The information provided is based on the published date.

Key takeaways

- Trying to predict the outcome of geopolitical events is difficult, investors should avoid making investment decisions based on assumptions about how these events will unfold.

- While geopolitical events can impact the economy, so can a number of other factors. These other factors could overwhelm the impact of the conflict.

- It is critical to follow a disciplined and consistent process when analyzing these events.

- When the impact of a geopolitical event is unclear, it's usually best to stay invested for the long term, as stocks tend to rise over time.

The ongoing wars in Ukraine and the Middle East have had a significant impact on world politics, the flow of trade, not to mention the tragic loss of life. They have also left investors grappling with how these events could impact markets. We thought we would dive into how Facet approaches geopolitics in our investment analysis.

Respect the unpredictability

War and politics are both notoriously difficult to predict. Many Western intelligence agencies did not expect Vladimir Putin to actually invade Ukraine, and it seems Putin was caught off guard by Ukraine’s ability to resist the invasion. If people with access to real military intelligence can be that surprised, those of us in the finance world need to be very humble about our ability to predict how geopolitical events will play out.

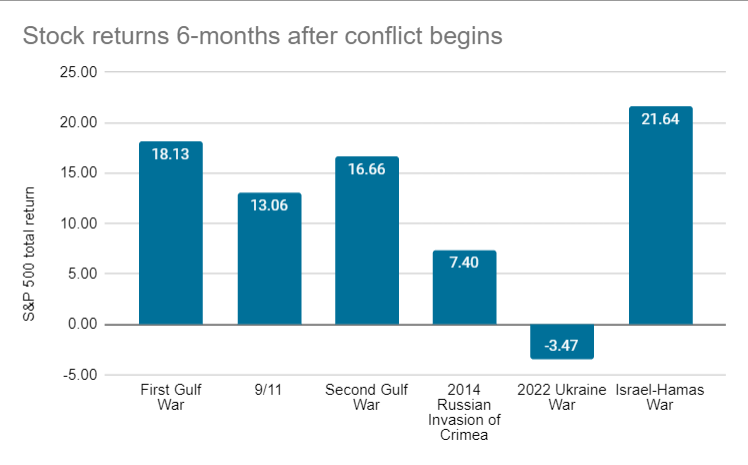

One simple way to see this unpredictability is to look at stock market performance surrounding major conflicts in the past. The chart below shows six such events and what the S&P 500 did in the six months after the event began.

Source: S&P Dow Jones Indices

Facet approaches thinking about geopolitics by starting with a narrative exercise. We come up with a story about how the conflict could cause stocks to decline over some period of time. We then try to come up with the opposite narrative, one where the event has a limited economic impact and/or ends quickly.

To be sure, this is a simplistic exercise, but it creates a good starting point. How easily both better and worse narratives come to mind helps you see just how uncertain the outcome is. It helps us avoid putting too much weight on any one outcome.

Think in terms of macroeconomic impacts

When we are thinking about these narratives, we focus on the economic impacts of the event. We have made a similar point when talking about domestic politics: the only thing that ultimately matters for stock prices is the effect on company earnings.

In other words, you have to think in terms of how this affects Ford’s ability to sell cars or Meta’s ability to sell more Facebook ads. In the very short-term, such as a day or a week, the market could decline on simple fear. But even stretching your time horizon out to a month or two, the fear usually fades. Wall Street’s analytical machine is going to take over, and that means actual company results are going to be what drives stock prices.

Even though we aren’t stock pickers at Facet, we still try to think about the impact of geopolitical events at the industry level. Does an event like the Israel-Hamas war impact defense spending? Probably. Does it impact business software sales? Probably not. In this sense, we treat narratives around geopolitics like any other macroeconomic scenario. It is all about what the impacts are, how large the effect is, how confident we can be in any given scenario, and then compare all that to what the market’s consensus is.

A lot of times this exercise leaves us thinking there is too much uncertainty to make a portfolio change. When that happens, we want to fall back on the foundational concepts: stocks tend to go up over time, so better to just stay broadly invested.

What about oil prices?

Many of the recent large conflicts have involved oil producing countries in the Middle East, including the current conflict in Israel. The Middle East accounts for about 31% of world oil production, with Russia making up another 11%. Wars can cause all sorts of impacts on oil prices, from attacks on facilities to sanctions to supply chain disruptions.

Oil prices rising is a great example of an actual macroeconomic impact that could stem from a wider Middle East conflict, and is something we are including in our scenario analysis. However, it is important to put the impact into context.

The first challenge is that oil prices aren’t just set by supply. For example, when Russia invaded Ukraine in 2022, many countries put sanctions on Russian oil. One would assume that a large decrease in supply of oil from Russia would cause prices to rise. The day before the Russian invasion, crude oil was trading about $92 per barrel. As of April 22, 2024 it is about $82 per barrel. And that’s with another war breaking out in the Middle East in 2023.

