The information provided is based on the published date.

Key takeaways

- The Q2 2025 stock market saw a dramatic rebound from early tariff fears, driven by strong corporate earnings and a somewhat speculative rally in tech and AI stocks.

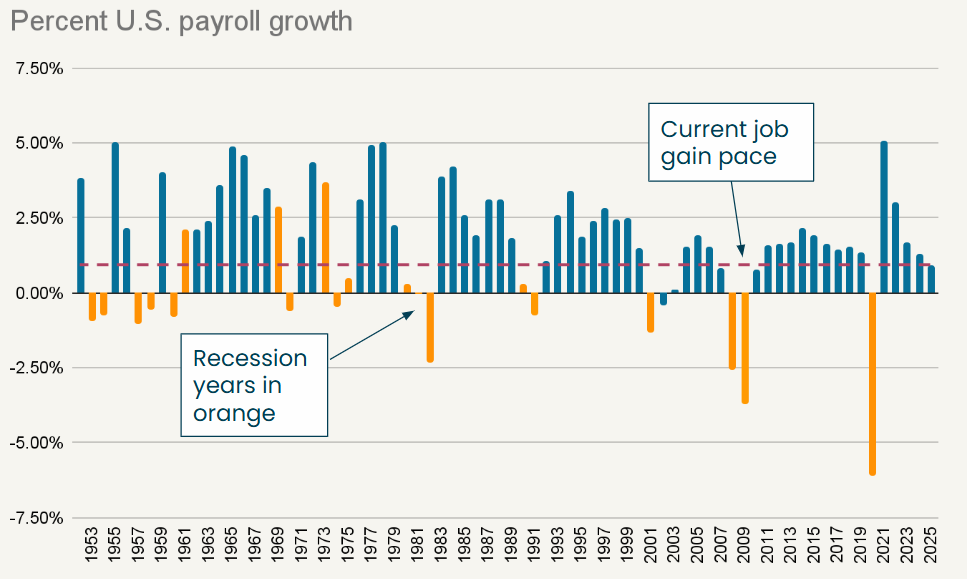

- Despite the market rally, the economic outlook for late 2025 is uncertain, as slowing job growth historically signals potential recession risk, contrasting with currently strong business investment.

- Tame inflation data in the second quarter gives the Federal Reserve flexibility to cut interest rates later this year, though the full price impact from tariffs remains a key unknown.

- The market's "risk-on" sentiment in Q2 favored speculative, low-profitability companies, causing more defensive, quality-focused investment strategies to potentially underperform in the short term.

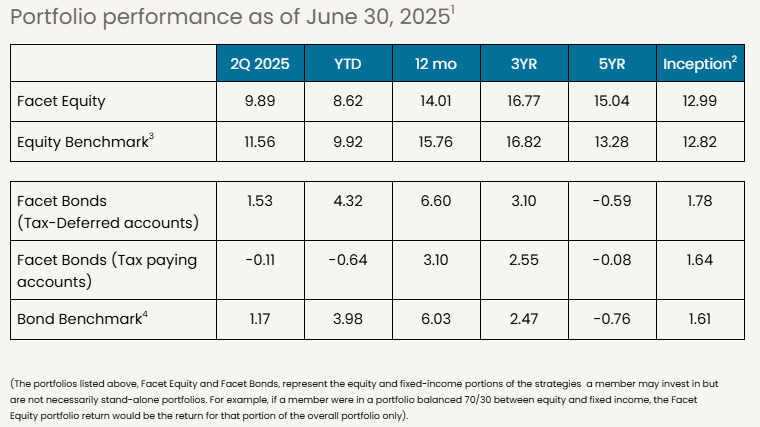

The second quarter was a period of extremes. In early April, the S&P 500 briefly fell into bear market territory, having declined more than 20% from its highs on worries about the “Liberation Day” tariff announcement. But after the initial tariff plan was put on “pause” stocks began to recover. By the end of the quarter, the Morningstar Global Markets index finished up over 11%, good for the best quarterly performance since 2020.

The bond market was also highly volatile, reacting to international flows, anticipation of Federal Reserve policy, and uncertainty about the U.S. budget. Despite all this, the Morningstar Core Bond index managed to post a small gain, rising 1.2%.

