The information provided is based on the published date.

Key takeaways

- Stocks fell modestly in the 3rd quarter, weighed down by rising interest rates, a strong US dollar, and weakness in China

- Longer-term interest rates rose to multi-decade highs this quarter

- A resilient US economy has investors convinced that the Federal Reserve will keep interest rates relatively high for the long-term

- Looking forward, we think that if the economy continues to grow, stocks will very likely rise over the next few quarters

- If the economy were to slow, Facet has built in some recession protection into our investment portfolios

US stocks declined mildly in the third quarter of 2023, with the Morningstar Global index declining 3.29%.

After three straight quarters of positive returns, a mixture of mildly negative news held stocks down this quarter, including rising interest rates, a strong dollar, and weakness in China.

Still, stocks remain solidly positive for the year, up with the same index up 9.44% through September 30.

Here is our review of what happened during the third quarter and our take on what might be coming next.

Model portfolio performance as of September 30, 2023

| 3Q 2023 | YTD | 12MO | 3YR | Inception | |

| Facet Equity | -3.11 | 9.01 | 21.63 | 10.30 | 10.00 |

| Equity Benchmark | -3.29 | 9.44 | 20.35 | 6.75 | 9.57 |

| Facet Bonds (Tax-Deferred accounts) | -2.87 | -0.36 | 1.78 | -5.25 | -0.21 |

| Facet Bonds (Tax paying accounts) | -3.12 | -0.76 | 2.28 | -3.30 | 0.36 |

| Bond Benchmark | -3.19 | -1.17 | 0.65 | -5.22 | -0.25 |

![]()

Are we actually getting a soft landing?

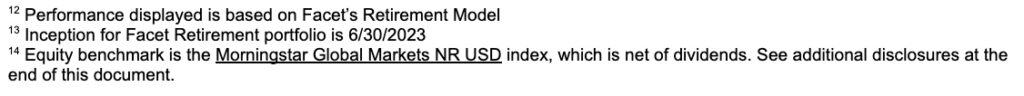

Since inflation began to climb in 2021, a huge question has hung over investment markets: can the Federal Reserve bring inflation down without causing a recession?

The last time inflation was this high was in the late 1970s. At that time, it took a steep downturn in 1980 and 1981, induced by then Fed Chairman Paul Volcker, to finally quell inflation. For much of 2022, it was assumed inflation would not subside without a meaningful economic slowdown.

As things stand right now, it looks more likely that we’ll get a “soft landing.” That’s what economists call an outcome where inflation subsides to around 2% without a meaningful increase in unemployment.

We may already be there. Economic growth is showing no signs of slowing, unemployment is steady, and Core CPI and Core CPI inflation have run at a 2.4% pace in the last three months.

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

The good news is that subsiding recession risk was the big driver of strong stock returns in the first half of this year. The bad news is increasing economic optimism is causing longer-term interest rates to rise.

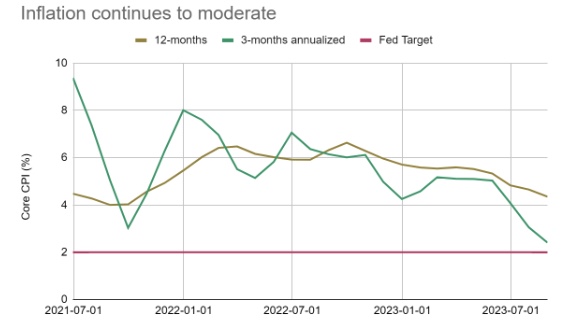

Higher for longer

At the Fed’s September meeting, Chair Jerome Powell suggested that the Fed was likely either done hiking for this cycle or perhaps would hike one more time in either November or December. Despite this, longer-term interest rates keep rising. The chart below shows the yield on the 10-year Treasury note so far in 2023.

