The information provided is based on the published date.

Key takeaways

- Stocks rose to another all-time high, with tech stocks a surprise laggard.

- A triple-witching day led to some major volatility, especially in Nvidia stock.

- It's tough to know when to sell an underperforming investment, even for pros.

- If you do decide to sell, it is generally a good idea to move on quickly.

Welcome to the latest edition of the Facet Investor Newsletter. I’m your Chief Investment Officer Tom Graff. This week we’ll tackle triple witching hour, Nvidia’s slide, and when is it time to sell a loser investment?

As always, we’d love to hear your questions and feedback. Email the Facet newsletter team at [email protected] with anything from thoughts on the newsletter, ideas for future content, or any questions you have about investing and markets.

Market recap

Stocks rose slightly this week, with the S&P 500 hitting another all-time high on Wednesday before retreating slightly Thursday and Friday. The AI craze took a breather this week, with Nvidia stock down about 3% and the semiconductor index down 1%. European stocks rebounded, up 1.5% in dollar terms as traders continue to assess the French election situation. Bond yields were about unchanged.

This week’s chatter

Friday was a special day in the trading calendar called a triple-witching day. This occurs four times a year when stock futures, individual stock options and equity index options all expire on the same day. This matters because when these contracts expire, it forces the holders of those contracts to do some kind of trade. That might mean closing out the contract, buying the underlying stock, etc. Anytime people are forced to trade, weird stuff can happen.

For example, take Nvidia’s price action this week. Shortly after the market opened on Thursday morning, the stock hit a new all-time high of just over $140. From there it proceeded to decline almost 10% to end Friday at $126.57.

There has been a lot of chatter among pro investors about whether Nvidia (and AI stocks more broadly) are a bubble. This kind of volatility tends to fuel these concerns. Of course, one day’s worth of action doesn’t prove anything one way or the other. In fact, Nvidia had very similar price action during the last triple-witching day in March only to surge over 40% in the subsequent months.

My own opinion is that it is not a bubble, but I’m certainly open-minded to the possibility that the AI euphoria has gone too far.

In my view, this is a really good argument for diversification. If you own a bit of everything, and the AI boom continues to fuel strong earnings for Nvidia and other companies, that’s great. You own plenty of those stocks. If the AI boom continues but some competitor eats into Nvidia’s market share, that’s fine too. The broadly diversified investor will own that competitor too. And lastly if AI turns out to be not as revolutionary as advertised, that’s OK too. The broadly diversified investor will be glad they owned more than just Nvidia!

Pro corner

When is it time to say goodbye to an investment that isn’t working? You know, that fund you’ve held on to that feels like it is always lagging everything else? Should you stay patient and wait for the fund to have its day? Or finally make a change?

This is a tricky situation, even for pro investors. There’s a lot of investor psychology that gets wrapped up in this decision. You might fear that as soon as you sell it, the fund’s performance will rebound. That’s called regret aversion. Or if you’ve lost money in the investment, you might be tempted to just wait until you are at least back to your cost. That’s called anchoring. People also commonly think of holding on to the security as somehow less of a decision than selling it. That’s called the status-quo effect.

Early in my career I was introduced to these (as well as other) behavioral biases, and I learned to embrace that I was just as subject to these mistakes as anyone else. Once you become conscious of that, you are much more equipped to recognize these biases in yourself, and thus avoid them.

Given all this, we have to approach analyzing our loser investment objectively. Start with why you own the investment in the first place. Does that original thesis still hold? At Facet, we write detailed research reports on each fund we buy for members, which include a falsifiable thesis statement. This makes it far easier to tell whether the reason why you bought something in the first place still holds today.

Now maybe you haven’t been creating a thesis with your investments in the past. If so, use this loser investment as your first attempt. But make sure you do your analysis as though you are buying the fund today. Don’t let the fact that you already own it color your thinking. If you would not buy it today, you should probably not continue to hold it.

Second, ask whether the fund’s performance fits your expectations. For example, Facet owns a U.S. small-cap value fund. That fund has underperformed the broader U.S. market materially over the last two years. But that isn’t because there’s something wrong with the fund, it is because small cap stocks have generally underperformed large caps recently. In other words, the fund has performed exactly as we would have expected. We want to have exposure to small cap stocks, and this fund is helping to fulfill that purpose. In other words, you can’t just compare each of your positions to some generic index like the S&P 500. You want to compare each to what you would have expected.

