The information provided is based on the published date.

Key takeaways

- Everyone’s situation - and reasons for saving - will be different

- The first goal of saving is to build an emergency fund

- The 50-30-20 Rule will help you allocate your income across key spending categories

- Don't invest funds you’ll need within five years in risky investments

- Balance your expenses today with the life you want to live tomorrow

How much of your paycheck should you save? Although various experts will quote a percentage, asking how much you should save is like asking, “How much should I eat?”

The answer to the food question really depends on how hungry you are. (Although you should never say no to tacos and pizza.)

Finances work the same way: once you know what sort of financial life you want to live, you’ll have a better idea of what you need to do to get there.

Although saving a percentage of your paycheck is a starting point, there’s much more to find the answer that works best for you.

Before you know how much you should be saving, getting a clear picture of your expenses is critical.

Everyone’s situation is different

The financial services industry has a habit of dispersing blanket advice, often recommending people save X% of their monthly paycheck or have one million dollars in retirement savings. But the problem with one-size-fits-all financial advice is that everyone’s situation is different. In other words, what works for one person may not work for the next. On top of that, if you put away anything, you’re already doing better than over 25% of American workers.

For example, someone paying off massive student loan debt is in a very different financial position than someone making six figures with no debt.

So before you focus on how much to save, you should really get a handle on every aspect of your financial life first.

A good place to start is the 50-30-20 Rule.

The magic of 50-30-20

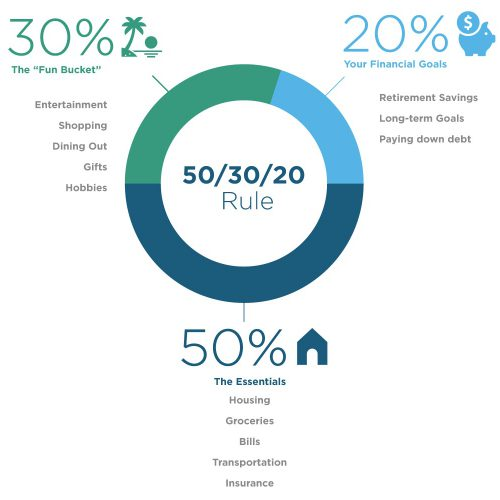

No matter how much you make and what debt and expenses you have, many experts recommend allocating your income using the 50-30-20 Rule as a starting point. Here's how the allocation breakdown works:

- 50% towards needs (housing, food, utilities, insurance, transportation)

- 30% towards wants (vacations, shopping, dining out)

- 20% allocated to savings and investments

Consider these as a good rule of thumb or guidelines, not rigid rules. For example, if you have no emergency savings, building an emergency fund might be a more immediate need than paying off more debt.

Once you have three months of emergency savings, then it might make more sense to save a little less and allocate more of your income towards paying off debt.

This is a dynamic process, so expect to tweak your plan as your circumstances and priorities change.

Preparing for life's unexpected moments

One of the best ways to gain peace of mind is to have a healthy emergency fund so that when a tire blows out or the roof starts leaking, the unexpected expense is annoying rather than devastating.

A recent study showed that roughly half of Americans don't have an emergency fund that could cover a $400 expense. So, you're ahead of the pack if you have only that much in savings—but obviously, more is always better.

For most people, a solid emergency fund should have enough to cover 3-6 months of expenses. That rule of thumb will vary, though.

If someone else in your household also provides income, you may need less in your emergency fund. On the other hand, if you're financially responsible for another, such as a child, or work in a volatile industry or for a company with high turnover, you may want to set aside more.

Of course, covering unexpected financial emergencies is only part of your financial life. For example, if you’re saving for a house, investing for retirement, have an income that fluctuates and need to build a financial trust for a special needs child, you may want to save and invest more than 20% of your income (if that’s possible).

Of course, if you’re financially secure, have no debt, and a pension and Social Security will fund your retirement, you can most likely save less.

One easy calculation is determining how much of your paycheck should go into your employer’s retirement plan, such as a 401(k).

If your employer matches employee contributions up to a certain percentage, at a minimum, you should have that much deducted and invested on your behalf. Otherwise, you’re leaving “free money” from your employer on the table.

Keep in mind that very few people complain that they have too much money put away for the future. But many retirees regret that they saved too little.

Once you know how much you need to save, the next decision is where to put it.

Where to save

One rule of thumb that should be religiously followed is where you save and invest.

Only invest money you won’t need for at least five years in stock-based funds. Anything short-term, such as building an emergency fund or saving to buy a car in two years, should be in a liquid, interest-bearing account.

There are five ways to earn compound interest that make sense for money you’ll need within the next five years.

- Checking accounts

- Bank savings and money market accounts

- Certificates of Deposit (CDs)

- Bonds (savings, municipal, Treasury, and corporate)

- Money market funds and bond funds (through a brokerage)

Deciding how much to save and invest while balancing your other financial needs and wants can be complicated. A CFP® professional from Facet can help you make the financial decisions that will help you live the life you want to enjoy today and tomorrow.