Source: Bloomberg

Source: Bloomberg

The chart shows that the 10-year Treasury surged from 3.84% at the start of the quarter to 4.57% currently. There have been similar increases in other borrowing rates, ranging from home mortgages to business borrowing.

These yields have been rising on a view that while the Fed may be nearly done hiking, they may leave their interest rate target at a very high level for an extended period. It may even be the case that interest rates will be structurally higher for the foreseeable future.

A year ago, many investors assumed that the economy couldn’t handle substantially higher interest rates. But the fact that the economy continues to grow at a strong pace suggests otherwise.

The rise in interest rates had a few effects on your investments. For bond portfolios, it resulted in slightly negative returns for the quarter. However, Facet’s bond portfolios did a bit better than our bond benchmark in the third quarter.

We expected that if interest rates were to rise, it would probably be longer-term yields that climbed the most. Therefore, we reduced our weighting to longer bonds in April, which has helped our portfolios perform slightly better than the broad bond market since.

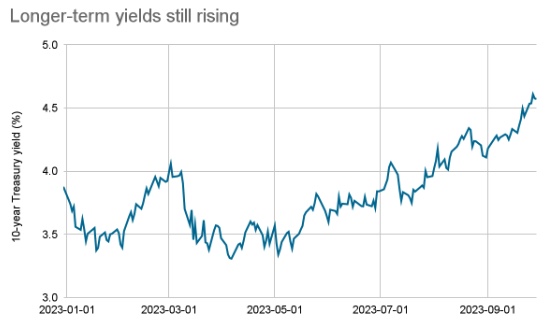

Higher yields may also be weighing on stocks. While the economy, in general, continues to grow, companies with a lot of debt are now facing higher interest costs down the road.

Large companies tend to have mostly fixed-rate debt, similar to a typical home mortgage. However, unlike a home mortgage, company debts typically come due on a five or ten-year schedule. While this means that large companies will not see their interest costs rise all at once, it won’t last forever.

But this also means that as old debts mature and are replaced at current rates, company borrowing costs will rise every year. If companies are paying more on interest costs, that lowers profits, all else being equal.

The chart below shows the average BBB-rated (the most common credit rating among large company borrowers) corporate bond yield over the last five years.

Source: Bloomberg

Source: Bloomberg

If interest rates remain this high in 2025, 2026, and beyond, it will be a significant change for more highly-indebted companies. This is a major reason why, in late 2022, Facet made changes in our stock ETFs to reduce holdings in companies with higher debt burdens.

We think if borrowing costs stay this high for an extended period, these companies are at risk for underperformance. Our underweight of such companies benefited our relative performance this quarter.

Are we out of the woods on a recession?

While the chance of a recession has certainly declined, some risk for 2024 remains. First of all, recessions are a normal part of the economic cycle, so it is undoubtedly true that, eventually, a recession will hit.

Specifically, high-interest rates may impact the economy with some lag. It is widely believed that when the Fed hikes interest rates, it takes some time before the full effect of that rate hike is felt. At one time, economists generally believed it was 6-12 months, but today, some argue the lag is shorter.

At Facet, when we think about risks, we try not to make predictions but rather consider a wide variety of possibilities. In this case, if we assumed the lag for rate hikes is indeed 6-12 months, then some constraint brought on by rate hikes is still to come.

Specifically, today, the Fed’s target rate is 5.50%. Six months ago, that was 5.00%. A year ago, that was 3.25%. So if it’s true that there is a 6-12 month lag before the economy entirely feels rate hikes, that means there’s somewhere between 0.50% and 2.25% worth of rate hikes still working their way into the system.

We came into 2023 having built in some recession protection into our stock ETF mix. It has turned out that protection was not needed, as the economy has been strong. However, given that Facet’s overall equity performance is very close to the benchmark, this protection came at very little cost. Thus, given that the risk of recession is still present, we are inclined to maintain that bit of safety in portfolios.

First-half stock leaders lag

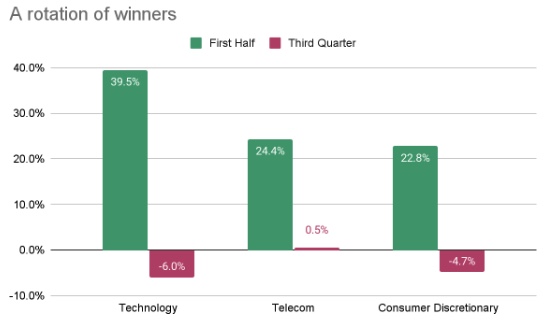

In our second quarter report, we wrote about how concentrated returns had been in the first half of the year. At the time, just three sectors, tech, telecom, and consumer discretionary, comprised 80% of the first-half return in the Morningstar Global Markets index.

Since then, many of the high flyers in those sectors have struggled. Overall, tech was the worst-performing sector in the global index, and consumer discretionary was not far behind.

Source: Morningstar

Source: Morningstar

Digging deeper, there was no one reason why these sectors struggled. A combination of rising interest rates weighed down the tech sector, some fading of the AI mania, China’s partial ban on iPhones, and more aggressive antitrust activity in both the US and Europe. Consumer discretionary was weighed down by the auto industry strike, falling prices of Tesla cars, and weak sales of appliances.

Meanwhile, the telecommunications sector was mixed. Companies in the online ad business, which includes giants like Alphabet and Meta, parents of Google and Facebook, respectively, were solidly higher on the quarter. Old-line telecoms like AT&T and Verizon fell, weighed down by heavy debt burdens and poor growth opportunities.

Facet’s ETF mix is overweight companies with lower debt burdens, more consistent revenue generation, and higher profit margins. We are underweight companies with high valuations, weak profitability, and that carry a lot of debt.

This combination was a solid benefit to relative performance in 3Q. Many of the weaker sectors this quarter are made up of high-debt, low-profitability companies, such as old-line telecoms and autos.

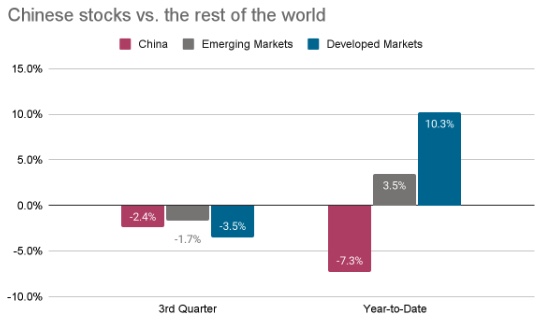

Chinese weakness

Growth in China’s economy had shown signs of slowing for much of 2023, but the trend accelerated in the third quarter. The Chinese economy is getting hit from several directions.

Developed countries’ consumption of goods has slowed as service spending has risen. This has hurt Chinese exports of goods. According to official Chinese data, Chinese exports to the US have fallen by 8.8% over the last year.

In addition, the Chinese property market continues to be weak. This quarter, Chinese property developer Country Garden was teetering on the edge of bankruptcy, and they are just the most prominent example of China’s struggling real estate development market.

For many years, construction was a major driver of Chinese growth, and many analysts were long concerned that China was overbuilding relative to demand. That fear now seems to be realized.

Lastly, China is suffering from the “friendshoring” trend. This is a term for countries moving more of their manufacturing supply chain to friendly countries. Arguably, this movement got started during President Donald Trump’s administration, when tariffs were raised, especially on Chinese goods. However, two more recent events have accelerated the trend.

First was the Russian invasion of Ukraine. The major sanctions imposed by Western democracies on Russia left companies with stranded Russian assets. If China were to invade Taiwan and impose similar sanctions, companies wouldn’t want parts of their supply chain interrupted.

Second is the US Inflation Reduction Act, which includes various tariffs and subsidies to bring manufacturing of certain key industries to the US. This includes some major Chinese exports, such as semiconductors and solar panels.

