The information provided is based on the published date.

Key takeaways

- The stock market's strong Q3 performance was led by speculative enthusiasm for AI, with unprofitable tech companies significantly outperforming, raising concerns about a potential bubble.

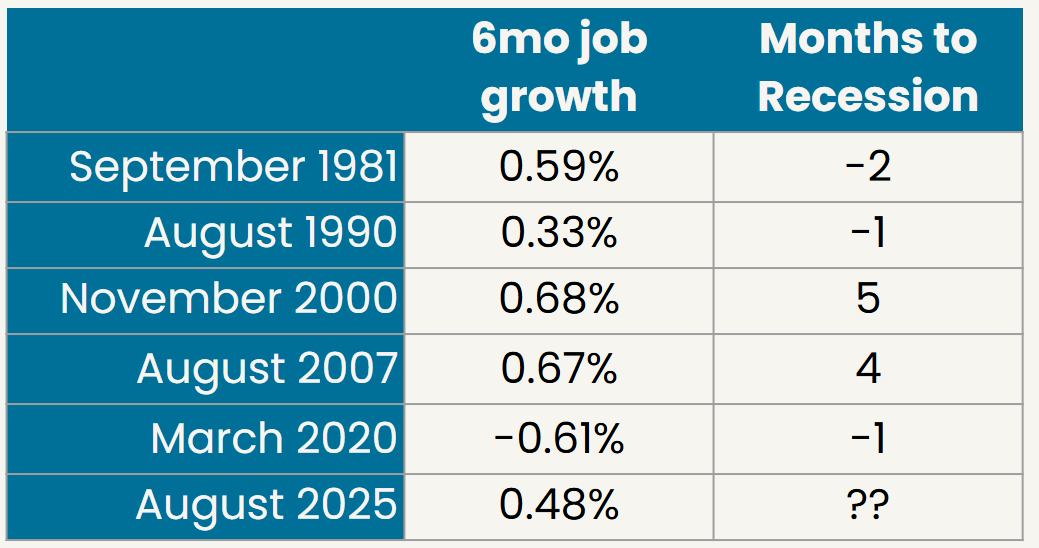

- A continued slowdown in U.S. job growth to near historical "stall speed" levels has increased the risk of an economic recession heading into the end of 2025.

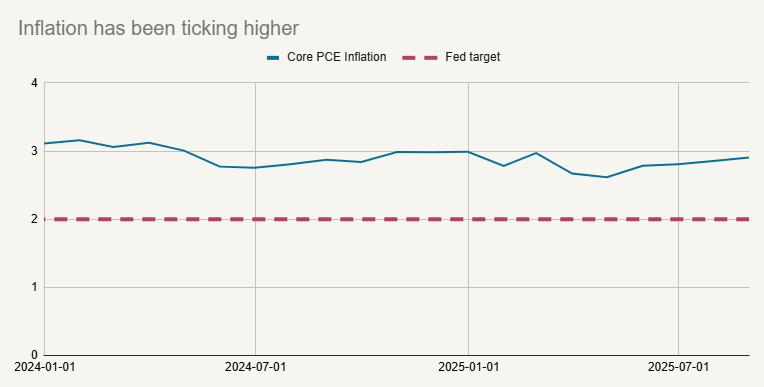

- The Federal Reserve began cutting interest rates, boosting investor sentiment, but future cuts will depend heavily on whether tariff-driven inflation proves to be temporary.

- Given the mix of a slowing economy and speculative market behavior, a defensive investment strategy that underweights the riskiest assets remains a cautious approach.