If you do decide to sell the investment, my suggestion is to not hesitate. It can be tempting to put off the decision for any number of reasons. “It has been down lately, I should wait for a rebound” or “as soon as I get back to my original cost” are two common ones. You always want to take your time with the analysis that feeds into your decision, but once you’ve decided there’s no more reason to wait. If you truly believe you are upgrading your portfolio, the sooner you do so the better.

Another reason why people sometimes wait to sell an investment is taxes. Maybe you own a stock or a fund that has appreciated in value, but has lagged behind the market. Selling would result in a tax bill, and no one likes paying taxes.

We wrote about taxes in more detail in a previous newsletter, so check that out for more detail, but here’s the short version. If you hang on to the investment, only one of two things can happen.

- It falls in value, such that you no longer have a gain. You don’t owe taxes, but you’ve also lost money.

- It keeps appreciating in value, meaning you owe more tax in the future.

Neither of those outcomes are good! So once again, if you’ve decided to sell the investment, may as well do it now. Don’t let the tax tail wag the investment dog.

Lastly, remember that investing is a difficult exercise. No one gets 100% of their investments right. Just try not to compound your mistakes by hanging on too long.

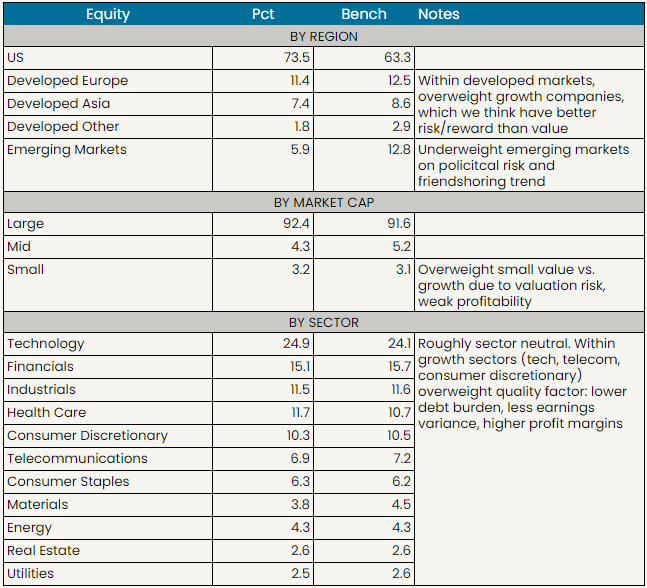

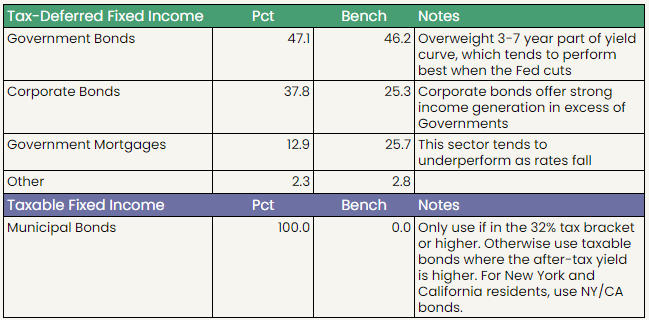

Facet portfolio positioning

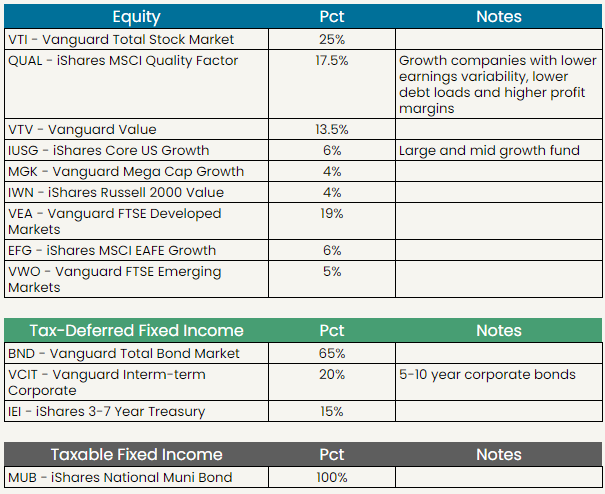

Facet’s current ETF models

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser. This is intended as educational information and is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. This is not a solicitation for the sale or purchase of any specific securities, investments, investment strategies, or products. Past performance is not a guarantee of future performance and all investments come with risks. Individuals should consider their personal risk tolerance, time horizon and goals when making a decision about investing. There are no guarantees on returns; implied or otherwise; investment results may vary.