strategy was marginally better than the Morningstar Global index for the quarter. The strategy utilizes a set of ETFs that screen out stocks based on certain ESG criteria. As a result, it tends to significantly underweight energy, utilities, and heavy industrial companies.

This quarter that was mostly a benefit for the strategy. While utilities were an outperformer, energy and industrials were relatively weak. Because of these underweights, the ESG strategy tends to be a bit overweight in sectors like tech and communications which were outperformers.

Facet's Retirement Strategy

Facet’s Retirement Strategy is meant for members who are either already in retirement or close to it. The strategy utilizes ETFs that we expect will have relatively less volatility than our traditional growth model. Generally speaking, Facet expects this strategy to lag the equity benchmark a bit during big up quarters. Adding lower-volatility funds to this ETF mix should protect against the downside while giving up some upside.

During 2Q, the lower volatility bent was a minor negative. Compared with our traditional model, the Retirement Strategy has slightly lower weighting to technology and communications, two strong performing sectors. This was somewhat offset by higher weighting in outperforming sectors like utilities and consumer staples, as well as lower weighting in energy, real estate and consumer discretionary.

The strategy also has no weight to Emerging Markets, which was also a bit of a drag this quarter.

Performance disclosure

Investment returns shown here are intended for illustrative purposes only. All investments involve risk, including the potential for the loss of principal. The model portfolio performance of Facet models began in 2018. Performance was calculated using Facet’s most common recommended equity and fixed-income ETF portfolios. At times when Facet changed a recommended ETF, the average transaction price of both buys and sells was used to update the portfolio. Otherwise, the portfolio was rebalanced monthly. Calculations were performed using the Bloomberg Portfolio Analytics tool. This illustration is meant to most closely resemble what a common Facet client in a given asset allocation mix may have returned. It does not represent any actual client or group of clients. The benchmark used for equity allocations is the Morningstar Global Markets Net Dividends index, which measures the performance of the stocks located in developed and emerging countries across the world. For fixed income allocation, the benchmark is the Morningstar US Core Bond index, which measures the performance of fixed-rate, investment-grade USD-denominated securities with maturities greater than one year. We believe the sources for this data to be reliable but cannot guarantee the accuracy or completeness of the information. No consideration was given to tax loss harvesting or other activities that occur during the ongoing management of investments, nor did Facet assert an opinion on the impact of these actions on these returns. These returns were calculated net of the fees associated with the underlying investments. Facet charges an annual planning fee based on the complexity of a client’s financial situation but does not charge a separate fee for investment management. The planning fee was not considered in the calculation of returns. Past performance is not indicative of future returns.

Benchmark disclosure

The Morningstar Global Markets Index NR USD and US Core Bond indices have been licensed by Facet for use for certain purposes. The services provided by Facet are not sponsored, endorsed, sold, or promoted by Morningstar, Inc. or any of its affiliated companies (all such entities, collectively, “Morningstar Entities”). The Morningstar Entities make no representation regarding such services. All information is provided for informational purposes only. The Morningstar Entities do not guarantee the accuracy and/or the completeness of the Morningstar Indexes or any data included therein. The Morningstar Entities make no warranty, express or implied, as to the results to be obtained by the use of the Morningstar Indexes or any data included therein. The Morningstar Entities make no express or implied warranties and expressly disclaim all warranties of merchantability or fitness for a particular purpose or use with respect to the Morningstar Indexes or any data included therein. Without limiting any of the foregoing, in no event shall the Morningstar Entities or Morningstar’s third-party content providers have any liability for any special, punitive, indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages.