The information provided is based on the published date.

Key takeaways

- The Federal Reserve remains focused on pursuing a 2% inflation target and is “squarely focused” on getting there

- It is unclear what an exact 2% target should be, as current inflation data is closer to 4.3%

- At the September meeting, half of Fed members projected zero or one more rate hike, and many more are open to no further hikes for the remainder of 2023

- Despite improving inflation data, longer-term Treasury bond yields have stayed near year highs due to expectations for higher interest rates

- Stock markets appear to not fear high interest rates impacting growth in the future

As was widely expected, the Federal Reserve left its interest rate target unchanged at the September meeting. Despite the lack of action on rates, the Fed gave investors a lot to consider. Fed Chair Jerome Powell struck a markedly different tone at this meeting than we’ve seen recently. What does this mean for the Fed and financial markets going forward? Here’s our take.

Two-sided risks

If there was one major theme from the September Fed meeting, it's “proceeding with caution.” Chair Powell has pointedly said that inflation was the Fed’s primary focus for the last two years. Many times, he expressly stated that the Fed was trying to slow the economy and that if a recession ensued, so be it.

This singular focus on inflation made sense a year or even six months ago. During this week’s press conference, Powell said that “without price stability, the economy does not work for anyone.”

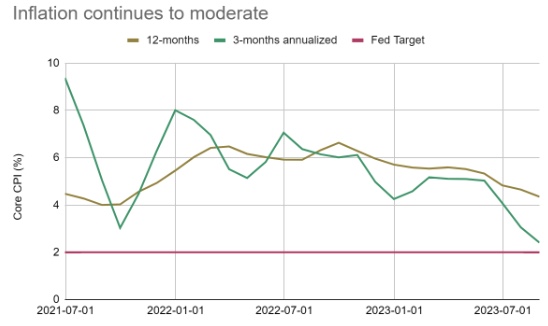

At this time last year, the Consumer Price Index was up over 6.3%, excluding food and energy over the prior 12 months. Now, that is down all the way to 4.3%. Over the last three months, Core CPI has only risen at a 2.4% annualized pace, very close to the Fed’s target.

Source: Bureau of Labor Statistics

Source: Bureau of Labor Statistics

When inflation was running over 6%, it was obvious that Fed policy was nowhere near restrictive enough. That is less obvious now that inflation is much closer to the target.

During the press conference, Powell said the Fed was “in a position to proceed carefully” and talked about the “evolving risks” which include both that inflation could stay high as well as that the economy could slow. In effect Powell is saying that the risks to the economy are two-sided. No longer it is singularly about inflation.

How much is enough?

The first question Powell was asked during the press conference boiled down to “how does the Fed know that interest rates aren’t already high enough to bring down inflation?” The fact that these questions are even being asked highlights the difficulty of Powell’s current communications job.

The Fed remains committed to a 2% inflation target. As Powell said the Fed is “squarely focused” on its 2% target and that they are “strongly committed” to getting there. However, it is less clear how precise a target of 2% should be. For example, the chart above shows that Core CPI has run at a 2.4% pace in the last three months. What happens if inflation continues at that pace but doesn’t decline more? Is 2.4% close enough? Should the Fed try to damage the economy more to get 0.4% closer to the target?

Part of why this is so important comes down to the Fed’s credibility. Most economists believe that if everyone thinks inflation is going to stay low and acts accordingly, that in and of itself helps to keep inflation low.

If the Fed has strong credibility with the public on fighting inflation, that alone goes a long way in keeping inflation expectations “anchored.” People might see inflation running a little high in the short term, but if it is generally believed the Fed is on the case, longer-term inflation expectations won’t change much.

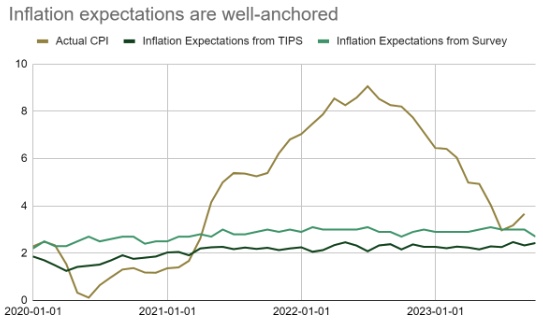

We’ve actually seen this play out over the last couple of years. The chart below shows the actual CPI (gold) vs. two measures of inflation expectations. The darker green is based on the Treasury Inflation Protected Securities (TIPS) measured 5-10 years out. The lighter green is from the University of Michigan Consumer Sentiment survey, also using a 5-10-year period.

Source: Bureau of Labor Statistics, St. Louis Federal Reserve, University of Michigan

Source: Bureau of Labor Statistics, St. Louis Federal Reserve, University of Michigan

Here, we see that longer-term inflation expectations hardly moved despite a massive jump in actual CPI. The Fed wants to keep it that way.

Here’s where the risk exists for the Fed. Say they let inflation hang around 2.4%. Would the public start to question how serious the Fed is about a 2% target? I.e., if 2.4% is good enough, what about 2.7%? Or 3.2%?

You can see how if the Fed isn’t careful in how this gets communicated, there’s a chance that inflation expectations become just a bit less anchored.

Does this mean more hikes?

This takes us back to the Fed’s two risks. They hike too much and damage the economy needlessly. They don’t hike enough and risk losing credibility on price stability. So, which way is the Fed leaning?

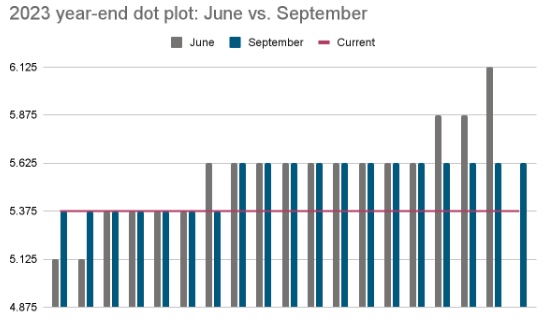

One way we can look at this is through the Summary of Economic Projections. This is a series of forecasts by the members of the Fed’s policy committee, with the latest one released in conjunction with this week’s meeting. Because each member submits their own projections, it can be a good way of seeing the range of forecasts among Fed officials.

One useful way to analyze this is to line up all of the “dots” from lowest to highest and compare that to the same ordering from the prior meeting. And while we aren’t told which dots belong to which Fed official, we can guess that the ones that were on the high side in June are probably still on the high side now, and vice versa.

So, if you line them up, you can get a sense of how many Fed officials have increased or decreased their rate hike projections. Below is a chart of these projections. (Note there is one new member of the Fed Board, Adriana Kugler, so there is one extra “dot” for September)

Source: Federal Reserve

Source: Federal Reserve

What we see is that all Fed officials are currently projecting zero or one hike. Note that zero hikes would be where the red line is. Roughly half of members now seem to favor no more hikes (9 out of 18). Based on Fed officials’ recent speeches, we bet that at least six more are open to the idea of not hiking again.

In reality, one more hike or zero more hikes doesn’t make a big difference for the macro economy in either direction. If inflation data over the next two months surprises to the upside, then another rate hike becomes pretty likely. However, given the slowdown in job growth in conjunction with the improving inflation data, we believe the most likely outcome is that the Fed stays on hold for the rest of the year.

Pushing back against rate cuts in 2024

Despite the improving inflation data, longer-term Treasury bond yields have continued to rise in 2023. Currently the 10-year Treasury yield is near 2023 highs.

Source: Bloomberg

Source: Bloomberg

This has been primarily for two related reasons. One is that the market views a near-term recession as less and less likely. The other is that the Fed has been promising to keep its interest rate target relatively high for an extended period. Currently the “dot plot” for 2024 indicates the median Fed committee member thinks their target rate should be 5.1%.

Leading up to this Fed meeting, markets were projecting three rate cuts in 2024. That could certainly happen. Both in 1995 and 2019, the Fed cut rates three times as a sort of adjustment after a long series of hikes. So, this same sort of thing could come in 2024.

Powell was asked about this a few times, and he did acknowledge the possibility: “as we go into next year… the time will come when it is appropriate to cut” but he was quick to add there was “too much uncertainty” around the possibility of 2024 rate cuts to say anything more definitive.

Regardless, it is important to consider that the yield curve is inverted right now, meaning that longer-term rates are actually lower than shorter-term rates. This tells us that investors are anticipating a certain number of rate hikes as it is. In other words, the mere potential for 3-4 adjustment rate cuts won’t be enough to bring the 10-year Treasury yield down substantially. We would expect longer-term interest rates to remain about this high until there is a more serious economic slowdown.

That has a number of implications. On one hand, it is good news for bond investors that yields could remain elevated for a while. It means higher return potential through more income generation. On the other hand, anyone looking to buy a house or any other kind of borrowing is less likely to get a substantially lower borrowing rate any time soon.

What does this mean for your portfolio?

There was a time last year when the stock market seemed singularly focused on what was going on with interest rates. Some of this was a very real adjustment to a world where borrowed money no longer came as cheaply.

One of the moves Facet made in late 2022 was to lower portfolio exposure to companies with high debt burdens. In a world of persistently higher interest rates, these kinds of companies will face higher borrowing costs, which will eat away at profits. Markets have had to adjust to this reality, which has hit various sectors, from real estate to banking.

However, in 2022, the downward pressure in stocks was also a function of uncertainty. Between 2008 and 2021, the Fed’s interest rate target had never been above 2.5%; for most of that period, it was at 0%. No one knew how the economy would handle interest rates rising into the 4 or 5% area.

Today, with the economy seemingly on solid footing and even sectors like housing starting to show signs of life, we can say that markets no longer fear high interest rates creating some kind of danger.

That isn’t to say that the Fed will stop being a source of volatility. As is almost always the case, stock prices gyrated around during Powell’s press conference. However, it does mean we can invest with confidence that even if the Fed’s target rate remains relatively high for an extended period, that can still be a fruitful time to be invested in markets.