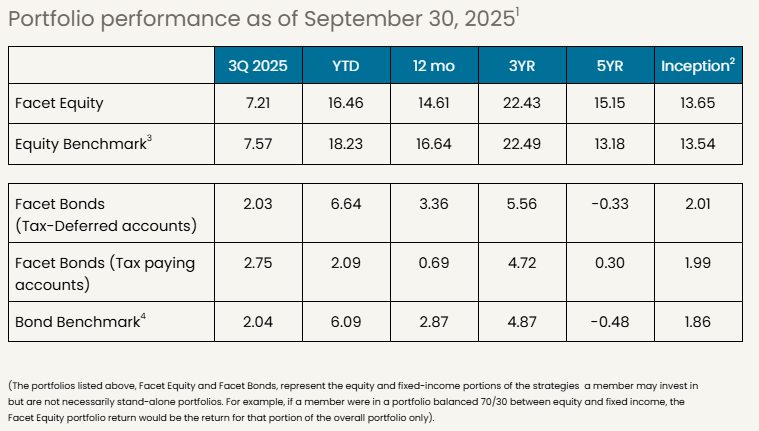

Stocks had another strong quarter in 3Q. The Morningstar Global Markets index rose 7.57% for the quarter, ending just below the all-time high set in September. Gains were powered by enthusiasm for Artificial Intelligence, hope for Fed rate cuts, and strong flows from individual investors. However, there are a number of risks that also became more prominent during the quarter. These include worries about a bubble in AI spending, a slowing U.S. economy, and stress on government budgets around the world.

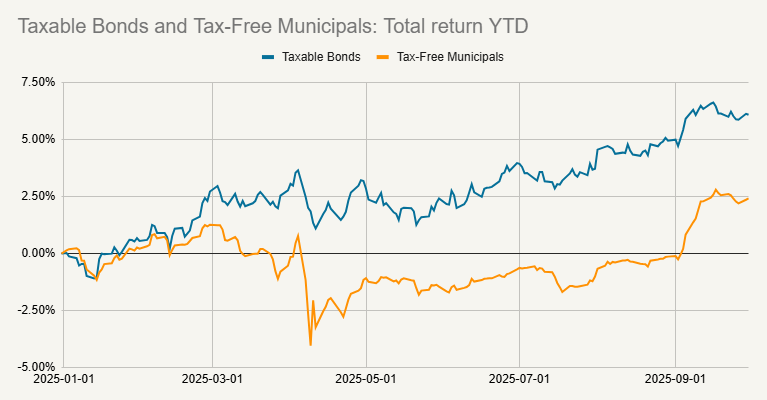

Bonds posted a solid gain for the quarter, with the Morningstar Core U.S. bond index rising 2.04%. This marks the third quarter in a row that bonds have produced positive returns. Treasury bond yields were only slightly lower for the quarter, but there were strong gains for non-Treasury sectors, such as corporate bonds, mortgage-backed securities, and municipal bonds.

Facet’s equity results were slightly below benchmark this quarter, as some of our defensive positions didn’t quite keep up this quarter. Our fixed income results were mixed, with our taxable bond strategy performing in-line with benchmark, while municipals outperformed.

Here are our thoughts on what happened this quarter, how it impacted your portfolio, and what we see coming next for financial markets.

Portfolio performance as of September 30, 2025

If you're a current Facet member and are interested in learning more about investing with Facet, please reach out to your planner and start the conversation. The investments team is available to meet with you, answer questions, and talk through your options.

AI enthusiasm continues to dominate

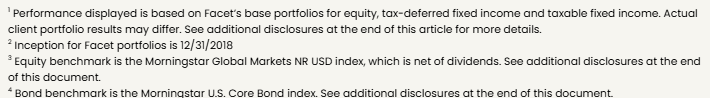

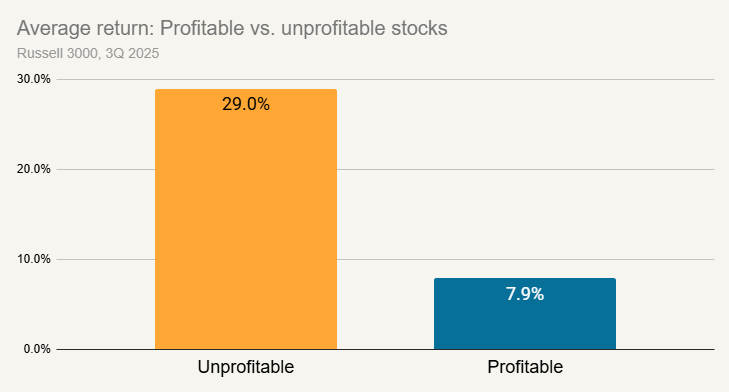

In a repeat of 2Q’s results, excitement over AI continues to be a dominant theme. Technology was the best performing sector in the S&P 500, and within the tech sector, companies at the center of the AI trade tended to be the better performers.

Source: Dow Jones S&P Indices

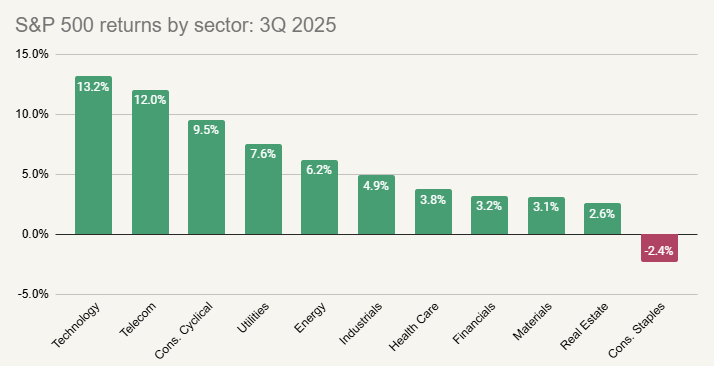

Also similar to last quarter, speculative stocks had another great quarter. One way we can show this is by looking at the performance of unprofitable companies. These are typically companies spending heavily to achieve growth, either in product research or marketing. They could grow into large successful companies down the road, but that future is highly uncertain. During this quarter, unprofitable U.S. companies enjoyed an average return of 29%, while the average profitable company made just 8%.

Source: Russell Indices, Bloomberg

This phenomenon was the main reason why Facet’s equity strategy was slightly behind benchmark this quarter, as well as for the year. We have made a conscious decision to overweight companies with especially high profit margins. We believe that these companies will be more resilient in an economic downturn, as high profit margin companies tend to be more able to maintain sales in the face of macro weakness. Moreover, high profit margin companies tend to be more able to raise prices when the cost of production rises. This should help these companies weather rising tariffs better than others.

We are also expressly underweight unprofitable companies. Through our ETF mix, we have plenty of investments in high growth stocks, but we think chasing the most speculative stocks tends to carry more downside than upside.

History is on our side. Over the 25 years ending in 2024, the broad U.S. market has returned just over 560% cumulatively. According to Bloomberg, had you invested each year in a portfolio of these unprofitable companies each year over that same period, you would have lost 18%. Speculative companies have their moments, but not many of them. You may remember that similar speculative booms occurred in 2021 and the late 1990’s, with both ending in significant losses for weaker companies.

This kind of pattern is typical of a period where investors are chasing big upside, with less regard to downside risks. That kind of market could continue for some period of time going forward, but we will continue to focus on building a balance of risk and reward in Facet portfolios.

Could AI be a bubble?

Sam Altman, the CEO of OpenAI (which is the company behind ChatGPT), said in an interview that “When bubbles happen, smart people get overexcited about a kernel of truth” and that people are currently “overexcited” about AI. Altman is hardly alone in raising worries about a bubble in AI. There are a number of easy parallels between the late 1990’s internet bubble and AI stocks today. Both periods were driven by excitement about a very real technological revolution: then it was the internet, now it is AI. Both saw a huge increase in retail interest in a relatively narrow set of stocks.

Another parallel is reliance on outside capital to keep fueling revenues at larger companies. In the 1990’s this was heavily fueled by an explosion in IPOs. These nascent internet companies would spend the IPO capital on chips from Intel and routers from Cisco and advertisements on Yahoo. When the IPO money ran out, suddenly these big, established tech companies realized they had a big revenue problem.

Today the revenue for many of the biggest tech companies is heavily reliant on the massive capital spending on AI projects. Take OpenAI as one example. The company needs to spend billions to both train new models and provide output on current models. They estimate they will lose $8.5 billion this year due to these costs. Where is this revenue going? Buying chips from Nvidia, servers from Oracle, cloud computing from Microsoft, Google and Amazon, etc.

In order to keep growing, OpenAI needs to keep spending. That capital is partly coming from venture capital. But it is also coming from their vendors. In September, Nvidia announced they would be making a $100 billion investment in OpenAI to support datacenter buildout. Of course, those data centers will need the most advanced semiconductors from none other than Nvidia. So in essence, Nvidia is giving OpenAI $100 billion so they can turn around and use that money to buy chips from Nvidia.

There’s nothing untoward about this kind of partnership. However it does highlight the risks with AI today. If the growth of spending on AI infrastructure were to simply slow down, not even reverse, there could be meaningful downside for a lot of the AI-related stocks. The equity capital flowing into companies like OpenAI is turning into revenue for established tech companies. Right now that might feel like a virtuous cycle, but as the 2000’s internet bust showed us, it can turn vicious.

In Facet portfolios, we have plenty of investment in AI-related tech companies. It might be that growth in AI is enough to turn companies like OpenAI profitable in the near-term, which would eliminate a lot of the risks we describe above. However, we think a careful assessment of upside vs. downside suggests a small underweight in tech makes sense.

Job growth slows in 3Q

Another big worry comes from the labor market. Job growth slowed significantly over the summer. While the pace of layoffs is relatively benign, the pace of hiring has dropped to near recessionary levels. Over the last six months, U.S. jobs have grown at a 0.48% pace. Every other time since 1980 when job growth has fallen below 0.7% over a 6-month period, a recession has followed.

Source: Bureau of Labor Statistics, National Bureau of Economic Research

Could this time be different? Maybe. Part of the reason why job growth has been so slow is that population growth has also been slow, primarily because of a plunge in immigration. The Pew Research Center estimates that 2025 may be the first time that total immigrants in the U.S. will actually shrink by a meaningful amount. That means that the U.S. needs to add fewer jobs to keep unemployment from rising. Atlanta Fed President Raphael Bostic made this argument recently, saying that because unemployment isn’t rising “there is still a lot of strength underlying the labor market.” Essentially he is arguing that the economy can’t add a lot of jobs if the pool of available workers isn’t growing.

My concern is that if employment isn’t growing, then household income won’t be growing either. If household income isn’t growing, then consumer spending will stagnate. If companies see weaker demand from consumers, they become more likely to lay off workers. This is what Fed Governor Christopher Waller called a “stall speed.” It is the idea that if the economy doesn’t grow fast enough to spur labor demand, then it runs the risk of falling into recession.

As I said above, every previous time job growth has slowed to today’s pace, a recession has quickly followed. However, it happened a few times where the pace of hiring fell to near this level only to quickly rebound. Perhaps that could happen this time as well. Maybe weak job gains over the summer stemmed from the shock of President Donald Trump’s tariff plans, and as companies get more clarity on trade conditions, employment could rebound. However, I would say the longer we go without a big rebound, the more concerned I will become.

Fed to the rescue?

One reason why the market has kept rising, despite all the risks mentioned above, is hopes for Fed rate cuts. It wouldn’t be the first time there were recessionary alarm bells, but some timely Fed maneuvers were able to reverse the momentum. This happened in 1995, 2016, and 2019.

If the Fed is able to rescue the economy this time, it will likely be through the housing market. According to Freddie Mac, the national average mortgage rate is currently 6.3%. That’s about 0.4% below the average mortgage rate from the end of 2022 until now. If mortgage rates can fall a bit further, maybe into the 5.75% area, it could result in a big refinancing boom. This would free up substantial cash for a large number of households, which could provide some economic stimulus.

In addition, falling rates could revive home buying. The most recent data on existing home sales indicates a 4.0 million annual pace. Existing home sales haven’t been this slow since 2010. Any revival in that market could also be meaningful economic stimulus.

We also know the Fed is willing to cut. There has been much attention paid to Trump’s cajoling of Jerome Powell, his attempts to fire Fed Governor Lisa Cook, and his appointment of White House officials to the Fed board. However, even if none of that were happening, the Fed would probably be cutting rates anyway. With all of the recession risk we discussed previously, it is natural for the Fed to be cutting rates.

The key question is how much the Fed will cut. As of October 1, futures markets are pricing in between three and four additional rate cuts over the next year. Anything less than that will probably be a disappointment for both stocks and bonds. For the Fed to be comfortable cutting as many as four times, inflation needs to start moving lower. The most recent Core PCE inflation figure report showed prices have risen 2.9% over the last year. That’s a long way from the Fed’s 2% target. Moreover the downward trend inflation had shown in the first half of the year has reversed. The last few months have shown consistently rising inflation.

Source: Bureau of Economic Analysis

There is reason to believe inflation will indeed subside in the coming months. Most of the recent inflation acceleration has been driven by physical goods, i.e. the kinds of things that are probably being influenced by tariffs. Things like clothing, furniture, cars, etc. It is likely that this is something of a one-time effect. In other words, those prices will rise to account for tariffs, but they won’t keep rising as long as the tariff rate stays steady. If that is the case, then we would expect the pace of price increases to subside toward the end of 2025.

The Fed’s rate setting committee is more or less counting on this being the case. Otherwise they probably wouldn’t have cut in September. Both the Fed and the market will be watching closely to see inflation does indeed start to subside. If it does, it will be a big positive for both stocks and bonds. If it doesn’t, that could be trouble.

Dollar declines take a breather

As we are writing this report, the U.S. government has shut down, as Republicans and Democrats fight over the budget. How this plays out is tough to say. Markets are less concerned about a prolonged shutdown than they are worried that any deal cut could result in a larger budget deficit, which would put renewed pressure on interest rates. While U.S. interest rates were modestly lower by the end of 3Q, the passage of the Big Beautiful Bill in July did touch off a 0.25% sudden spike in 30-year Treasury bond yields.

Fiscal pressure has been a big theme this quarter. The U.K., France and Argentina all dealt with acute moments where bond yields spiked and/or currencies plunged over worries about each country’s fiscal position.

In part because of these increasing pressures, the U.S. dollar actually ended the period about unchanged vs. most major currencies this quarter. We can’t say that the weakening trend we saw all of 2025 is over. If the Fed does wind up cutting rates even more than is currently projected, i.e., the U.S. falls definitively into a recession, expect the dollar to resume dropping. This could make international stocks an especially good diversifier right now.

However, it could also be that the market has already priced in enough of Fed rate cuts, and the dollar’s movements become more about capital flows. If AI continues to be the major source of capital investment, the U.S. dominance in that space may ultimately bode well for the dollar.

Municipal bonds rebound a bit in 3Q

Tax-free muni bonds have struggled to keep up with their taxable counterparts in 2025. It hasn’t been that muni bond prices have dropped, rather that taxable bonds had enjoyed price increases, while during the first half of 2025, munis had stayed roughly flat.

Source: Morningstar

This kind of thing is typical of periods where individual investors are chasing rising stocks. Taxable bonds are purchased by all kinds of investors, from pension funds to endowments to insurance companies to foreign central banks. Municipal bonds are purchased almost exclusively by individuals. So muni bond prices can be highly influenced by the mood of these individual investors. As we said above, it seems that these investors are focused on speculative stocks, not safe muni bonds. This has been the major driver of why munis have struggled so far in 2025.

However, as we wrote in last quarter’s review, munis and taxable bond returns tend to converge over time. This started to happen this quarter: the Morningstar Municipal Bond index did about 1% better than the taxable index. This is one of the beauty of bonds: if one segment of the bond market underperforms, that naturally means the forward-looking yield on that segment is now higher. Hence with tax-free munis, one of two things will happen. Either muni yields will stay relatively high compared to taxable bond yields on an after-tax basis, in which case investors will keep earning a strong level of after-tax income. Or muni prices will start to catch up with taxable bond prices. We got a little of the later this quarter.

What comes next?

We spent a good deal of this quarterly review talking about risks. As stewards of our members’ investments, we are constantly thinking about what could go wrong. Unfortunately, that list is fairly long right now. Hence why we have built in some defense into portfolios.

- Overweight high profitability companies: These kinds of companies tend to be able to raise prices in the face of higher costs, including tariffs

- Underweight companies with more debt: In a slowdown, these kinds of companies have less financial flexibility, while leverage causes profits to slide more quickly

- Underweight unprofitable companies, especially in small caps: Right now 35% of the small-cap universe is projected to lose money over the next year. That’s an abnormally high percentage, and typically those kinds of companies suffer significantly in an economic downturn.

- Underweight tech: This underweight is small, only about 2%, but we think given high valuations this provides some protection against a sell-off

- Underweight emerging markets: These countries are much more dependent on exports for economic growth. If there is a generalized slowdown in trade, emerging markets companies are probably more vulnerable.

We think all of these positions add up to a significant amount of defense present in Facet portfolios today. Given all of the risks we have identified, we think maintaining this defense is well justified. For some members, we are also considering things like alternative investments as additional ways of adding protection.

That being said, a recession is by no means a foregone conclusion. There are three paths to avoiding a recession.

First, it might be that the current slowness in job growth simply reflects policy uncertainty. Maybe companies were worried about the impact of tariffs and paused hiring. In the coming months, the impact of tariffs is going to become more and more clear. If the outcome is not as bad as firms feared, they might restart hiring. In that scenario, job growth would revive, pulling the U.S. out of the “stall speed” problem we described above.

Second, it could be that heavy spending on AI overwhelms any slowdown in other kinds of spending. A decline in company investment spending is usually a key trigger for a recession. But in this period it might be that companies view AI spending as too important to cut. If AI spending keeps growing, it could be enough to prevent an overall decline in business investment.

Third, as we mentioned before, falling interest rates could also provide some stimulus, especially to the housing market. Housing revival would be another way that the economy could offset any decline in business investment.

Any mix of these three possibilities could easily be enough to rebuild positive momentum for the economy. I don’t know what odds to put each of these happening, but I do think the cumulative odds of any of these things being enough is pretty high.

This is why we think staying invested, but building defense into your portfolio is a better strategy than selling your stocks. If all of the risks we see simply don’t occur, sitting in cash could be extremely painful. Whereas if you stay invested with a somewhat defensive portfolio, you will keep moving toward your goals. You might fall a little behind the market, but you’ll keep earning a competitive return. And if one or more of the risks we described do come to fruition, you will have built in some resiliency to your portfolio, and be in a better position to take advantage of the eventual rebound.

When we talk about trying to build portfolios with a balance of risks and opportunities this is what we mean. We may never make the perfect trade, but we are comfortable with how our portfolios will perform in various scenarios.

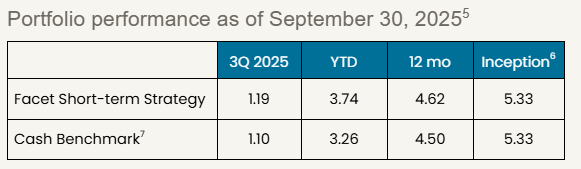

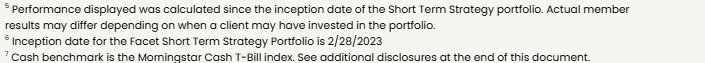

Facet’s Short-Term Strategy

Facet’s Short-Term Strategy (STS) is designed to produce stable returns commensurate with the yields available in shorter-term bonds. The strategy is designed for members with money goals that are only a year or two away.

STS’s performance was about the same as the Morningstar Cash T-Bill benchmark during this period. Typically this strategy does a bit better than the T-Bill benchmark during periods where rates are falling. Although the Fed did cut rates this quarter, that was mostly anticipated in prior quarters and therefore priced into the market. In other words, the benefit from falling Fed rates is evident in YTD outperformance.

Movement in rates is going to tend to be a minor factor over the long-term though. This strategy is going to mostly be driven by income generation. The strategy’s 4.1% current yield is very competitive with things like high-yield accounts and money markets, and we think that gap will only keep widening as the Fed keeps cutting rates.

Portfolio performance as of September 30, 2025

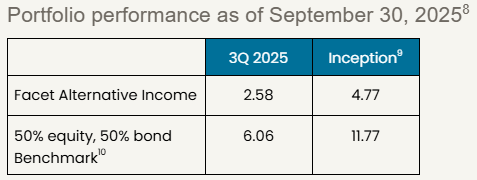

Facet’s Alternative Income Strategy

Facet launched the Alternative Income Strategy in April, so these results only reflect about five months of performance. In that short period, the strategy is performing as we would expect. The strategy uses a combination of private credit, private real estate and some public market credit instruments to produce a high level of current income.

Alternatives are difficult to compare to a benchmark. We are using a 50% stock, 50% bond benchmark, because we believe over time, that’s about the risk profile of this strategy. However in short periods, the strategy isn’t very comparable to such a benchmark. Since April, stocks have surged in a way that our alts strategy never would. The opposite would have also been true: during periods where stocks are sideways or down, the strategy is likely to outperform.

We are focused on whether the funds are performing as we would expect, i.e., tracking the roughly 9% return implied by its income generation. On that metric, the strategy is doing very well. We expect that return stream to be very competitive with stocks over the long-term, while producing substantially less volatility.

Portfolio performance as of September 30, 2025

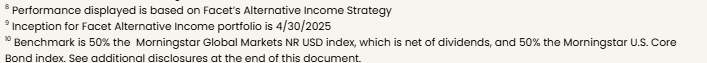

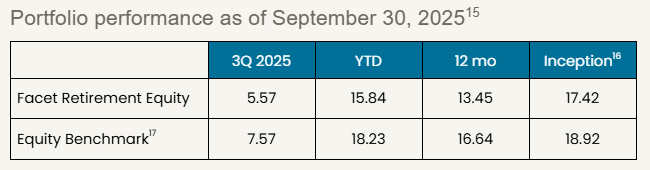

Facet’s Environmental Social Governance (ESG) Strategy

Facet’s ESG equity strategy performed about the same as the benchmark this quarter. The strategy utilizes a set of ETFs that screen out stocks based on certain ESG criteria. Specifically, the screens result in a significant underweight energy, utilities, and heavy industrial companies. By extension, that means a slightly higher weight for everything else.

For this quarter, these weighting variations didn’t cause a huge impact. Energy was a mild underperformer, and this did help boost results slightly when compared to our primary portfolio, but even this effect was minor.

Portfolio performance as of September 30, 2025

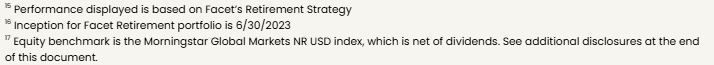

Facet’s Retirement Strategy

Facet’s Retirement Strategy is meant for members who are either already in retirement or close to it. The strategy utilizes ETFs that we expect will have relatively less volatility than our traditional growth strategy. Generally speaking, Facet expects this strategy to lag the equity benchmark a bit during big up quarters. Adding lower-volatility funds to this ETF mix should protect against the downside while giving up some upside.

Not surprisingly, in a quarter where speculative stocks dominated, a portfolio meant to minimize volatility is going to tend to underperform. That’s exactly what happened this quarter. However, for members currently in retirement, avoiding big market declines can be a major key to portfolio longevity. Hence, we would argue that for some members, giving up some upside in order to preserve capital in down markets is a worthwhile tradeoff.

Portfolio performance as of September 30, 2025

Performance disclosure

Investment returns shown here are intended for illustrative purposes only. All investments involve risk, including the potential for the loss of principal. The portfolio performance of Facet strategies began in 2018. Performance was calculated using Facet’s most common recommended equity and fixed-income ETF portfolios. At times when Facet changed a recommended ETF, the average transaction price of both buys and sells was used to update the portfolio. Otherwise, the portfolio was rebalanced monthly. Calculations were performed using the Bloomberg Portfolio Analytics tool. This illustration is meant to most closely resemble what a common Facet client in a given asset allocation mix may have returned. It does not represent any actual client or group of clients. The benchmark used for equity allocations is the Morningstar Global Markets Net Dividends index, which measures the performance of the stocks located in developed and emerging countries across the world. For fixed income allocation, the benchmark is the Morningstar US Core Bond index, which measures the performance of fixed-rate, investment-grade USD-denominated securities with maturities greater than one year. We believe the sources for this data to be reliable but cannot guarantee the accuracy or completeness of the information. No consideration was given to tax loss harvesting or other activities that occur during the ongoing management of investments, nor did Facet assert an opinion on the impact of these actions on these returns. These returns were calculated net of the fees associated with the underlying investments. Facet charges an annual planning fee based on the complexity of a client’s financial situation but does not charge a separate fee for investment management. The planning fee was not considered in the calculation of returns. Past performance is not indicative of future returns.

Benchmark disclosure

The Morningstar Global Markets Index NR USD and US Core Bond indices have been licensed by Facet for use for certain purposes. The services provided by Facet are not sponsored, endorsed, sold, or promoted by Morningstar, Inc. or any of its affiliated companies (all such entities, collectively, “Morningstar Entities”). The Morningstar Entities make no representation regarding such services. All information is provided for informational purposes only. The Morningstar Entities do not guarantee the accuracy and/or the completeness of the Morningstar Indexes or any data included therein. The Morningstar Entities make no warranty, express or implied, as to the results to be obtained by the use of the Morningstar Indexes or any data included therein. The Morningstar Entities make no express or implied warranties and expressly disclaim all warranties of merchantability or fitness for a particular purpose or use with respect to the Morningstar Indexes or any data included therein. Without limiting any of the foregoing, in no event shall the Morningstar Entities or Morningstar’s third-party content providers have any liability for any special, punitive, indirect, or consequential damages (including lost profits), even if notified of the possibility of such damages.