Facet’s equity exchange-trade fund (ETF) portfolios finished a bit behind benchmark for the quarter. Our underweight of Emerging Markets stocks as well as our overweight of more profitable companies were both drags on the results. Meanwhile our bond strategies were mixed. For tax-deferred accounts we were slightly ahead of benchmark, while tax-paying accounts lagged due to underperformance from municipals. Facet’s longer-term results remain strong.

Here are our thoughts on what happened this quarter, how it impacted our strategies, and what we expect in the coming quarters.

If you're a current Facet member and are interested in learning more about investing with Facet, please reach out to your planner and start the conversation. The investments team is available to meet with you, answer questions, and talk through your options.

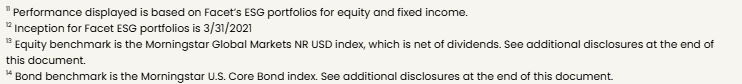

A quarter of extreme volatility ends with stocks near all-time highs

The quarter began with President Donald Trump announcing a surprisingly aggressive tariff plan on April 2. Between April 2 and April 8, the S&P 500 dropped over 12%. That was the worst four trading-day drop since March 2020. Then on April 9, Trump announced a “pause” on the most severe of the tariffs, touching off a 9% rally in a single day. That was the largest one-day gain for the S&P 500 since October 2008 and the 8th largest percentage gain ever. The rally continued in May and June, and by the end of the quarter, global stocks were hitting new all-time highs.

Source: Morningstar, Dow Jones S&P indices

Part of the continued rally came from strong earnings. During the quarter 78% of S&P 500 companies reported earnings that were above Wall Street forecasts. Traders had been bracing for a more negative earnings season, especially worried that companies would forecast weaker profits in the back half of the year. So far this has not happened in a big way, and that helped fuel the stock rally this quarter.

Especially encouraging was company investment. Despite the uncertainty brought on by tariffs, companies continued to invest in expansion and growth. This is particularly true in regards to artificial intelligence. Declining business investment is a common cause for recessions, so this is an area Facet is watching closely. This could definitely change as tariffs actually take hold, but so far business investment seems to be holding up.

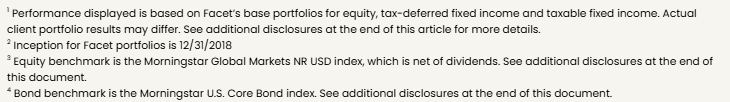

No sign of inflation yet

Another major positive that helped boost stocks this quarter was a lack of inflation. The May Core PCE inflation figure came in at +0.18%, suggesting that tariffs haven’t had a meaningful impact on overall prices just yet. In fact inflation over the last three months has been at just a 1.77% pace, below the Fed’s 2% target.

Source: Bureau of Economic Analysis

The good news is that this may make it easier for the Federal Reserve to cut rates later this year. It seems likely that the Fed would already be considering cutting rates right now if not for concerns about tariffs causing future inflation. At the very least, these tame inflation reports tell us that there isn’t excess inflation pressure outside of tariffs.

That’s good news. If the economy does slow later this year, having the Fed able to cut rates more aggressively could help forestall a recession. The Fed will only be able to do so if inflation remains benign.

I would caution against jumping to the conclusion that the lack of inflation right now means tariffs aren’t going to cause prices to rise. Many companies built up substantial excess inventory ahead of the April tariff announcement. This might mean that companies are still sitting on goods that were imported before tariffs took effect. Perhaps they are choosing to not raise prices until this pre-tariff inventory is exhausted. It may be politically beneficial, especially for large companies, to quietly raise prices later in the summer, and avoid the ire of the President.

Regardless, it's important to note that someone has to be paying the cost of tariffs. This simple fact has big consequences for investors. If the cost of tariffs is passed fully on to consumers, then there will be less consumer spending overall, and this will cause the economy to slow. If companies were to fully absorb the cost of tariffs and not raise prices, then company profits will fall. That would weigh on the stock market.

The more likely scenario is that it winds up a mix of consumers and companies that pay the tariff tax. For investors, we believe it will be the companies with more pricing power that will fare better. Those are the companies that will be able to raise prices and maintain margins, which should result in better share price performance. While there is no simple way to tell what companies have pricing power, it tends to correlate with high profit margins and/or more stable revenue. Through our ETF mix, Facet is overweight these kinds of companies.

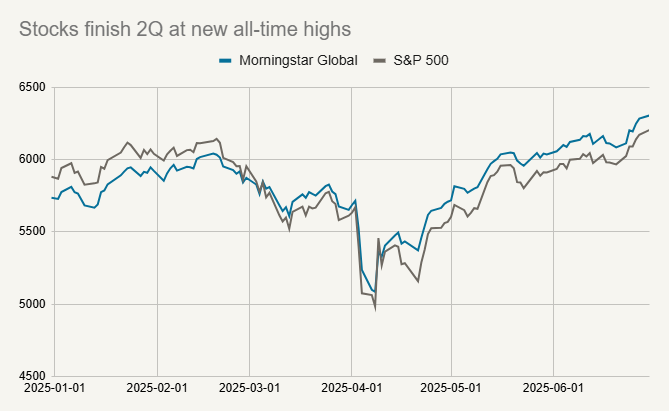

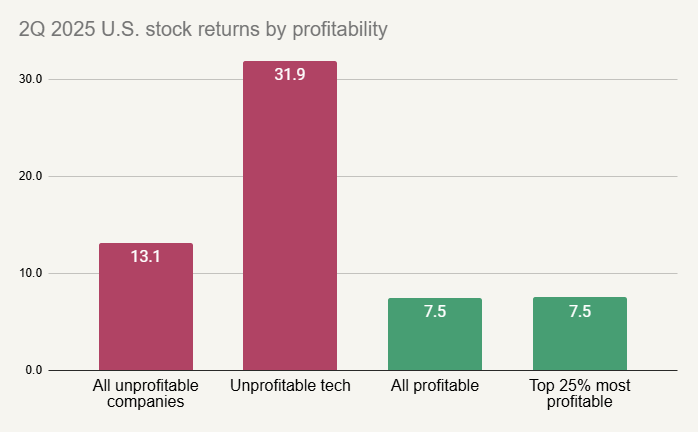

Low quality companies outperform

Somewhat surprisingly, high profit margin companies were underperformers in 2Q. Looking within the U.S. market, companies with the worst profit margins (including those that are losing money) were the big outperformers this quarter.

Source: Bloomberg

This is a sign that investors are in a speculative mood. We highlighted unprofitable tech companies in the chart above to illustrate this point. This is a category that includes a lot of AI or crypto-related companies. Most of these are aggressively spending to try to goose growth. During 2Q investors flocked to these kinds of companies, driving those stocks higher.

To be clear, it wasn’t just unprofitable AI-related companies that did well this quarter. Moreover, the enthusiasm over AI isn’t unfounded or entirely speculative. In general the big AI companies (Nvidia, Meta, etc.) posted strong results this quarter. As we said above, investment spending on AI seems to be holding up well. However, it's worth noting that the average profitable tech company was only up 15% this quarter, or half as much as their unprofitable peers.

This says something about today’s market. Investors are more focused on potential as opposed to results. Or put another way, investors are chasing upside instead of thinking about balancing risk and reward.

This is a kind of market where Facet tends to struggle a bit vs. our benchmark. Seeking balance of risk and reward is central to our approach to investing. We believe this approach is the best way to maximize the chance our members reach their financial goals. However it does mean that from time to time, we’re going to lag a bit when the market gets particularly speculative.

Specifically, we came into this quarter explicitly avoiding companies with weak profitability. Our belief then, as it's now, is that if the economy does slow these speculative stocks will struggle. Moreover, the threat of the economy slowing isn’t some hypothetical. As we’ll discuss in more detail below, the ingredients for an economic slowdown are all present right now.

In other words, the positions Facet owned did very well. What we didn’t own just did even better. We estimate that simply being underweight non-profitable companies vs. those more profitable resulted in about 0.4% of underperformance vs. our benchmark.

Even if the AI boom is real, doesn’t mean today’s stocks will be the winners

We have written about the potential for an AI bubble a few times in the past. I’m generally not of the view that AI stocks are a bubble in the same way that internet stocks were in the 1990’s. While there is a certain amount of speculative behavior, as highlighted above, it's nowhere near the fever pitch of the 1990’s. Or even that of 2021 for that matter.