Why have oil prices failed to rise? There’s probably several reasons, but one of them is economic weakness in China. The decreased demand for oil as the Chinese economy has slowed has offset any supply constraints related to these two wars.

Additionally, the relationship between oil prices and the economy is tricky. Instinctively, people often assume that higher oil prices are bad for the economy since it increases various costs to both consumers and businesses. But the impact might be smaller than you think.

Energy spending by goods producers makes up about 5.5% of total cost of production. For consumers, spending on energy is about 6.7% of household budgets. So roughly speaking, a 20% rise in all energy costs would be about a 1.1% increase in total costs to producers and about a 1.4% increase to consumers. Note that a 20% rise in oil prices may result in less than a 20% increase in all energy prices, but this illustration helps to put some size to the impact.

That isn’t to say that a 1.4% hit to consumer budgets isn’t meaningful. It definitely is. Rather we are saying that an effect that small can easily be wiped out by other factors, similar to the Chinese oil demand issue mentioned above. For the U.S., there is a large oil production sector here domestically. If oil prices rise, that might encourage more spending on energy investment. In other words, oil prices have multiple impacts, some good some bad.

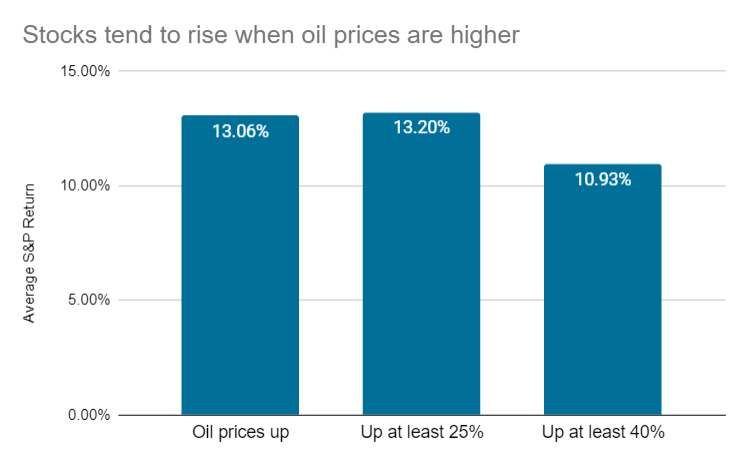

We can see how this has netted out historically by looking at calendar year stock market returns given various increases in oil prices. Below shows the average annual return of the S&P 500 from 1983 to today in years when oil prices have risen. We also looked at years with unusually large increases of at least 25% and 40%.

Source: S&P Dow Jones Indices, Bloomberg

As you can see, stocks generally have been up in years where oil rises, even if the oil price increase is substantial.

Salience bias

One reason why geopolitics carries so much weight in many investors’ minds is something called salience bias. This is where people overrate the importance of events that are relatively rare and noteable. In other words, the outbreak of war feels like a very big deal. Therefore it seems like it must matter to investment markets.

Of course, war is a very big deal in a general sense. That doesn’t automatically mean it is a big deal for investment markets. This is why having a process to analyze these kinds of events is so important. As we mentioned above, we focus on real economic effects. We believe following a strict process helps to avoid falling victim to biases, such as the salience bias. We believe this is crucial to investment success.

The danger of getting out of the market

Geopolitical events can create the temptation to sell out of the market for fear of the conflict causing some kind of market crash. In general, Facet is going to always recommend against any kind of market timing. However, this version of market timing is especially problematic.

Let’s take the current conflict in Gaza, which has now been going on for just over six months. Say that after Hamas first made their incursion into Israel, you feared the worst. Say you believed that the Israeli response would result in a protracted urban combat campaign. Say you worried it would result in political fallout around the world. Say you were concerned that the conflict could widen to include Iran or organizations that Iran sponsors.

All of those things have been happening. Or at the very least, if you were worried about them six months ago, you are certainly still worried now.

And yet as our chart above shows, stocks have been up over 21% during that time. Had you sold your investments over fears about this war, you would have missed that large rally.

Now here is where it gets even more challenging. Say you missed the 21% rally. Now what? Should you get back in the market now? Nothing about the conflict seems to be getting better. If you had made the decision to stay out of the market six months ago, it would be very difficult to get back into the market now.

I have seen it happen many times that an investor sells some or all of their portfolio and then becomes stuck. Whatever fears caused them to sell in the first place never quite went away. As we’ve written before, there’s always a good argument for why stocks might go down. If all you do is focus on those negative arguments, you’ll always sit on the sidelines and never get your money working for you in markets.

As we said above, we aren’t saying geopolitics has no bearing on investing. Rather we are saying that putting it into context and proportion are extremely important. Generally speaking, too many people overrate the importance of major geopolitical events, and when they do, they tend to make investment mistakes. Facet’s investment process is designed to avoid such biases, and deliver portfolios built on objective analysis.