The information provided is based on the published date.

Key takeaways

- Live modestly. Martin Luther King Jr. was on a spiritual journey and believed that material possessions were not the key to a successful life

- Invest in yourself. Education is directly correlated with one's success. Specifically, educated people experience greater self-awareness, happiness, and higher income levels

- Give generously. Despite struggling financially, Martin Luther King Jr. donated to charity every month

- Persevere. MLK Jr.'s life was filled with many trials and tribulations, but he never gave up. What we can learn from Dr. King is that your mindset is everything

- Build with intention. No one ever reached their goals living frivolously

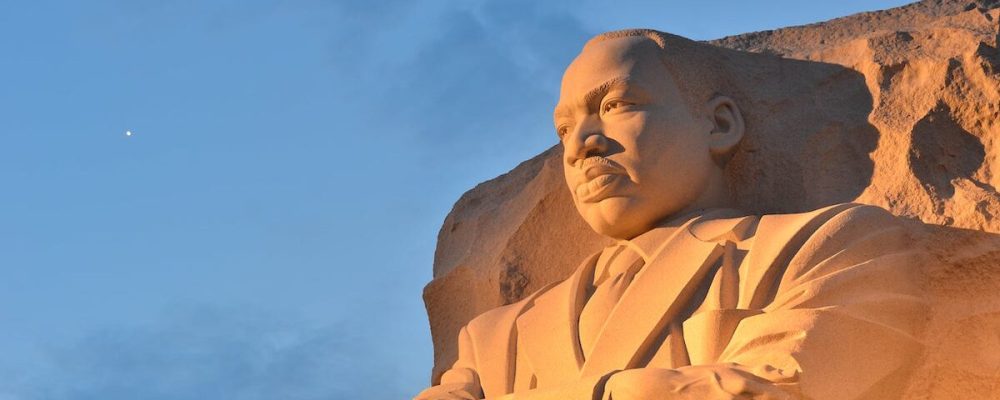

Martin Luther King Jr. Day falls on Monday, January 16 this year. It’s more than a day off from work; it’s a vital reminder of our country's history and how it has shaped us into the nation we are today. This day honors the fact that no matter how much struggle and hardship we may endure, justice and righteousness will always prevail.

While it’s well known that Dr. Martin Luther King Jr. helped shape the course of history through his fight for civil rights and injustices in America, his life lessons also impart practical wisdom about money that still ring true today. This blog post will look at five valuable lessons about money from one of the greatest speakers and activists there ever was.

Lesson #1: Live modestly

“Money in its proper place is a worthwhile and necessary instrument for a well-rounded life, but when it is projected to the status of a god it becomes a power that corrupts and an instrument of exploitation.

Martin Luther King Jr. was on a spiritual journey and believed that material possessions were not the key to a successful life. He lived very frugally and never forgot his humble beginnings. He feared that society’s obsession with the almighty dollar would ultimately lead to its demise.

It’s been nearly seventy years since Dr. King voiced his concerns about the damning effects materialism could have on our society, and he was right. In fact, now there’s even a term for this phenomenon. It's called lifestyle creep, and it happens when someone overspends to the point where they have nothing left to save for future (more important) needs.

Lesson #2: Invest in yourself

“The function of education is to teach one to think intensively and to think critically. Intelligence plus character–that is the goal of true education.”

Martin Luther King Jr. believed strongly in education. He invested a ton of time learning about leadership and public speaking to deliver his message with conviction and clarity. We can learn from his example and invest our money into experiences that will help us grow our knowledge and open the door to greater success in life.

Education is directly correlated with one's success. Specifically, educated people experience greater self-awareness, happiness, and higher income levels. Human capital refers to the knowledge, skills, abilities, and experience an individual brings to an organization. It’s a measurement of value that is rewarded by promotions, pay raises, and even new opportunities.

It’s important not to confuse the word “invest” with just money. You can also invest your time. Time is perhaps the most valuable commodity of all, and everyone owns it. It’s what you do with your time that will ultimately determine your future.

Lesson #3: Give generously

“Life's most persistent and urgent question is, 'What are you doing for others?'”

Despite struggling financially, Martin Luther King Jr. donated to charity every month. He even donated the money he received for winning the Nobel Peace Prize in 1964 at the tender age of 35. The prize money was valued at $54,600, and every cent of it went to the civil rights movement. If you’re wondering how much that value would be in today’s money, adjusted for inflation (at an annual rate of 3.87%), that number comes to $492,640.

While it’s not expected you meet Dr. King’s level of generosity, even the smallest donation to a cause that aligns with your values can make not only a difference in someone else’s life, but also your own. When you give to others, you feel happier and more satisfied that you are making a difference in the world. And, if that’s not enough, most donations are tax-deductible, too.

Lesson #4: Persevere

“If you can't fly then run, if you can't run then walk, if you can't walk then crawl, but whatever you do you have to keep moving forward.”

MLK Jr.'s life was filled with many trials and tribulations, but he never gave up. Despite his financial struggles, the unlawful arrests, and the multiple attempts on his life, he was determined to become an influential leader and activist, and he succeeded against all odds.

So what does perseverance have to do with finances? A lot, actually. No one ever makes all the right money decisions. Everyone fails at one point or another. Whether it’s a sketchy investment opportunity that your friend talked you into, or a mortgage that seemed too good to be true (and was), we’ve all been there.

The differentiating factor is what you do after a failure. Those that learn from their mistakes typically move on and persevere. Those that don’t either give up or continue making the same mistakes. What we can learn from Dr. King is that your mindset is everything. Every misstep in life—financial or otherwise—is a stepping stone to a better tomorrow.

Lesson #5: Build with intention

“Whenever a building is constructed, you usually have an architect who draws a blueprint, and that blueprint serves as the pattern, as the guide, and a building is not well erected without a good, solid blueprint.”

No one ever reached their goals living frivolously. As Winston Churchill once said, “Those who plan do better than those who do not plan, even should they rarely stick to their plan.”

Your finances need a blueprint, and intentional spending is a great way to create one. When you practice intentional spending, you give money a purpose—aligned with your goals and values. It involves planning and maintenance, allowing you to keep track of the construction of your dream life every step of the way.

Ask yourself these questions to make sure you are spending intentionally:

- How will this improve my life?

- What problem is it solving?

- Do I have to purchase it right now, or can I wait a day or two?

- Does this item have different uses?

Final word

By following in Martin Luther King Jr.'s footsteps, we can learn valuable lessons about money and how to use it responsibly. We should strive to make decisions that will lead to the growth of ourselves and our communities. Although money is important, living with intention and investing in experiences are key for true success. Martin Luther King Jr.'s legacy can remind us of the importance of financial literacy and responsible money management.

Facet

Facet Wealth, Inc. (“Facet”) is an SEC registered investment adviser headquartered in Baltimore, Maryland. This is not an offer to sell securities or the solicitation of an offer to purchase securities. This is not investment, financial, legal, or tax advice. Past performance is not a guarantee of future performance.