That being said, one lesson we can learn from the 1990’s internet bubble is that even if a technology does turn out to be revolutionary, it doesn’t always translate neatly into stock market performance. As we all know, the internet really has changed everything about our economy and even our society. However many of the best internet-related companies from the 1990’s have been loser investments or have disappeared entirely over the last couple decades.

I’m personally pretty optimistic about how AI might benefit the economy. However I have material concerns about the stocks that are today’s AI darlings.

Today you have a large number of companies racing to create AI products. This ranges from the big large language models (OpenAI, xAI, Anthropic, Alphabet, Meta, etc.) to the myriad of companies trying to create AI-based tools. All of these companies need things like semiconductors, data center capacity, access to LLMs, etc. This is similar to the 1990s: the emerging web companies all needed servers, switches, web hosting, etc.

If there were to be a shakeout among more speculative AI companies, it would almost certainly bite the profits for the big players. This is exactly what happened in the early 2000’s. As some weaker web companies started disappearing, it became obvious that there was overcapacity in internet infrastructure. That caused stocks like Intel or Cisco Systems to drop rapidly.

Also like the 1990’s, some of the big providers of AI infrastructure are also investing in companies that could be their customers. One example would be Nvidia’s investment in CoreWeave. Nvidia made a big investment in the AI cloud computing provider when it was still private. As CoreWeave grew, it became a bigger and bigger buyer of Nvidia’s chips. In this sense, Nvidia is financing their own demand generation. There’s nothing untoward about companies investing in emerging customers, but it does create a certain risk that the demand generation could be circular.

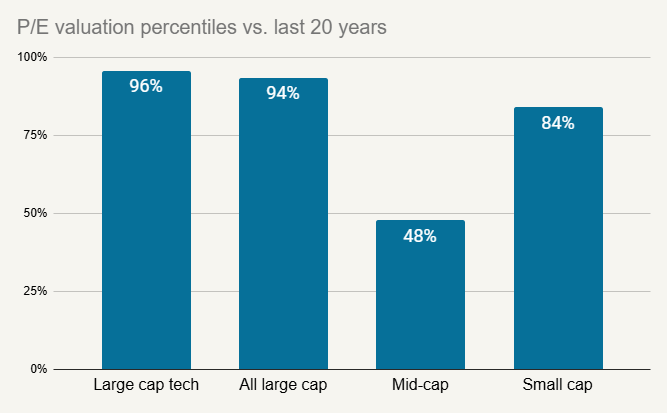

Lastly, the valuation on tech companies today is extremely high. The current price-to-earnings ratio on large tech companies is in the 96th percentile compared to the last 20 years. This means that tech stocks have only been more expensive 4% of the time during the last two decades.

Source: Dow Jones S&P Indices, Russell Indices, Bloomberg

So on one hand, there are some things that could go wrong with large tech companies, even amidst the AI boom. On the other hand, the stocks are currently priced with very little margin for error.

We believe this combination warrants an underweight to U.S. tech. There certainly is still considerable upside for tech stocks, and hence we’ll continue to keep a healthy weighting. However we think the downside risks are material enough to justify owning just a bit less than our benchmark.

During 2Q this underweight was a negative for Facet’s equity performance relative to benchmark, subtracting about 0.5% from relative returns.

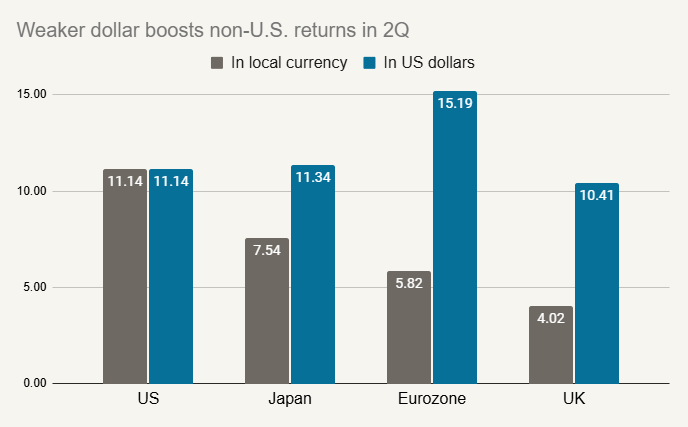

Dollar weakness continues in 2Q, boosting non-US stocks

The U.S. dollar declined again this quarter, continuing a trend from 1Q. This was driven mainly by ongoing trade tensions and the potential that U.S. economic weakness could lead to rate cuts by the Federal Reserve. The euro finished the quarter at its highest level vs. the dollar since 2021.