The way out of this problem is for China to develop more internal demand. This would reduce their reliance on exports and construction spending for their economic welfare. Right now, Chairman Xi Jinping is resisting such stimulus, preferring instead to encourage more lending to property firms to keep them afloat.

Facet is underweight emerging markets stocks in general, and thereby also underweight China. During 3Q, Chinese stocks fell for the third consecutive quarter. This was only a minor impact on relative return this quarter, as Chinese stocks were down about as much as developed markets stocks, but it has been a major benefit for our members year-to-date.

Source: Morningstar

Source: Morningstar

King dollar

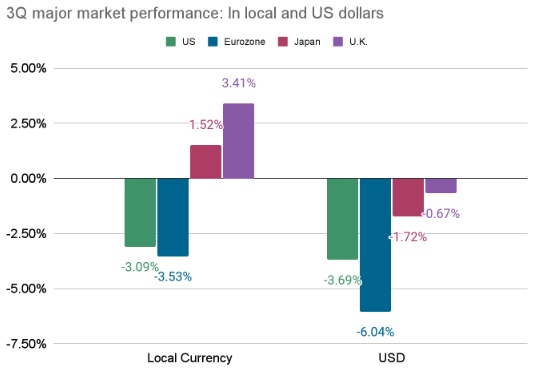

Reports of the US dollar’s demise appear to be greatly exaggerated. This quarter, the dollar surged vs. most major world currencies as a combination of higher interest rates, subsiding inflation, and improving growth prospects attracted global capital into the US.

Dollar strength has been a significant driver of performance for international stocks. When a US-based investor buys an ETF of non-U.S. stocks, two factors make up the ETF’s return. First is the performance of the stocks themselves. But because those stocks are denominated in some foreign currency, that stock return must also be translated back into dollars.

For example, if the ETF were buying a company on a Japanese exchange, it would take your US dollars, purchase Japanese yen, and then buy the stock. Since your returns are reported in dollars, if the yen weakens while you are holding the Japanese stock, that will harm your return.

This phenomenon was on display this quarter. The chart below shows the performance of US, European, Japanese, and UK stocks as measured in their home currencies on the left and then in US dollar terms on the right.

Source: Morningstar

Source: Morningstar

Measured in local terms, the Eurozone performed only slightly worse than the US, while Japan and the UK substantially outperformed. In a sense, this is a pure measure of how well the companies in those countries are faring fundamentally. However, when translated back into USD, Europe becomes a big underperformer while most of the outperformance for Japan and the UK goes away.

We aren’t sure this trend of US dollar strength will continue. For now, drivers of dollar strength are rapid disinflation and rising interest rates. It would be easy to imagine US inflation leveling off near 2% and interest rates leveling off over the next few quarters. Such a thing would open the door for some catch-up for other currencies.

Meanwhile, fundamentals in Europe and Japan are arguably better than they have been in a long time. The friendshoring trend that is harming China is benefiting developed markets as manufacturing rotates to friendlier countries. Long-term drags, like meager interest rates in Japan or the confusing process of Brexit, are fading as issues.

Right now, Facet has a neutral weighting to non-U.S. developed markets. However, we can see several scenarios where international markets outperform the US in the coming quarters, including ones where the dollar stops being such a drag on results.

What might be coming next?

As mentioned above, Facet’s process is not to make predictions about the economy or markets. Instead, we prefer to think in terms of possible scenarios. While guessing which scenario will happen is challenging, we can usually make confident estimations about how different stocks and bonds will perform within each scenario.

For example, if the economy continues to grow and companies keep hiring, it is very likely that stocks will rise in the coming quarters. We looked back at every period where the S&P 500 lost money over a two-year period from 1970 to now. Out of the six separate periods this occurred, there was a recession in five of them, and unemployment rose by at least 2% in all six cases.

This tells us that while stock prices can bounce around—like they did this quarter—if the economy is in good shape, stock prices tend to rise.