The dollar weakness helped boost non-U.S. returns this quarter. For the second quarter in a row, non-U.S. stocks outperformed. However, it's notable that this quarter, the outperformance is entirely due to currency movements. On a local currency basis, the U.S. outperformed other major world markets.

Source: Morningstar

What this chart is telling us is that an investor living in the Netherlands who bought European stocks made about 5.82% this quarter. They would have underperformed a U.S. investor who made 11.14% in just U.S. stocks. However, an American investor buying Eurozone stocks would be up 15.19%, because when the return of the EZ stocks was translated back into U.S. dollars, it would have been boosted by the surging euro.

This situation probably isn’t sustainable. Currencies tend to move toward the market where the best returns are available. If profit growth in Japan or the Eurozone isn’t fast enough to generate strong equity market returns in the local market, it's unlikely that the currency will keep appreciating. In other words, profit growth in foreign markets relative to U.S. markets has to improve if the dollar is to continue to weaken.

That being said, I do think non-U.S. stocks are something of a recession hedge. If there is a U.S.-centric recession, that would likely slow our profit growth relative to foreign markets. Interest rates would probably also decline. Both of those factors would probably cause the dollar to keep weakening.

Facet is neutral on developed markets, and about 5% underweight emerging markets. The emerging underweight was a small drag on returns this quarter. Despite a series of negative economic figures coming out of China, flows continued to favor emerging markets. We think this is a bit of the same speculative attitude that is driving U.S. tech stocks, and we remain cautious on EM.

Bond yields mixed, municipal bonds struggle

It was a mixed quarter for bonds. Shorter-term Treasury bond yields declined, as traders began to bet that the Federal Reserve would be cutting rates later this year. However longer-term rates rose, with the 30-year Treasury bond yield rising 0.27% to 4.84%.

In bond market parlance this is called a “twist” and it's pretty unusual. While different maturities within the Treasury bond market often move by different degrees, most of the time they move in the same direction.

What we are seeing right now is short-term Treasuries responding to the Fed. The Fed only directly controls the rate on overnight loans and deposits. But this winds up having a lot of influence over other shorter-term yields, even out to two and three year maturities. As you keep going longer, the Fed’s influence fades and other factors become more important: things like the long-term inflation rate, uncertainty about inflation and growth, as well as the supply of bonds in the future.

Longer-term bond yields are rising because of these other factors. There is worry that deglobalization and decreased immigration could cause the long-term inflation rate to rise in the U.S., or at the very least result in more inflation volatility. There is also concern that political interference with the Fed might also result in higher inflation and/or more volatility. Lastly there’s the fact that the budget currently working its way through Congress is likely to increase the deficit. That means the U.S. will have to sell more bonds in the future, which all else being equal will push up yields on Treasury bonds.

For qualified accounts, this yield curve twist benefitted Facet’s relative return, and helped our taxable bond ETFs outperform the benchmark. Facet is overweight bonds in the 3-7 year part of the maturity curve, and underweight bonds longer than 10 years.

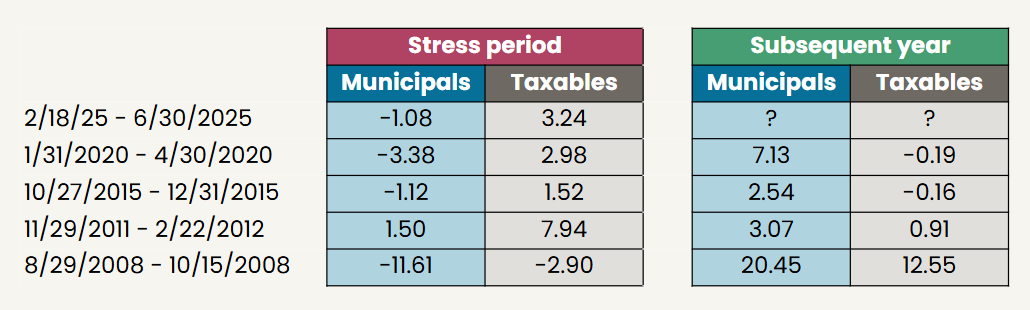

Unfortunately, municipal bonds continue to lag the performance of Treasury bonds, a repeat of what happened in 1Q. This doesn’t have anything to do with the particular muni ETFs Facet selected, but rather a general lack of demand for municipal bonds right now. It's also true that municipal bonds generally tend to be longer than taxable bonds, which resulted in some underperformance due to the yield curve shift mentioned above.

It's not unusual for municipal bonds to significantly deviate from taxable bonds, especially during periods of high volatility. At times municipals can far outperform, as happened in 2022. Other times they underperform, as is happening now. However, the two markets tend to even out over time. In the table below we show the last five periods where municipal bonds underperformed taxable bonds by 2.5% or more. We can see that in the prior four instances, municipals made up most of the prior underperformance over the subsequent year. We can’t know for sure if history will repeat itself this time, but given there are not deep fundamental reasons for municipals to have lagged, we think some degree of catch up is likely.

Source: Bloomberg

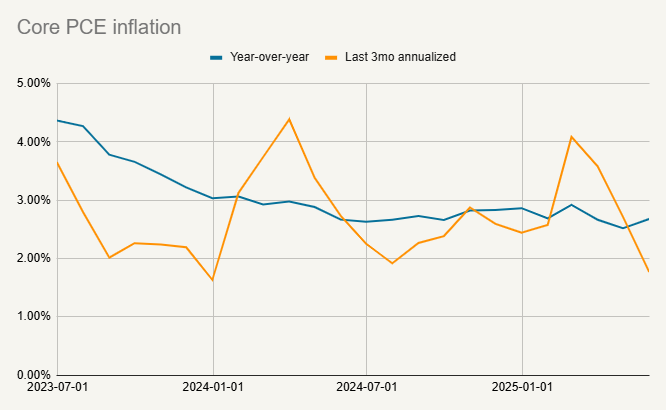

Tariffs inject significant uncertainty

There are upside and downside scenarios for the economy in the second half of the year. On the positive side, the tariff situation is starting to become more clear. Technically the Liberation Day tariff pause ends on July 9, and the White House has given mixed messages about how important that deadline is or isn’t. We think it likely that negotiations will continue past July 9 with any major trade partners that haven’t already made a deal. However, given the deals struck with the U.K. and China, plus what is rumored for the EU, it's becoming clearer what the Trump Administration wants from these negotiations.

That is giving companies some sense of what tariffs rates are likely to be. To be sure, the tariff rate will be quite high. Estimates for where the average tariff rate will end up after various negotiations range, but are generally in the 10-15% area. The rate was only 2.5% at the end of 2024. An increase in import taxes of that degree will certainly have economic consequences.

However, U.S. companies have a long history of adapting, even to negative circumstances. The more clarity can be gained, the easier it's for firms to adjust. There is no doubt that the level of uncertainty is lower today than it was in April.

On the negative side, we are currently seeing a number of signs that the economy could be slowing. Job growth has been positive, but has slowed from the pace of the last few years. Total employment has increased by 0.39% so far this year. If growth continued at that pace for the whole year, it would be the slowest pace of job growth since 2020, and the slowest non-recessionary year since 2010.

More concerning is that historically job gains have never come in below 1% in any calendar year that wasn’t either going into a recession, in a recession, or just after a recession. The chart below shows the annual percent payroll gains, with recessionary years in orange and the current pace of job growth as the red dotted line.

Source: Bureau of Labor Statistics

You see that all of the years below today’s pace are right around (or during) recessions. This could indicate that there is a kind of stall speed to the economy. In other words, job growth may need to keep up a certain pace in order for consumer demand to keep growing. If firms become more cautious for whatever reason and stop hiring as aggressively, household income growth slows. This in turn could cause consumer spending to also slow. If firms start seeing a decline in demand for their products, they become even more cautious and hire even fewer new workers. They may even start layoffs. That sequence is one way to get to a recession.

This is by no means inevitable. It may be that the slow payroll growth during the first half of the year was just due to tariff uncertainty. It could easily rebound in the second half. Clearly the stock market’s big move up this quarter indicates considerable optimism on the part of investors that the economy will regain strength in the coming months. In addition, as we said above, Fed rate cuts could also provide a boost, especially if lower rates helped spur company investments.