As we said before, there are certainly scenarios where the economy turns weaker, and we think we have some recession protection built into our ETF selections. This includes our overweight of companies with lower debt burdens, more stable revenue streams, and higher profit margins. It would also include our underweight of emerging markets, which tend to suffer anytime developed markets slow down.

In terms of interest rates, we believe interest rates will generally remain high, and the yield curve will remain inverted as long as the economy keeps growing. The Fed might cut interest rates in 2024 slightly if inflation continues to decline, but interest rates are only likely to change in a big way when the economy slows.

Combined, this makes for a pretty good environment for investors. Relatively high interest rates mean you are making a good return on bonds and even short-term investments. The fact that the economy appears to be on sound footing also suggests a decent environment for stocks.

Short-Term Strategy

Facet’s Short-Term Strategy (STS) is designed to produce stable returns commensurate with the yields available in shorter-term bonds.

In the third quarter, short-term interest rates moved modestly higher, as the Fed hiked rates by 0.25% in July but made no other changes. That pushed the yield on STS to 5.6% as of the end of September, a new high for the strategy since we launched earlier this year. This means the forward-looking return potential has increased.

That being said, anytime interest rates rise in a quarter, it will cause a bit of a short-term drag on STS vs. its T-Bill benchmark. The tradeoff is good for STS investors in the long run, as higher income generation will ultimately mean more return on your money. But in the short-term, it can create a slight lag to benchmark, as it did this quarter.

See our recent article here for more details on your different short-term investing options.

Model portfolio performance as of September 30, 2023

| 3Q 2023 | Inception | |

| Facet Short-term Strategy | 1.18 | 2.73 |

| Cash Benchmark | 1.39 | 3.04 |

![]()

ESG

Facet’s ESG equity strategy was slightly behind the Morningstar Global index for the third quarter. The strategy utilizes a set of ETFs that screen out stocks based on certain ESG criteria. These screens wind up removing a large chunk of energy-related exposure to the strategy.

Energy had been a big laggard in the first half of the year, but it was the best-performing major sector in the third quarter as oil prices surged over 30%. The strategy has a substantial underweight to energy producers, especially oil and gas drilling, and this was a drag on results this quarter compared to the benchmark.

This highlights how the ESG strategy can vary from a more traditional strategy in the short term. Having less energy will be a benefit for a couple of quarters, then might be a drag for a couple of quarters. But this should be a minor difference in performance over the long run.

In bonds, the 3Q results were right in line with the benchmark. For the year, Facet’s small overweight of corporate bond ETFs relative to other types of bonds has been a small benefit relative to the index.

Model portfolio performance as of September 30, 2023

| 3Q 2023 | YTD | 12MO | Inception | |

| Facet ESG Equity | -3.99 | 11.40 | 20.69 | -0.37 |

| Equity Benchmark | -3.29 | 9.44 | 20.35 | 0.17 |

| Facet Bonds (Tax-Deferred accounts) | -3.19 | -0.63 | 1.51 | -5.58 |

| Facet Bonds (Tax paying accounts) | -3.12 | -0.76 | 2.28 | -3.74 |

| Bond Benchmark | -3.19 | -1.17 | 0.65 | -5.18 |

![]()

Retirement Strategy

Facet’s Retirement Strategy is meant for members who are in retirement or close to retiring. It utilizes ETFs that have somewhat less volatility than our traditional growth model, which we believe is more appropriate for members who are actively drawing from their portfolio but also need enough growth to ensure it lasts their lifetime.

Given the strategy’s focus on lower volatility, we would expect it to outperform modestly during down quarters and underperform modestly during up quarters. That held true in 3Q, with the strategy producing a negative return but not as much as the benchmark.

Model portfolio performance as of September 30, 2023

| Inception (06/30/2023) | |

| Facet Retirement Equity | -3.05 |

| Equity Benchmark | -3.29 |