However, we see enough evidence to warrant some caution. It isn’t just the payroll data. The manufacturing sector seems to be contracting, the housing market is getting softer, consumer confidence is low, and spending has shown signs of caution as well. Despite all this, as we showed above, stocks are trading at relatively expensive valuations.

We have built in some defense into our portfolios, through things like being underweight emerging markets, underweight low profitability companies, and owning slightly less of the most expensive companies. As discussed earlier these defensive positions didn’t help Facet’s relative performance in equities this quarter.

As we said above, the economy could regain momentum. If that happens, we think positions like our mid-cap overweight will do extremely well. However if the economy turns weaker, we think some of our defensive positions are likely to be a benefit.

This is what we mean by balancing risk and reward. There is no way to guarantee outperformance every quarter, but we think having a balance of offense and defense in portfolios is the right way to drive our members toward their financial goals.

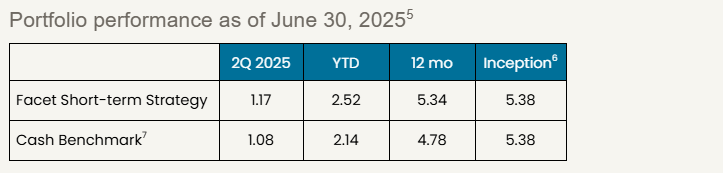

Facet’s Short-Term Strategy

Facet’s Short-Term Strategy (STS) is designed to produce stable returns commensurate with the yields available in shorter-term bonds. The strategy is designed for members with money goals that are only a year or two away.

STS’s performance was about the same as the Morningstar Cash T-Bill benchmark during this period. The strategy holds a mix of floating rate bonds and 1-3 year Treasury bonds. Shorter-term rates were quite volatile this quarter, but wound up very slightly lower. However, this wasn’t enough to make a material difference between our funds and those in the benchmark.

Over longer periods, it's going to be income generation that drives this portfolio’s performance. With a 4.4% yield, we believe STS offers a solid yield while also keeping volatility low.

Facet’s Alternative Income Strategy

Facet launched the Alternative Income Strategy this quarter, so these results only reflect two months of performance. However over that short period, the strategy is performing as we would expect. The strategy uses a combination of private credit, private real estate and some public market credit instruments to produce a high level of current income.

Currently the strategy has a dividend yield of about 9%. As we expect the vast majority of return for this strategy to be from income generation, during normal periods the strategy should have a return that is equivalent to approximately a 9% annual pace. This means that during periods where the stock market surges, as it did this quarter, the strategy is unlikely to keep up. The opposite is also true: during periods where stocks are sideways or down, the strategy is likely to outperform.

This was the case this quarter. The strategy is doing what we expect. The returns were a bit above a 9% annual pace over the last two months. We expect that return stream to be very competitive with stocks over the long-term, while producing substantially less volatility.

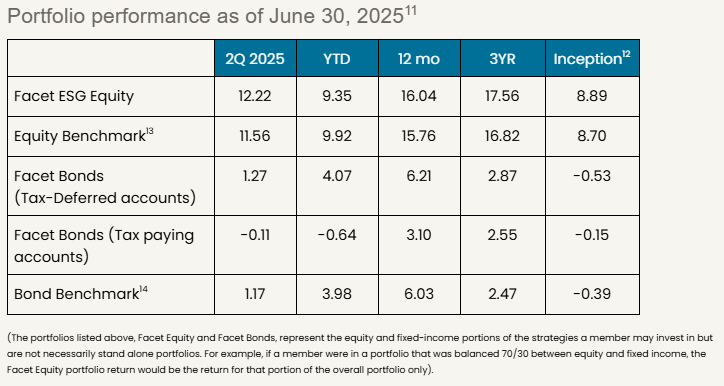

Facet’s Environmental Social Governance (ESG) Strategy

After a strong 2024, Facet’s ESG equity strategy underperformed the Morningstar Global index for the first quarter of 2025. The strategy utilizes a set of ETFs that screen out stocks based on certain ESG criteria. Specifically, the screens result in a significant underweight energy, utilities, and heavy industrial companies.

After a very strong 1Q, energy was the big loser this quarter. Within the S&P 500, the energy sector was down 8.6% vs. almost 11% for the whole S&P index. This was driven mainly by weaker oil and natural gas prices. Despite the tensions in the Middle East, softer global demand drove energy prices down, and this tends to be a negative for energy companies. Other sectors the ESG strategy tends to avoid, including utilities and materials were also laggards, albeit not to the same degree as energy.

Hence while the ESG strategy did suffer from some of the same issues discussed above, this underweight of energy and some other sectors helped buoy results this quarter, leaving the strategy close to benchmark for the period.

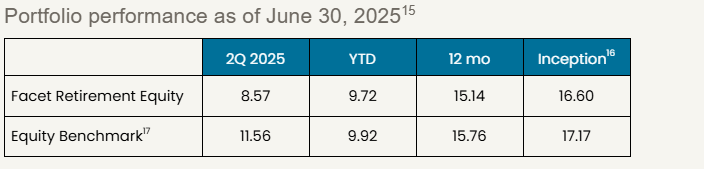

Facet’s Retirement Strategy

Facet’s Retirement Strategy is meant for members who are either already in retirement or close to it. The strategy utilizes ETFs that we expect will have relatively less volatility than our traditional growth strategy. Generally speaking, Facet expects this strategy to lag the equity benchmark a bit during big up quarters. Adding lower-volatility funds to this ETF mix should protect against the downside while giving up some upside.

As discussed above, any kind of defensive or lower volatility position tended to underperform this quarter. That is to be expected during a quarter when stocks return double-digits in such a short period of time. The Facet Retirement strategy was no exception, underperforming its benchmark this quarter.

For members currently in retirement, it's important to preserve some capital on the downside, even if that means giving up some on the upside. If the strategy can stay reasonably close to a more aggressive benchmark, then it's doing its job. As we can see by the year-to-date and longer periods, we think that is the case.

Performance disclosure

Investment returns shown here are intended for illustrative purposes only. All investments involve risk, including the potential for the loss of principal. The portfolio performance of Facet strategies began in 2018. Performance was calculated using Facet’s most common recommended equity and fixed-income ETF portfolios. At times when Facet changed a recommended ETF, the average transaction price of both buys and sells was used to update the portfolio. Otherwise, the portfolio was rebalanced monthly. Calculations were performed using the Bloomberg Portfolio Analytics tool. This illustration is meant to most closely resemble what a common Facet client in a given asset allocation mix may have returned. It does not represent any actual client or group of clients. The benchmark used for equity allocations is the Morningstar Global Markets Net Dividends index, which measures the performance of the stocks located in developed and emerging countries across the world. For fixed income allocation, the benchmark is the Morningstar US Core Bond index, which measures the performance of fixed-rate, investment-grade USD-denominated securities with maturities greater than one year. We believe the sources for this data to be reliable but cannot guarantee the accuracy or completeness of the information. No consideration was given to tax loss harvesting or other activities that occur during the ongoing management of investments, nor did Facet assert an opinion on the impact of these actions on these returns. These returns were calculated net of the fees associated with the underlying investments. Facet charges an annual planning fee based on the complexity of a client’s financial situation but does not charge a separate fee for investment management. The planning fee was not considered in the calculation of returns. Past performance is not indicative of future returns.

Benchmark disclosure

The Morningstar Global Markets Index NR USD and US Core Bond indices have been licensed by Facet for use for certain purposes. The services provided by Facet are not sponsored, endorsed, sold, or promoted by Morningstar, Inc. or any of its affiliated companies (all such entities, collectively, “Morningstar Entities”). The Morningstar Entities make no representation regarding such services. All information is provided for informational purposes only. The Morningstar Entities do not guarantee the accuracy and/or the completeness of the Morningstar Indexes or any data included therein. The Morningstar Entities make no warranty, express or implied, as to the results to be obtained by the use of the Morningstar Indexes or any data included therein. The Morningstar Entities make no express or implied warranties and expressly disclaim all warranties of merchantability or fitness for a particular purpose or use with respect to the Morningstar Indexes or any data included therein. Without limiting any of the foregoing, in no event shall the Morningstar Entities or Morningstar’s third-party content providers have any liability for any special, punitive, indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages.